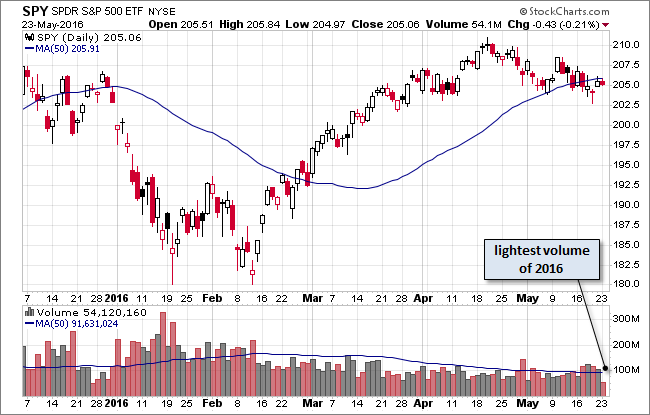

Markets on Monday were in a mildly depressed mood. Asian indexes were mixed, but gold finished lower, crude oil declined and European indexes lost ground. Our benchmark S&P 500 wiggled through the day between its 0.16% high and -0.25% low — the second narrowest intraday trading range of the year. The index finished with a fractional loss of 0.21%. There was no economic news to stir the trade, so the popular financial press explains today's (in)action as a lull in wait of further signals from the Fed on a rate hike.

The yield on the 10-year note closed at 1.84%, down one basis point from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

On the daily chart of the SPDR S&P 500 (NYSE:SPY) ETF, which generally gives a better sense of investor participation, volume was the lowest since Christmas Eve.

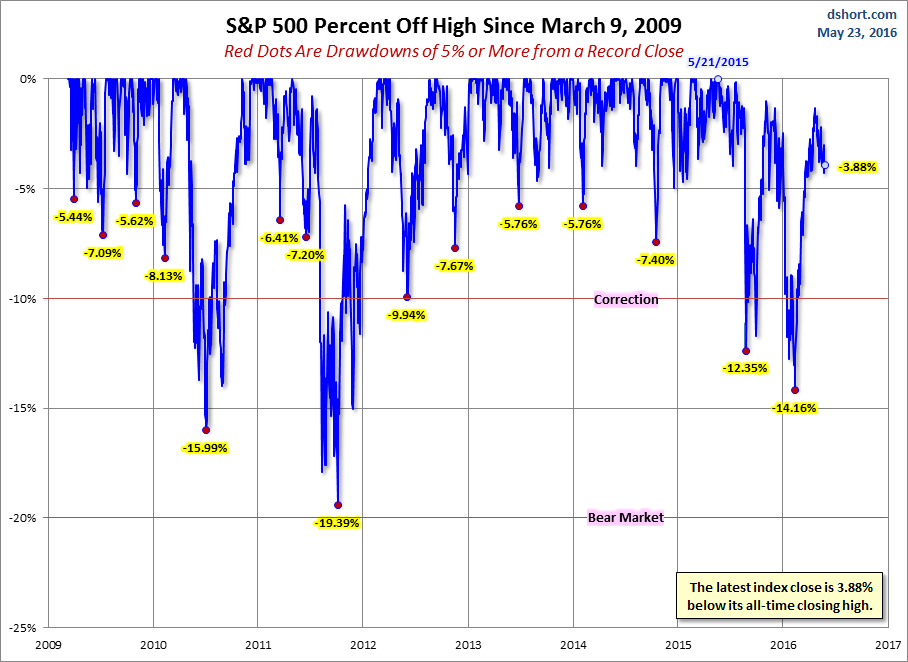

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

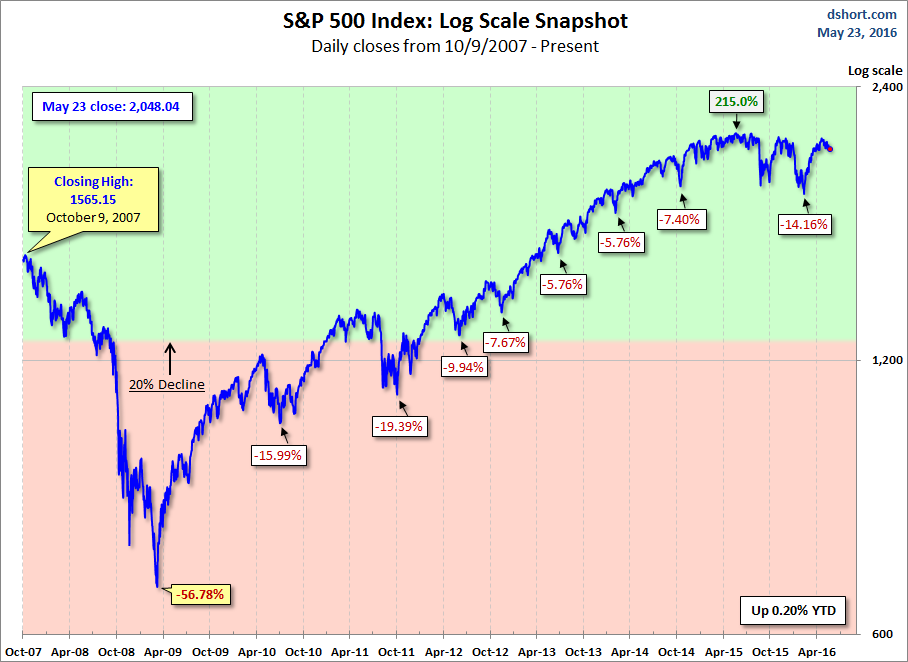

Here is a more conventional log-scale chart with drawdowns highlighted.

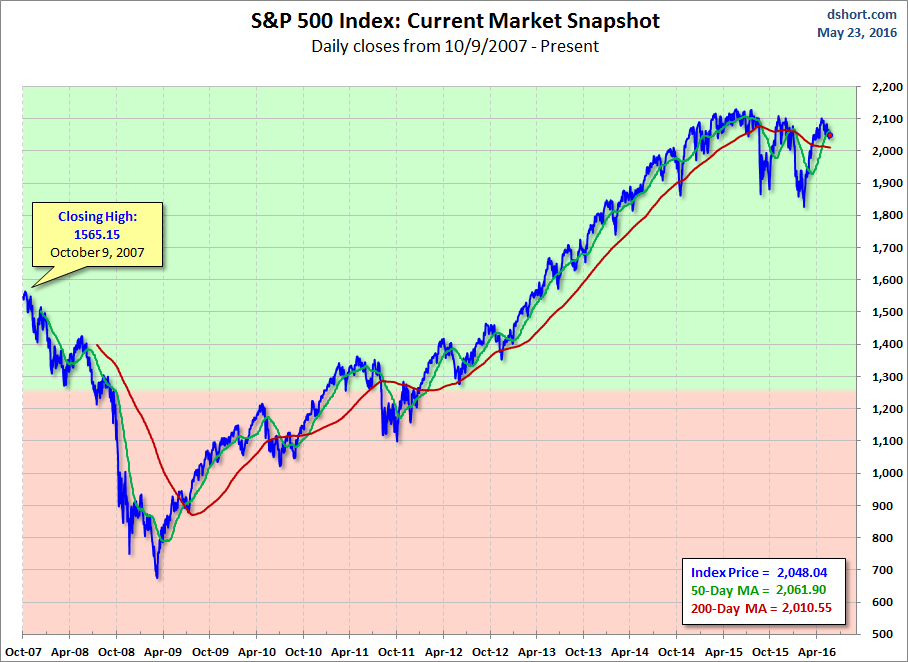

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

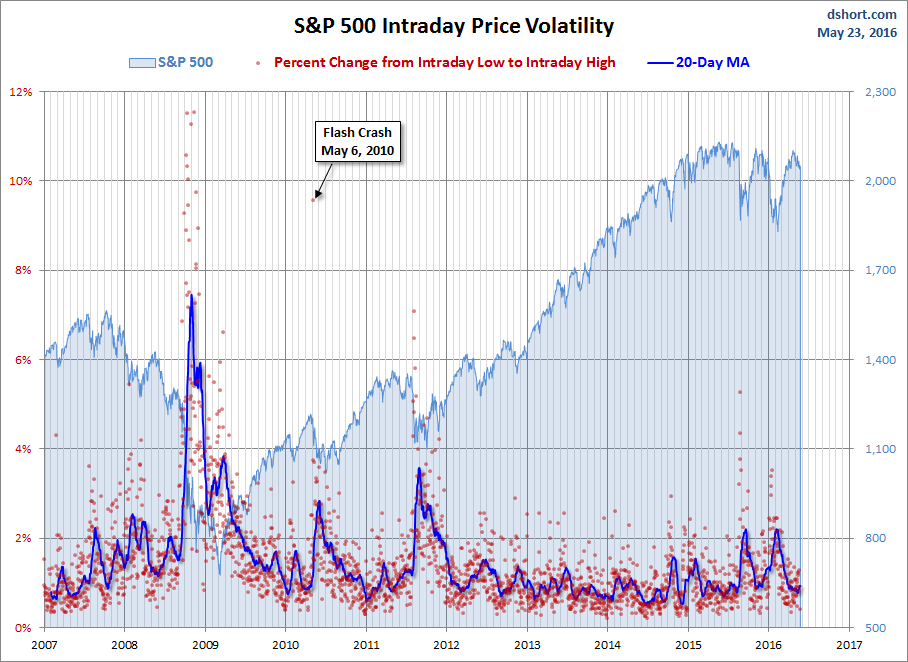

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.