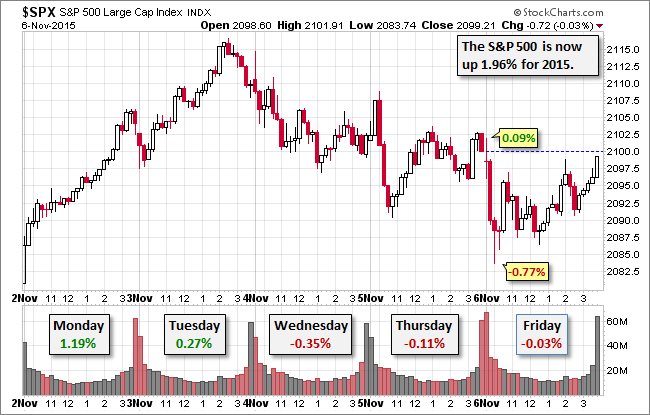

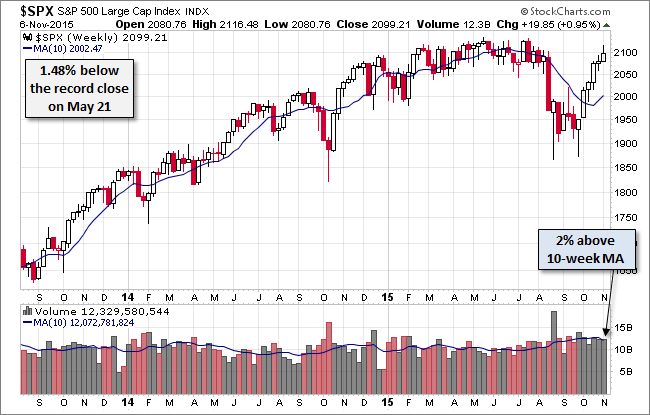

The better-than-forecast October employment report presumably strengthened the odds of a December Fed rate hike, but the market's reaction was surprisingly subdued. The S&P 500 opened fractionally lower, hit its 0.09% intraday high minutes later and then sold off to its -0.77% intraday low about 20 minutes after that. The index then spent the rest of the day zigzagging higher to its tiny 0.03% loss for the session. It closed the week with a 0.95% gain, its sixth consecutive weekly advance. The S&P 500 is up 1.96% for the year and only 1.48% below its record close in May.

The yield on the 10-year note closed at 2.34%, up 18 bps from last week's close and the highest closing yield since mid-July.

Here is a snapshot of past five sessions.

Here is a weekly chart of the index. Trading volume today was unremarkable for the day and week.

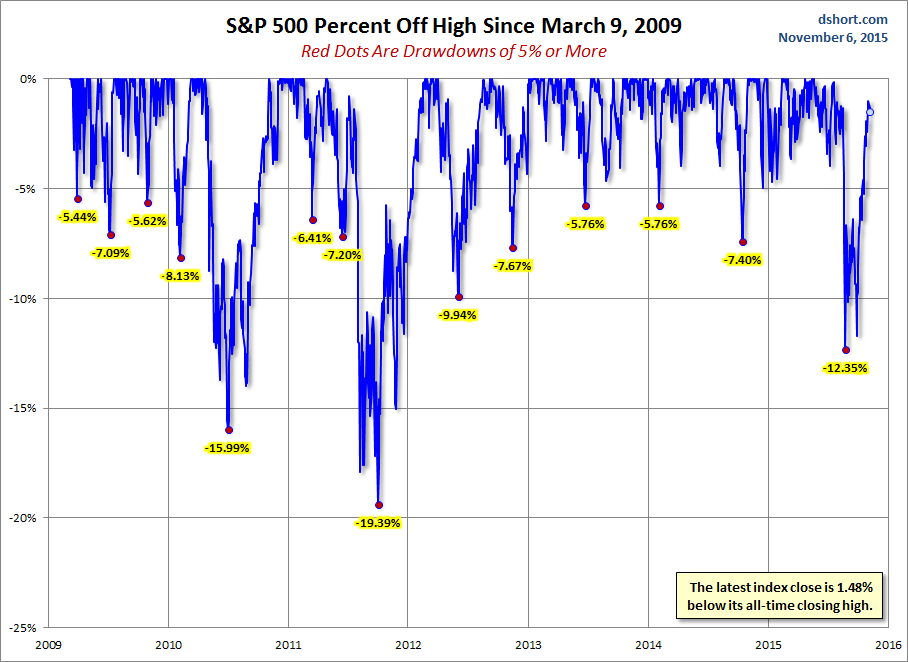

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

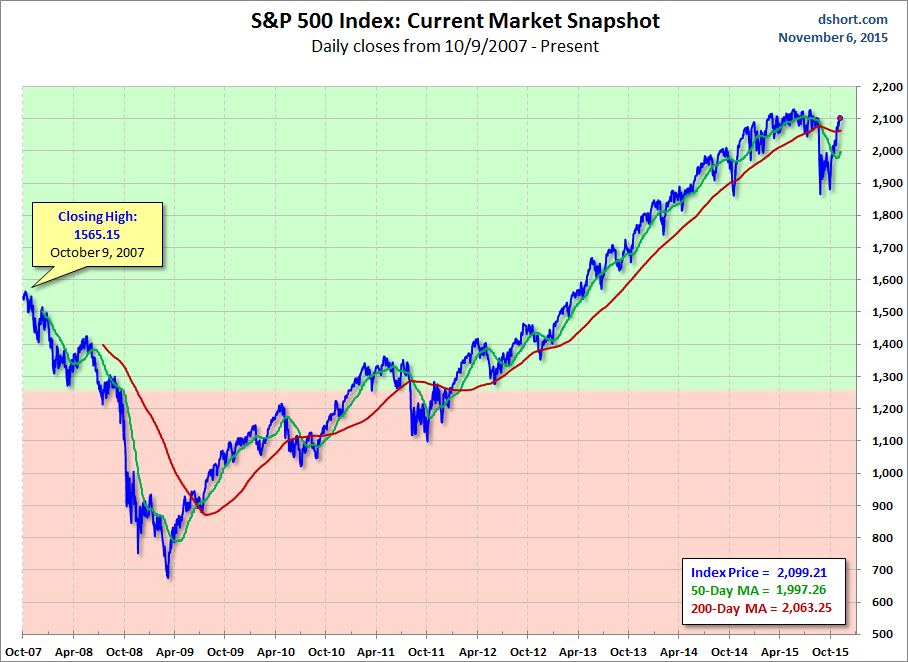

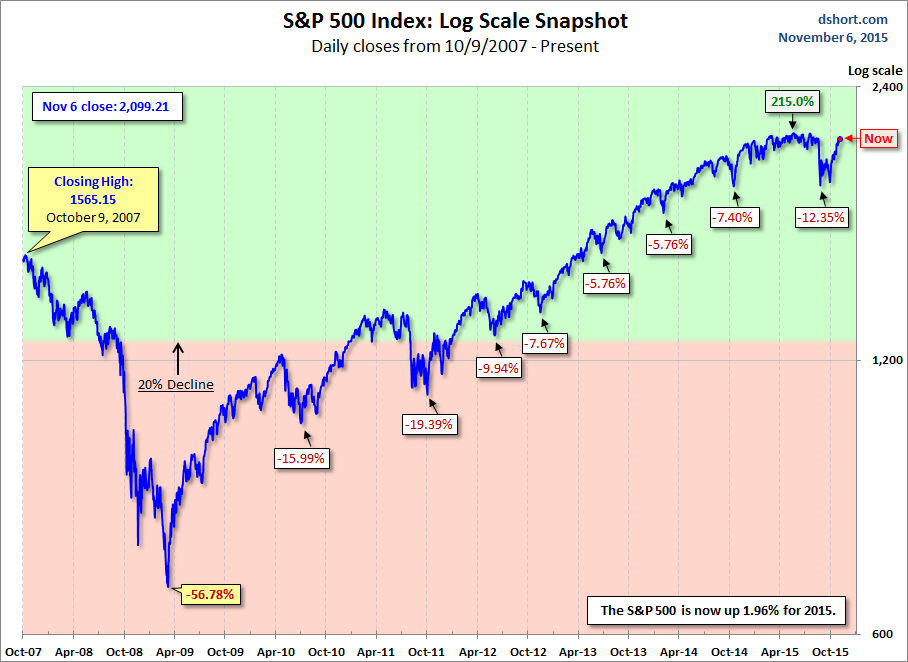

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.