Street Calls of the Week

The financial crisis in Greece continues its slow-motion journey to resolution, whatever that may be. But today the attention grabber for the US markets was the generally disappointing June employment report. Fewer jobs added than expected, downward revisions to the past two months, and a smaller unemployment rate largely driven by a labor force that shrank more than the number of unemployed. The S&P 500 opened higher and hit its 0.37% intraday high a few minutes later. It then trended lower to its -0.31% mid-afternoon low. It then drifted higher to a nearly flat finish, down 0.03% for the day. The index is down 1.18% for the pre-holiday shortened week.

The yield on the 10-year note closed today at 2.40%, 3 bps below yesterday's close.

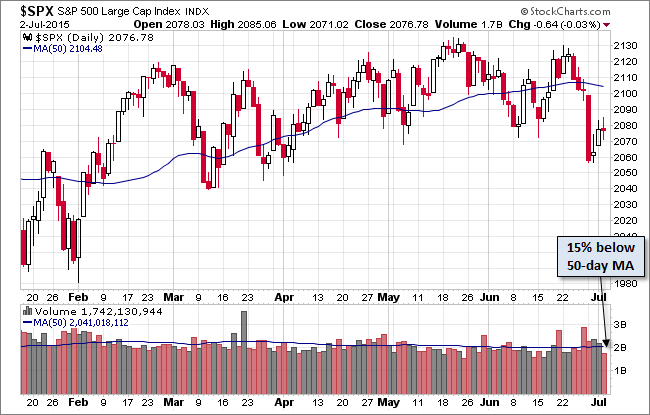

Here is a 15-minute chart of the past five sessions.

Here is a daily chart of the index, which remains below its 50-day moving average. Today's trading came on light pre-holiday trading.

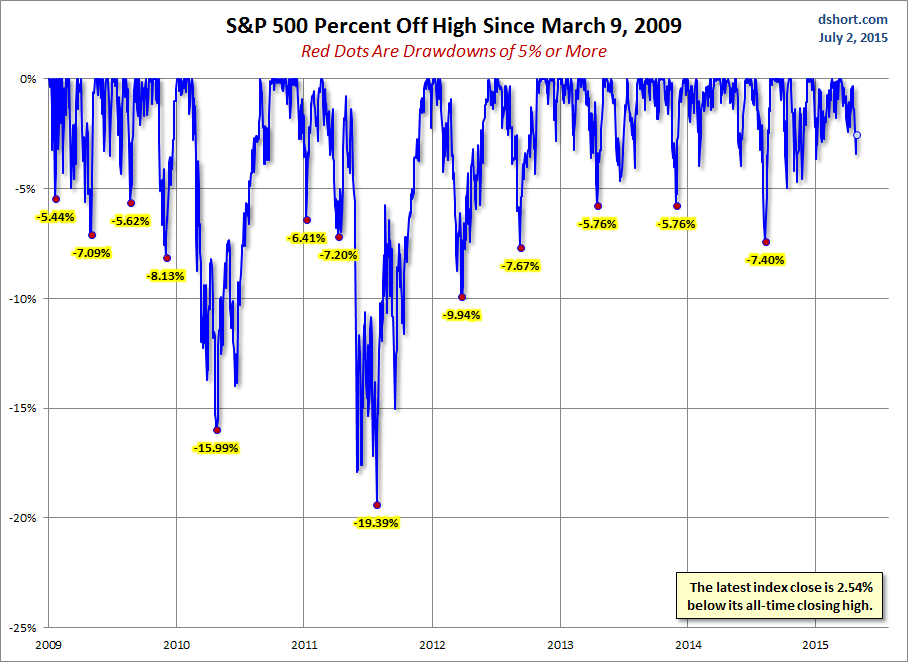

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

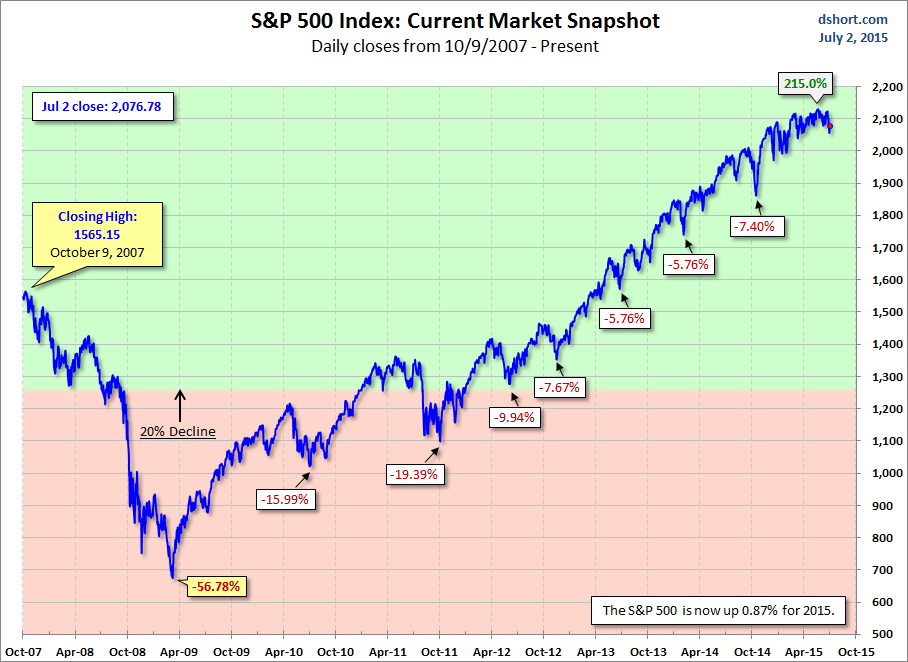

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.