The S&P 500 spent the week alternating between daily wins (Tuesday and Thursday) and losses (Monday, Wednesday, Friday), with the two wins trumping (pun intended) the three losses. Despite today's modest -0.24% close, the index finished the session with a 0.81% weekly gain.

More dramatic was the acceleration of the treasury selloff. The yield on the 10-year note hit an intraday high of 2.36% the highest since early December of last year. It closed the session at 2.34%, up 19 BPs from the previous weekly close, and up 55 BPs over the past two weeks. Freddie Mac puts the latest weekly average of the 30-year fixed rate mortgage at 3.94%, about half a percent higher than where it was a month earlier.

Here is a snapshot of the past five sessions.

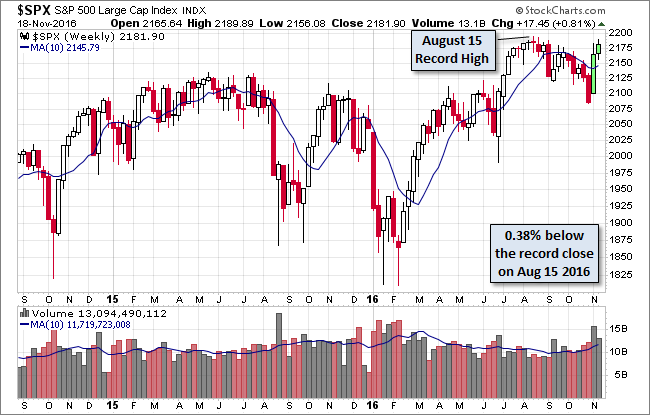

Here's a weekly chart of S&P 500 with the two-week Trump rally highlighted. The latest weekly gain of 0.81% is well off the 3.80% surge the previous week.

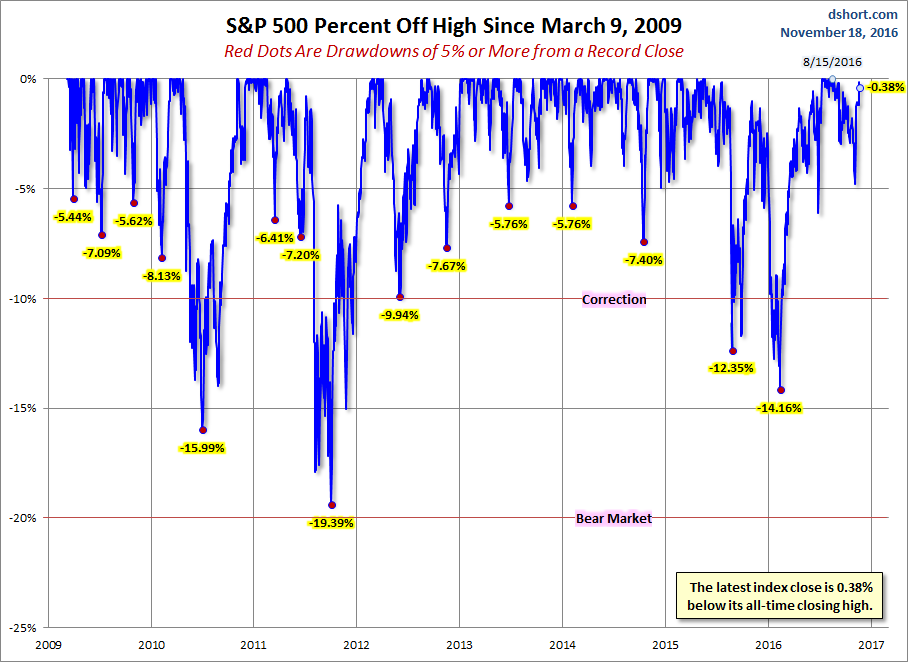

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

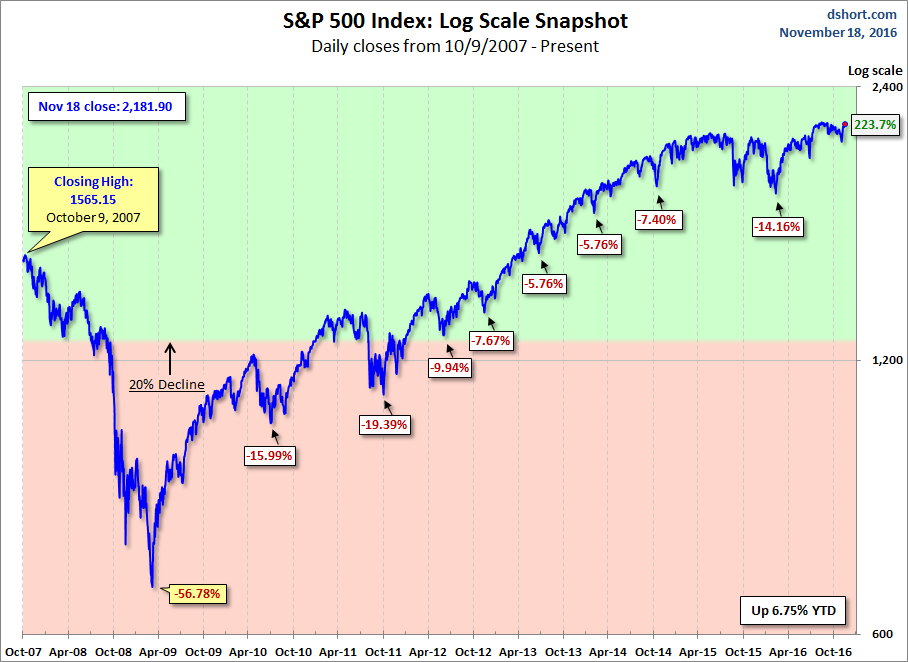

Here is a more conventional log-scale chart with drawdowns highlighted.

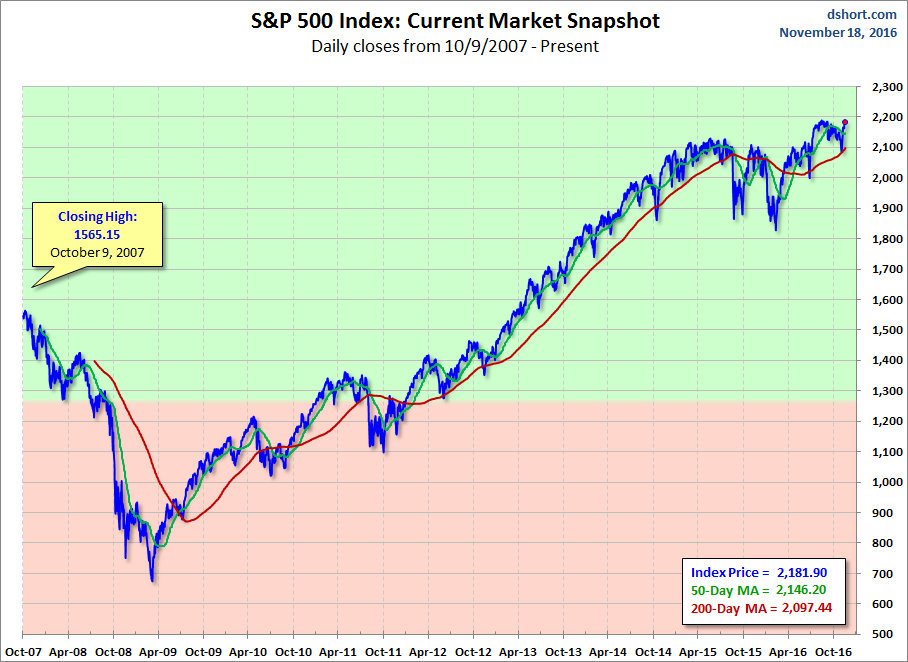

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

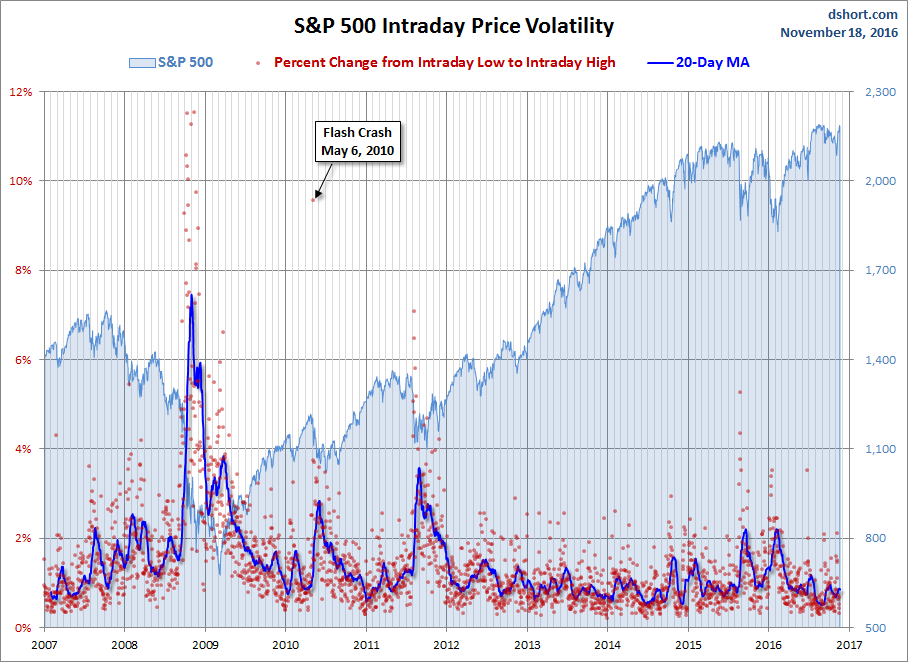

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.