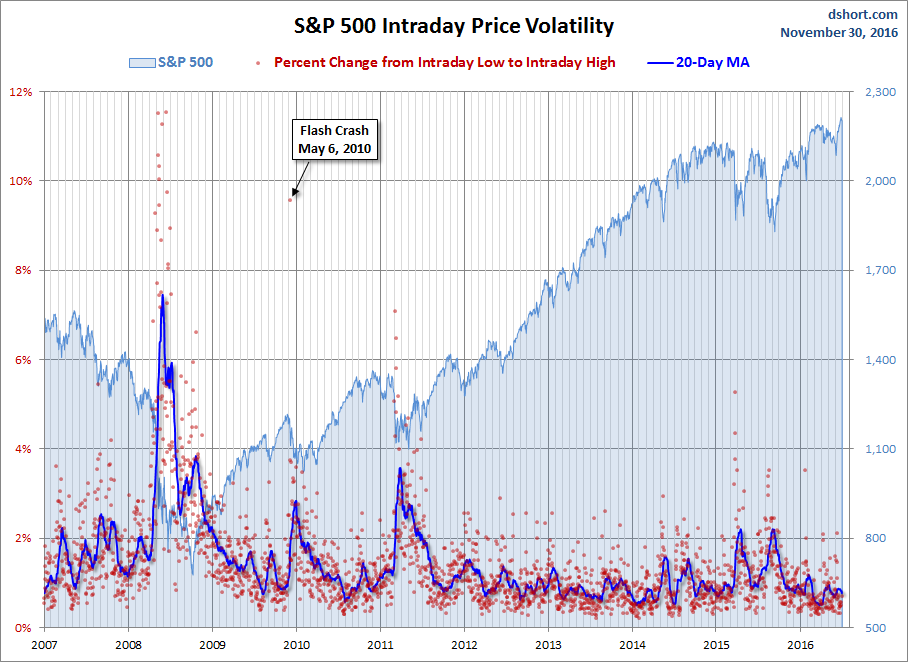

The S&P 500 popped at the open and hit its 0.43% intraday high about 15 minutes into the session. The rest of the day was a pattern of zig-zagging downward to the its -0.27% intraday low at the close. On a brighter note, the index posted a 3.42% monthly gain, its best since its 3.56% July advance.

The selloff in Treasuries resumed today. The yield on the 10-year note closed at 2.37%, up seven BPs from the previous close and an interim high, the highest close since mid-July 2015.

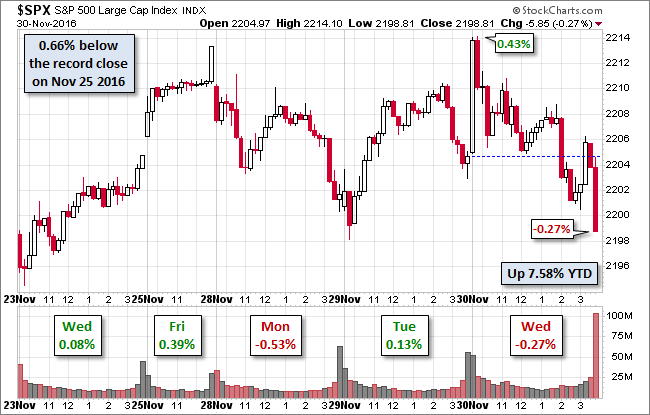

For a longer perspective, here's a monthly chart of the S&P 500.

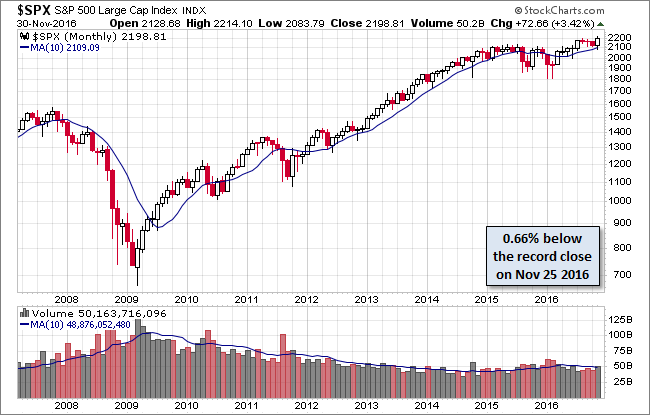

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

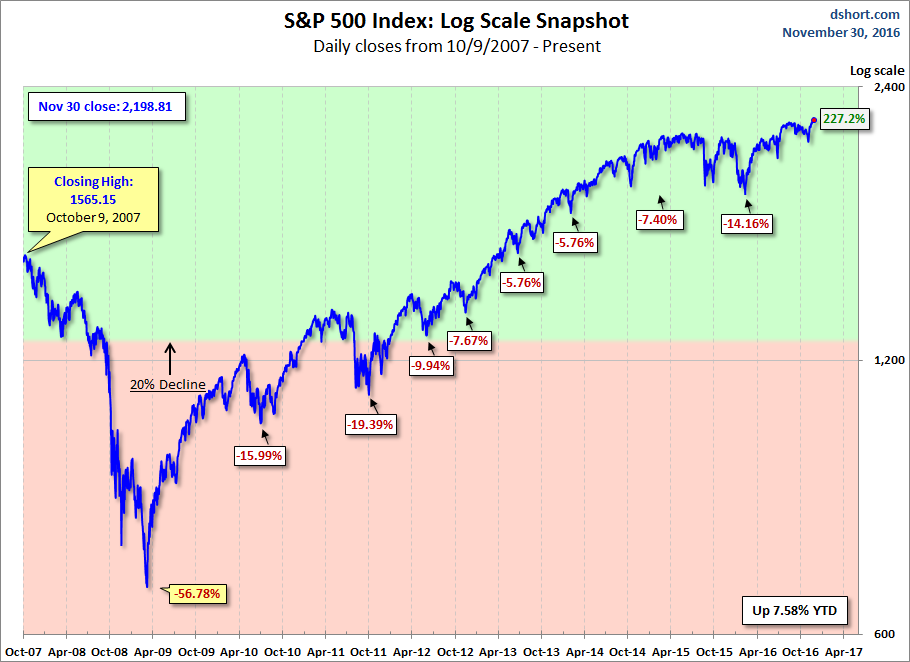

Here is a more conventional log-scale chart with drawdowns highlighted.

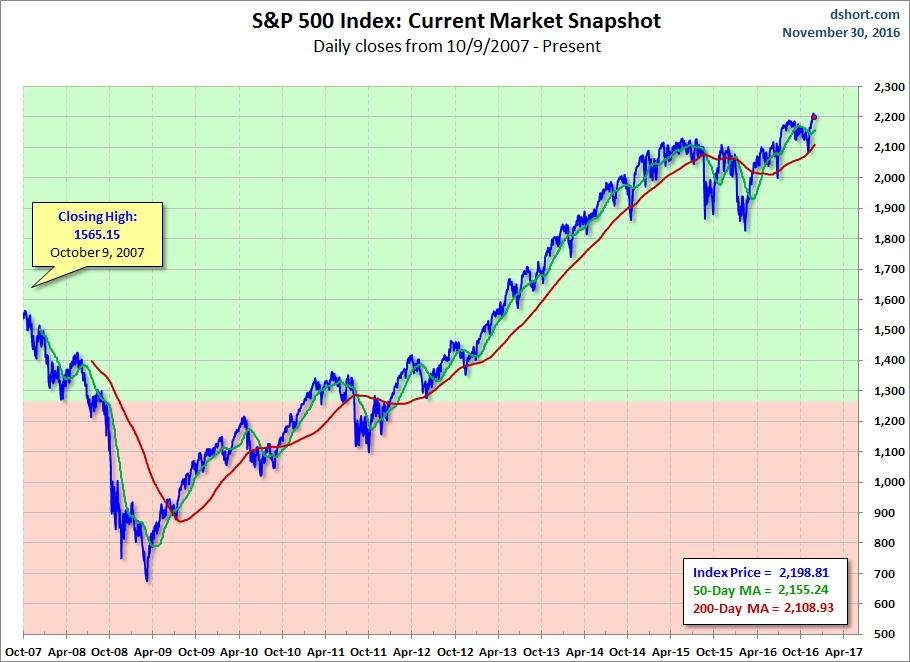

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

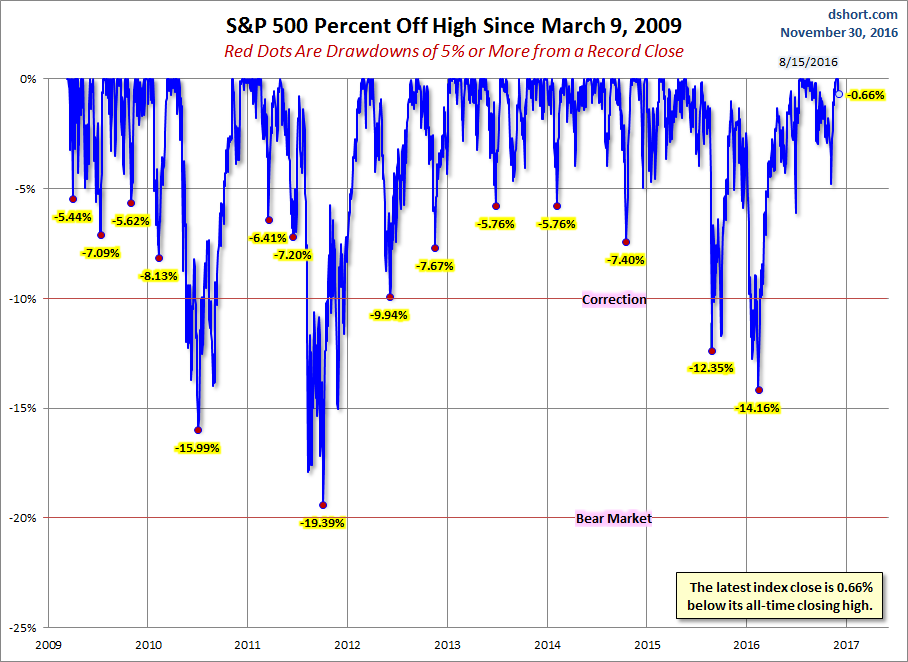

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.