Investing.com’s stocks of the week

On a day of light economic news, the S&P 500 continued its downward drift that started in the second half of last week. A popular duo of explanations is, yawn, worrying about Greece and fretting over a Fed rate hike in September. And speaking of the Fed, today we at Advisor Perspectives began tracking the Labor Market Conditions Index, a relatively new diffusion index unveiled by Fed economists last fall. A key reason we decided to add the LMCI to our repertoire is rather astonishing frequency the phrase "labor market conditions" appears in FOMC statements.

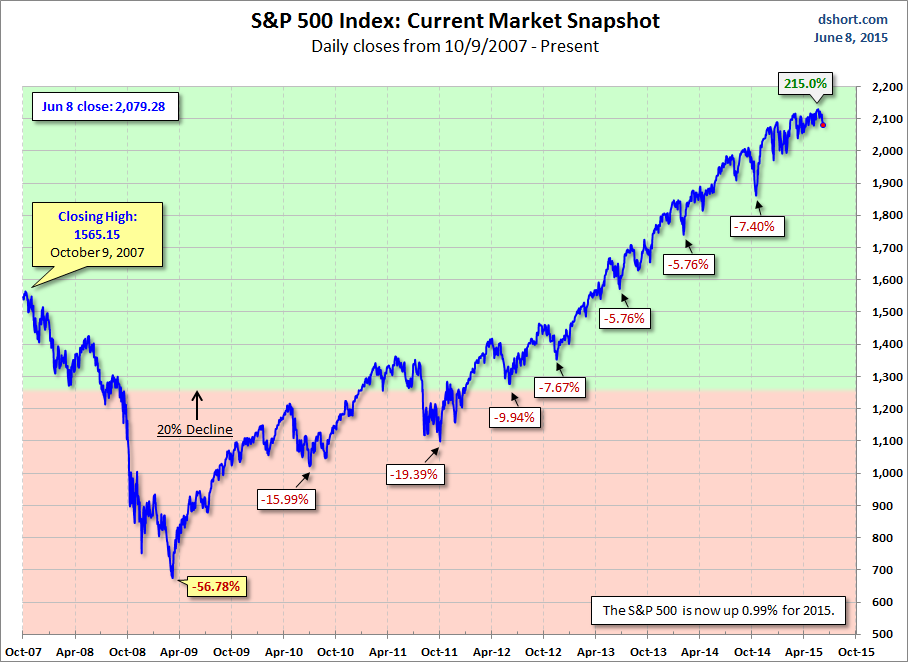

Today's -0.65% decline, just a hair above the S&P 500's -0.67% intraday low, has trimmed this year's advance to 0.99%.The index is now -2.42% below its record close on May 21st.

The yield on the 10-year note slipped two bps to close at 2.39%.

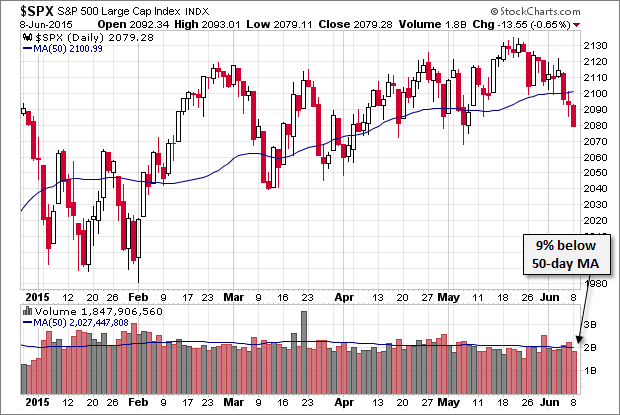

Here is a 15-minute chart of the past five sessions.

Today's selling came on somewhat subdued volume.

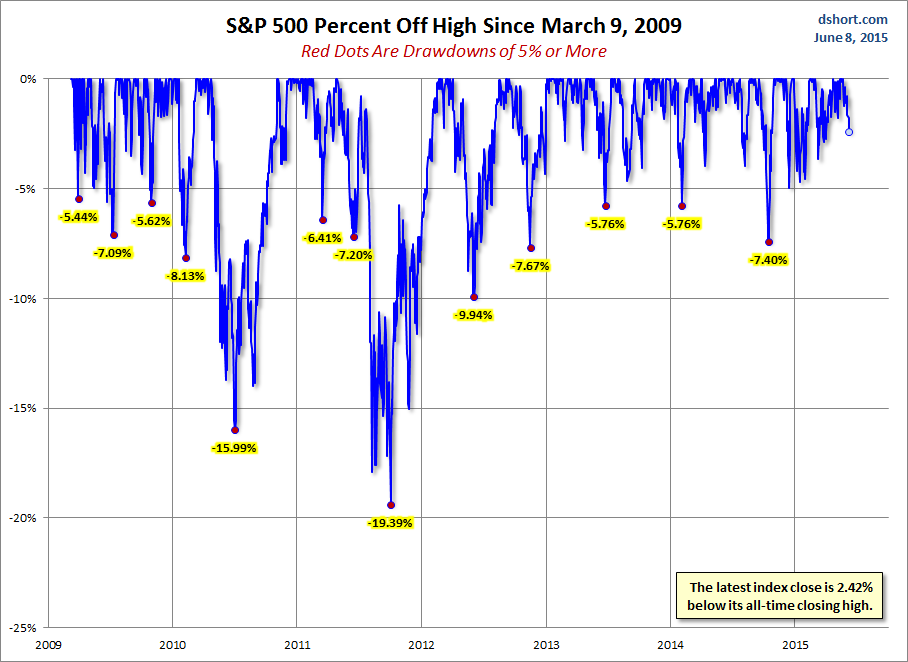

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.