The S&P 500 rallied at the open and continued its upward trend through most of the morning. In the absence of any economic updates, the pundits generally attributed the gain to optimism of a near-term resolution of the situation in Greece. The index drifted sideways through the afternoon, closing with a 1.20% gain, not too far below its 1.36% mid-afternoon intraday high. Today's advance was its best gain since its 1.35% pop on May 8th, over a month ago.

Meanwhile, treasuries dropped. The yield on the benchmark 10-year note rose eight bps to end the day at 2.50%, its highest close since September 30th of last year.

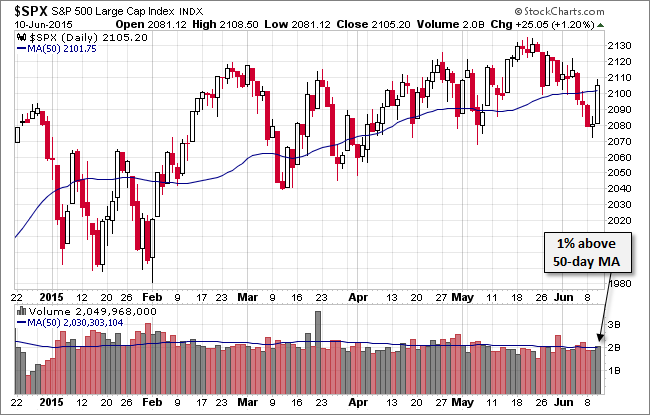

Here is a 15-minute chart of the past five sessions.

Today's rally, which came on average trading volume, pushed the index back above its 50-day price moving average.

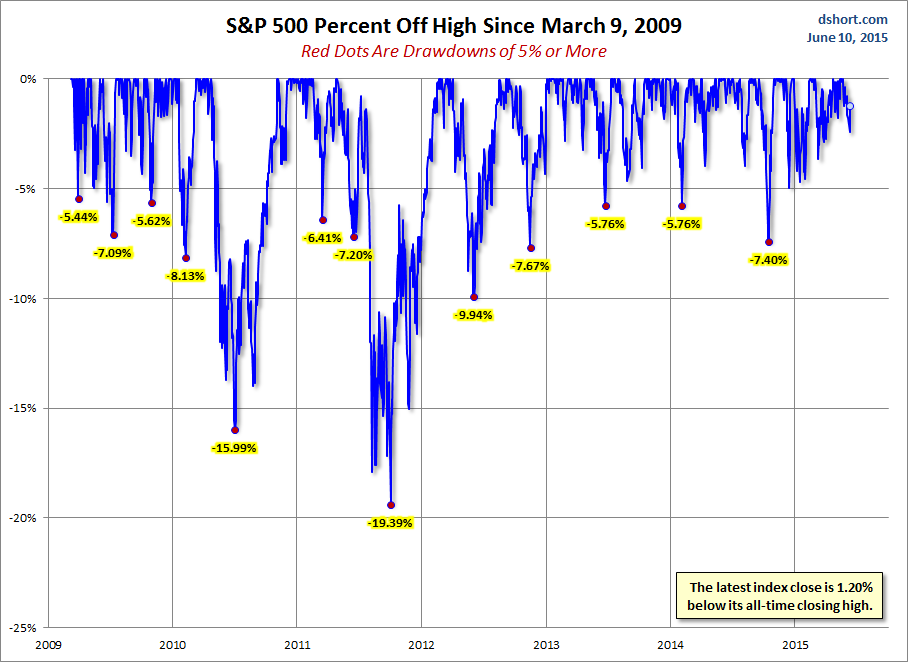

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

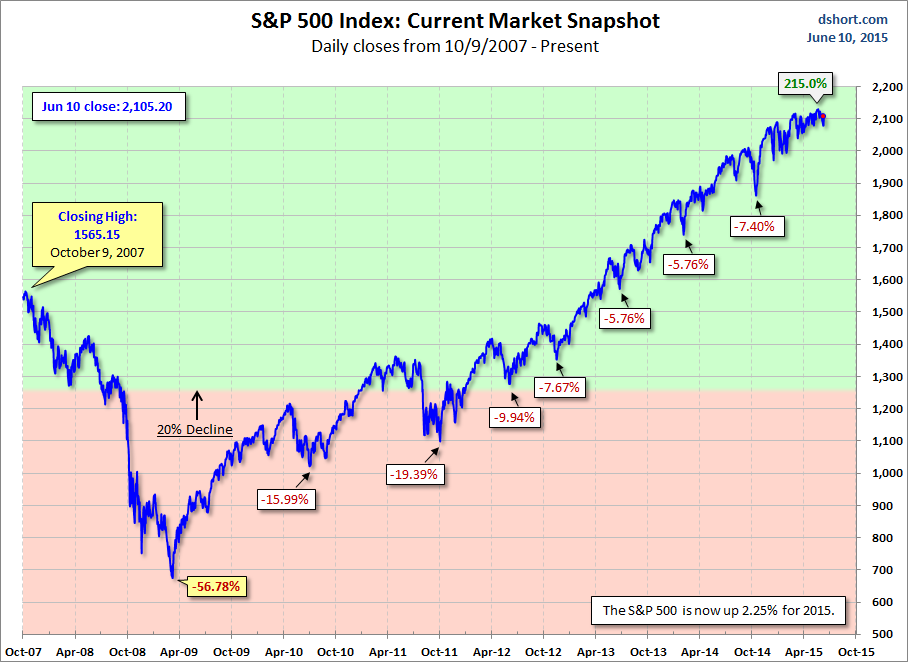

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.