The S&P 500 spent the early trade yesterday in apparent indecision following the pre-market release of upbeat residential building permits but downbeat starts, hitting its -0.07% intraday low about 30 minutes into the session. The index then rallied to a relatively narrow trading range from mid-morning to its 0.22% closing gain, about half off its 0.41% intraday high around 2 PM, which coincided with the reasonably sound Fed Beige Book update.

The yield on the 10-year note closed at 1.76%, up one BP from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

Here's a daily chart of the SPDR S&P 500 (NYSE:SPY) ETF, which gives a better sense of investor participation in yesterday's advance. Yesterday's trading volume was rather light.

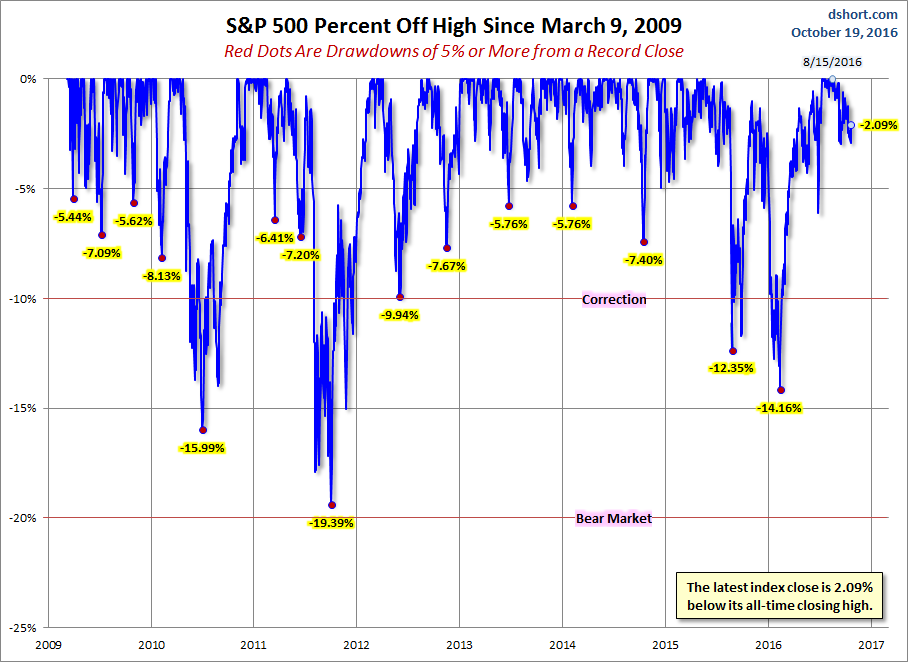

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

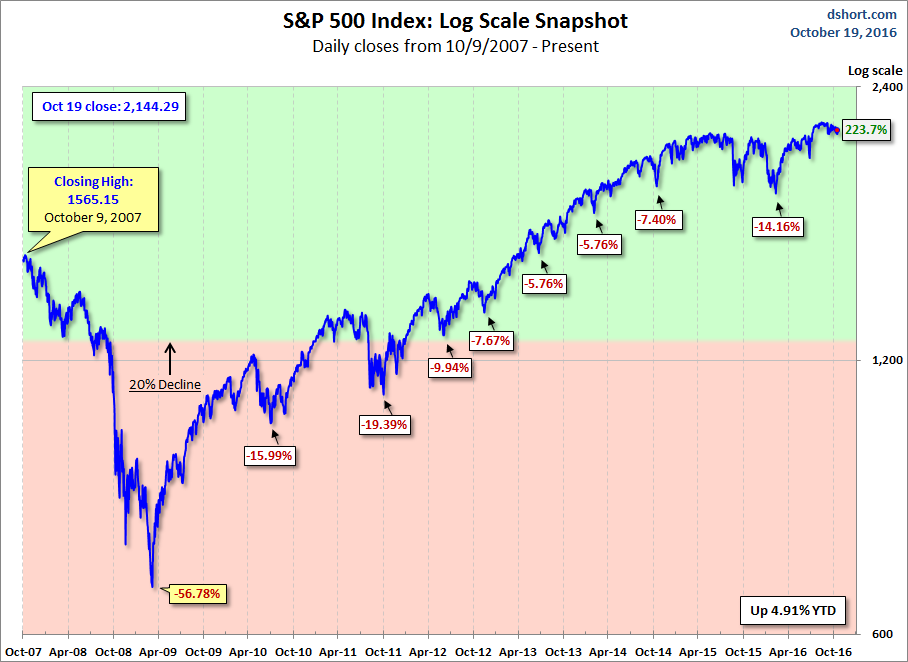

Here is a more conventional log-scale chart with drawdowns highlighted.

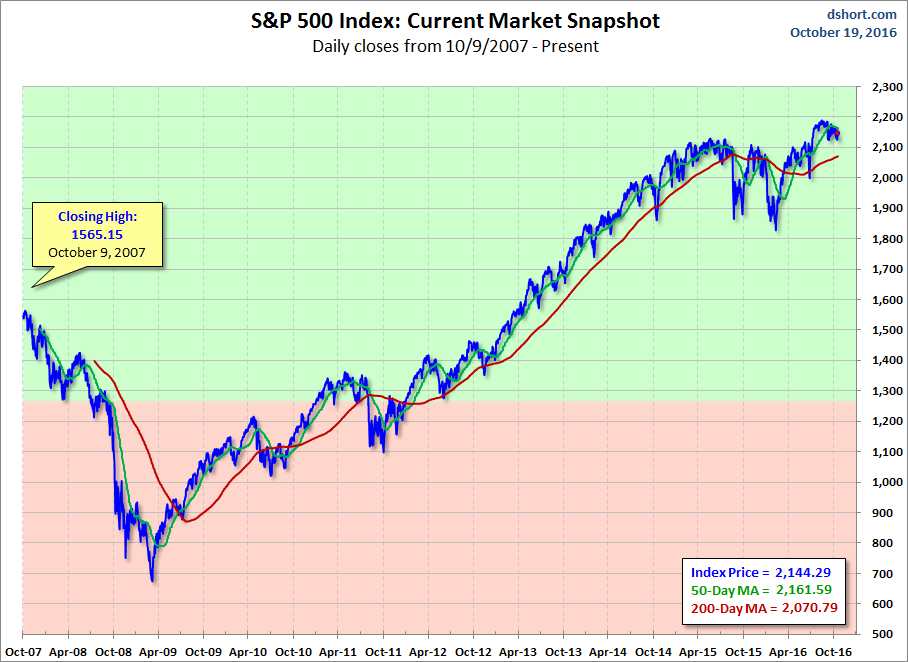

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

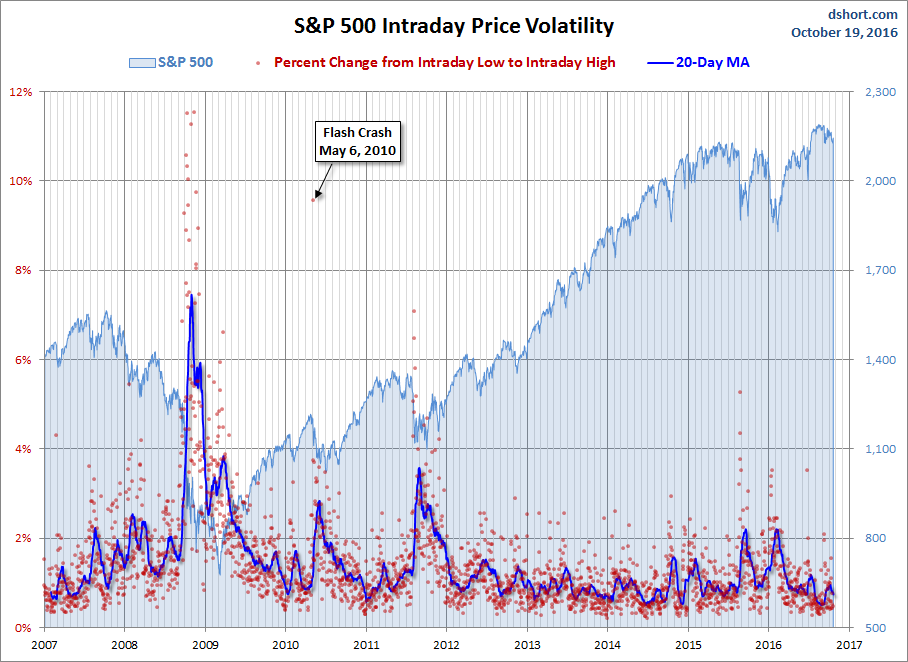

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.