The S&P 500 logged its second consecutive record close. The index opened higher, traded sideways for about 45 minutes and then sold off to its -0.17% intraday low. It recovered to the flat line during the early afternoon and then resumed its rally in the later afternoon, rising to its 0.30% intraday high just before the final bell and a final trimmed gain of 0.22%.

The yield on the 10-year note closed at 2.31%, down two BPs from yesterday's close. The 30-year bond remained unchanged at 3.00%, one BP (NYSE:BP) off its interim closing high at the end of last week.

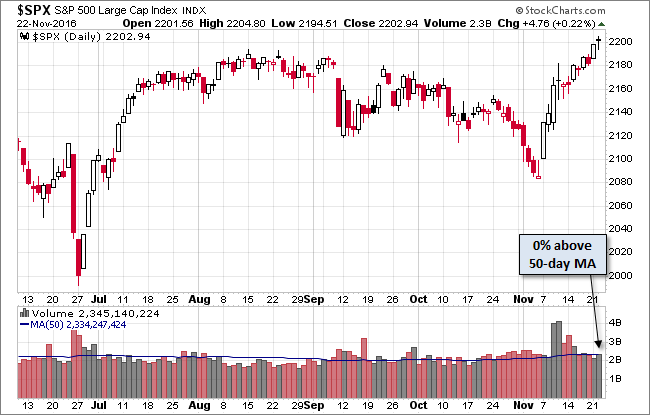

Here is a snapshot of the past five sessions.

Here's a daily chart of the S&P 500. Trading volume was again unremarkable on today's follow-up record close.

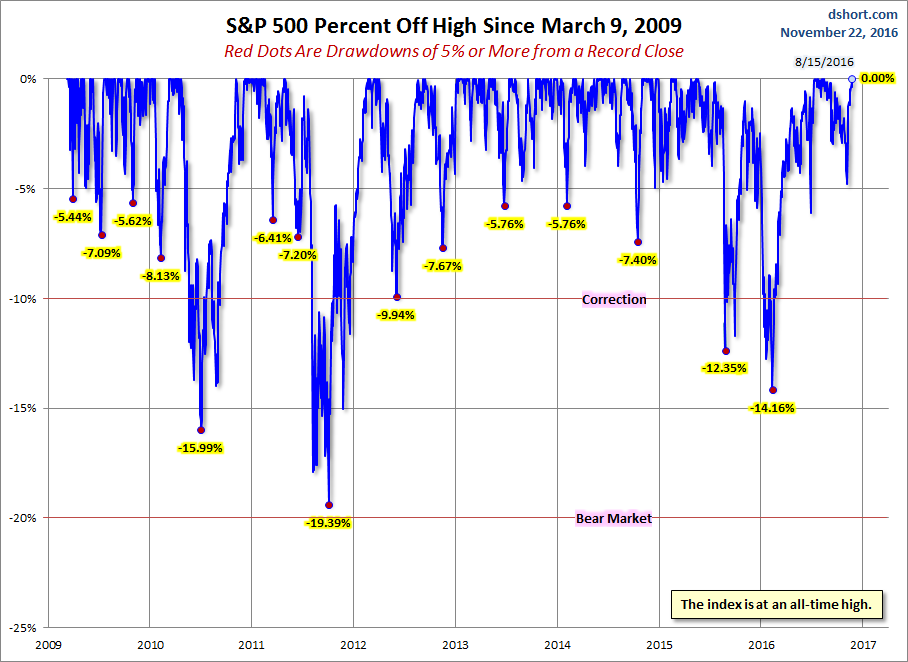

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

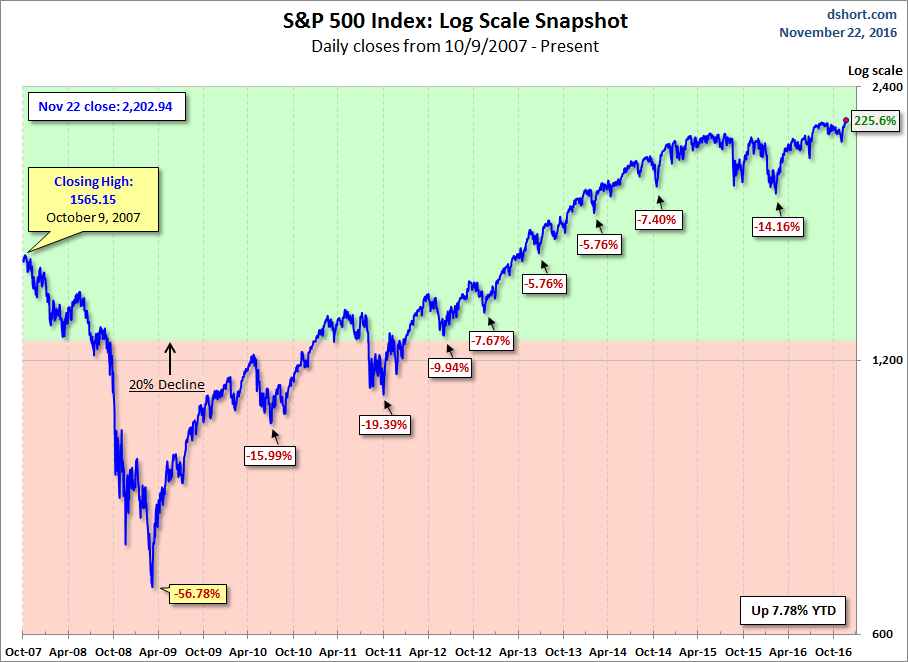

Here is a more conventional log-scale chart with drawdowns highlighted.

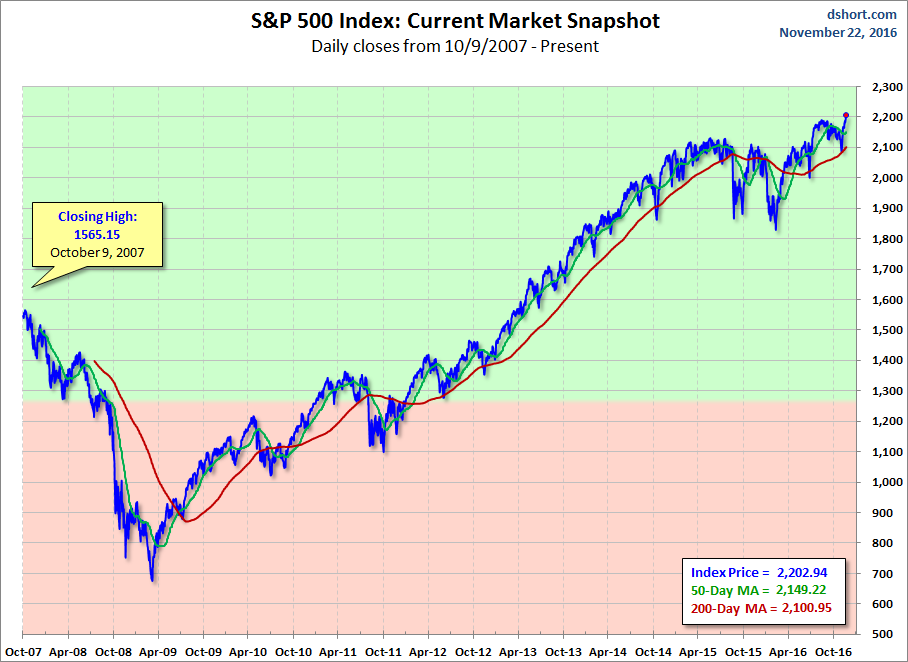

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

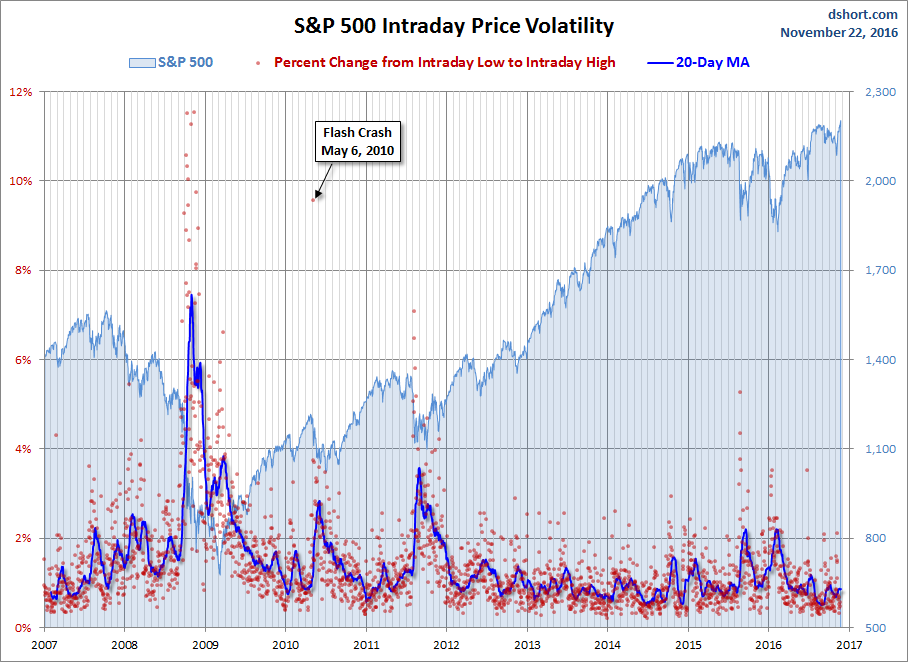

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.