Investing.com’s stocks of the week

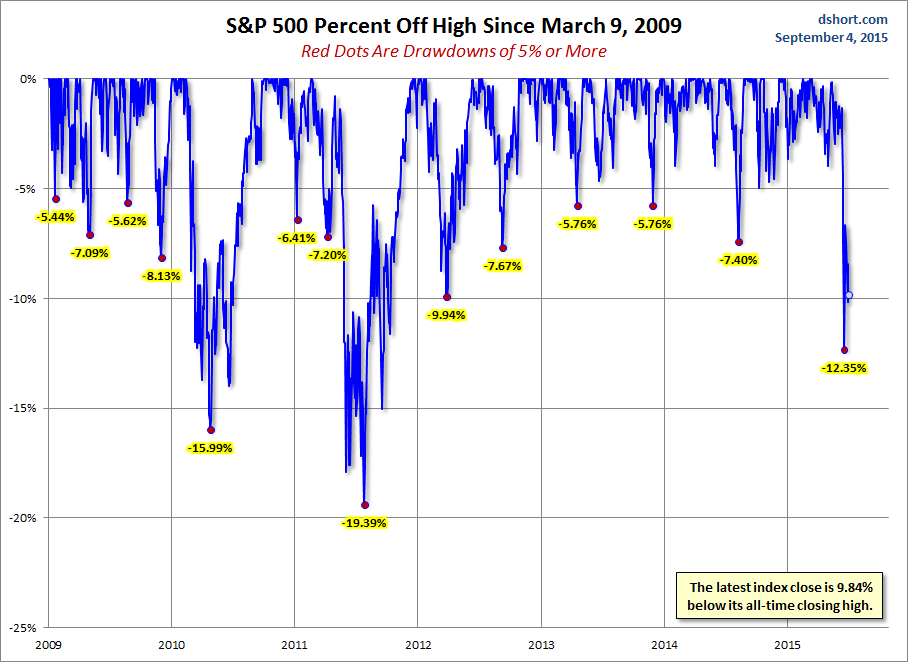

Our benchmark S&P 500 ended a volatile week on a low note, down 1.53% for the day and 3.4% for the week. Fridays's employment report was light on August new jobs, but the revisions to the two previous months and the down tick in the unemployment rate from 5.2% to 5.1% was interpreted by the market as a green light to a Fed rate hike -- bad news for equities. The index, nevertheless, remains a bit above the -10% correction zone, now down 9.84% from its May 21st record close. Year-to-date it's down 6.69%.

The yield on the 10-year note closed at 2.13%, down 5 bps from yesterday's close.

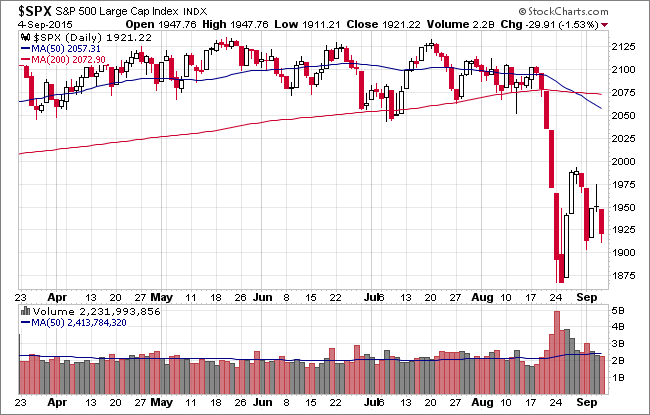

Here is a snapshot of past five sessions:

On a daily chart we see that volume on today's selling was unremarkable:

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough:

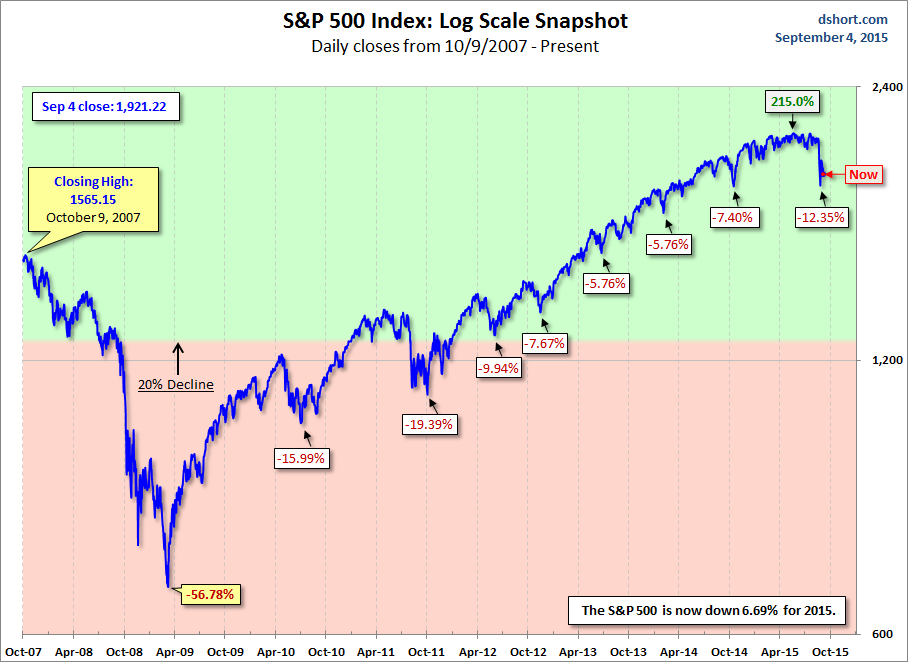

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession: