Investing.com’s stocks of the week

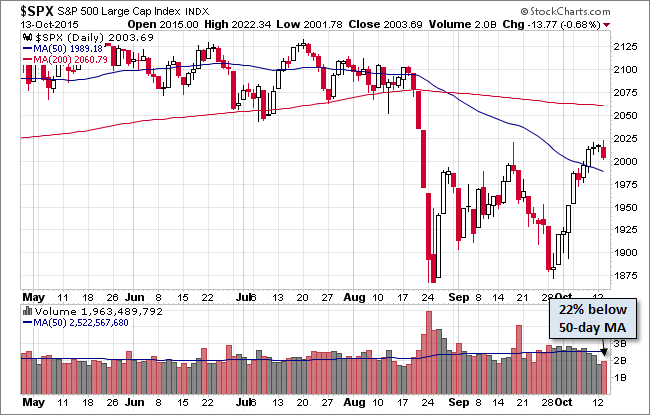

The S&P 500 snapped a four-day with a modest decline. Actually that four-day advance was largely the result of the first two sessions. The two sessions before today's loss were tiny. The index slumped at the open and then rose to its 0.24% intraday high about 90 minutes later. Selling then became the order of the day. The closing decline of -0.68% was off the -0.78% intraday low a few minutes before the bell.

The yield on the 10-year note closed the session at 2.06%, down 6 bps from the previous close.

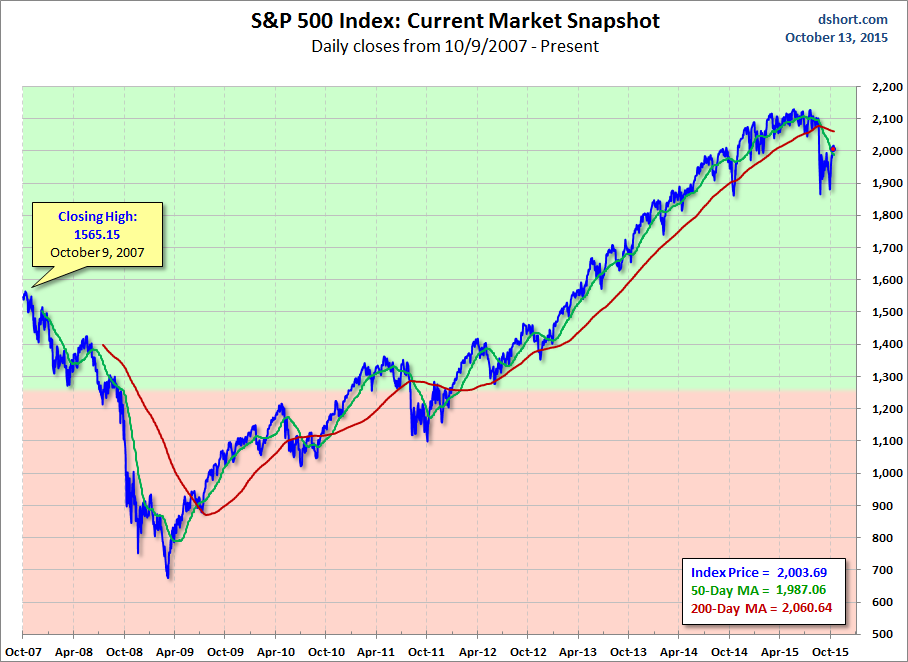

Here is a snapshot of past five sessions.

Volume was light on today's decline.

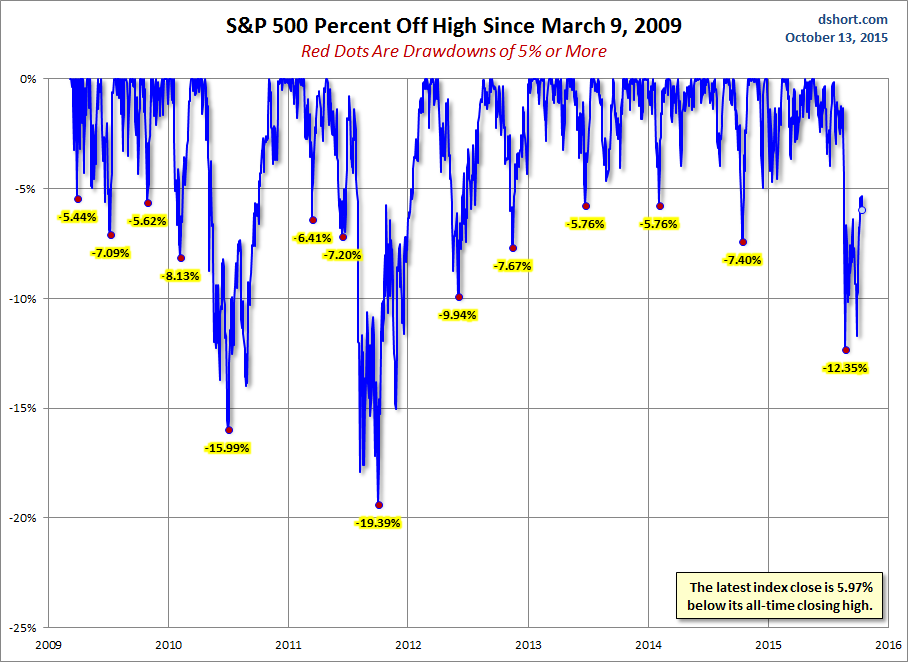

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

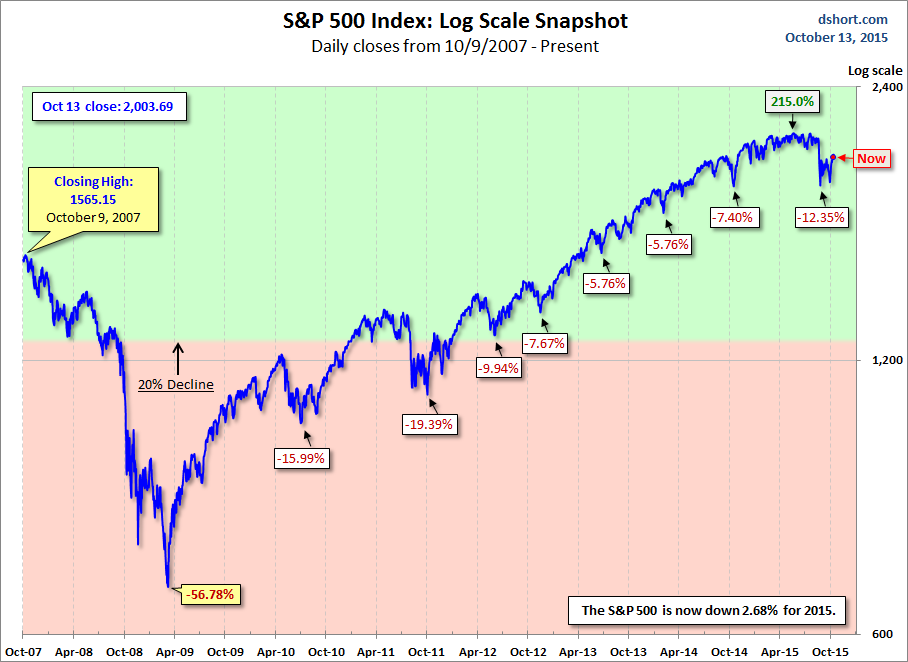

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.