Investing.com’s stocks of the week

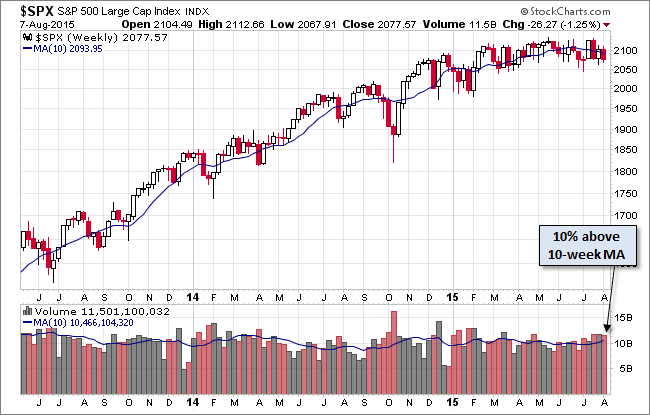

The headline numbers for this morning's employment report for July were reasonably strong. Nonfarm employment came in a tad below expectations, but the upward revision to the two previous months more than compensated. With the increased likelihood of a Fed rate hike, the S&P 500 opened fractionally lower at its intraday high and sold off to its -0.75% intraday low in the early afternoon. Some action in the final hour trimmed today's loss to -0.29%. The index closed the week with a -1.25% loss.

The yield on the 10-year note closed the week at 2.18%, down 5 bps from yesterday's close but only 2 bps below last Friday's close.

Here is a snapshot of past five sessions:

On the weekly chart we see that the index has fallen below its 10-week moving average on above-average volume:

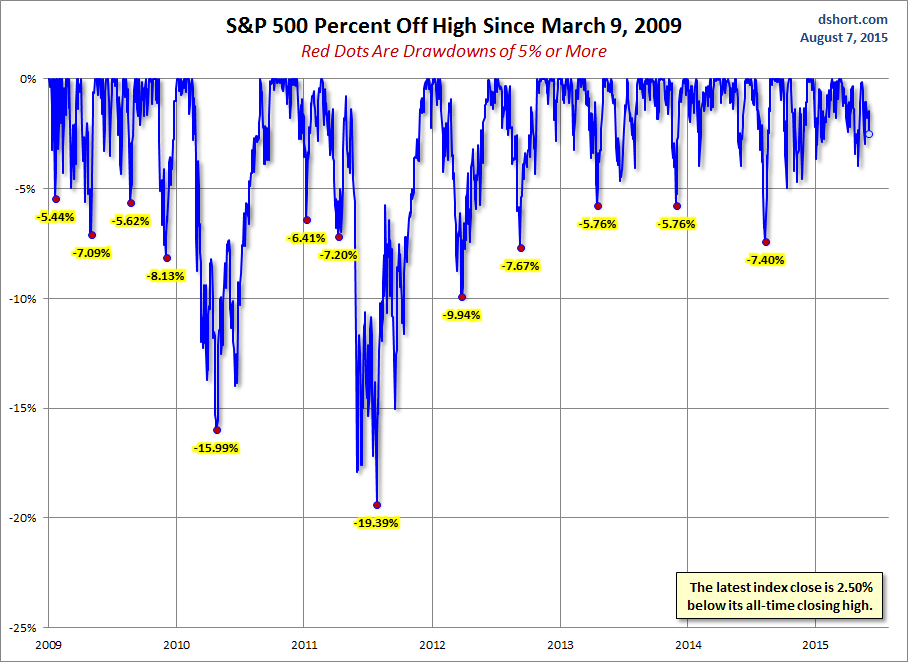

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough:

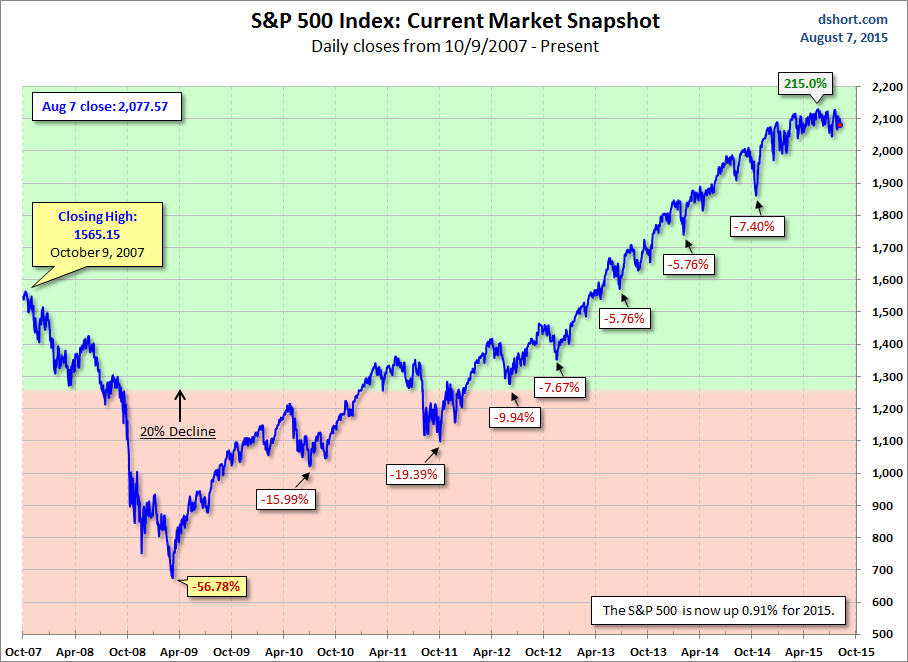

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession: