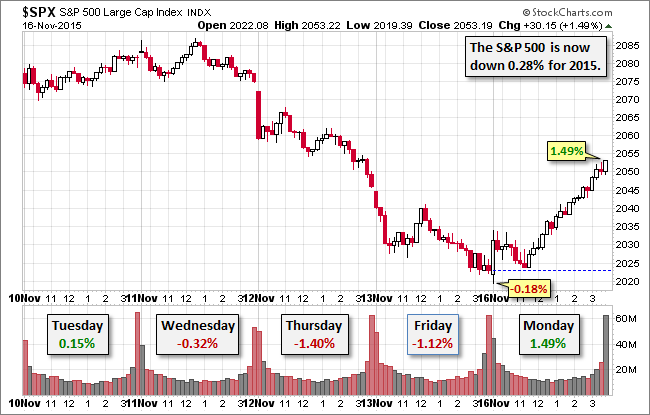

While Eurozone indexes finished the day flat, US markets rallied. In light of the Paris attacks, the Energy Select Sector SPDR (N:XLE) surged with a closing gain of 3.33%. The S&P 500 exhibited some indirection for the first two hours, but about the time Eurozone markets were closing, the energy trade emerged, and the 500 index traded steadily higher though the rest of the day to its 1.49% close, just 3 bps off its intraday high.

Treasuries were little impacted by the events in Europe. The yield on the 10-year note closed at 2.27%, down only 1 bp from Friday's close.

Here is a snapshot of past five sessions.

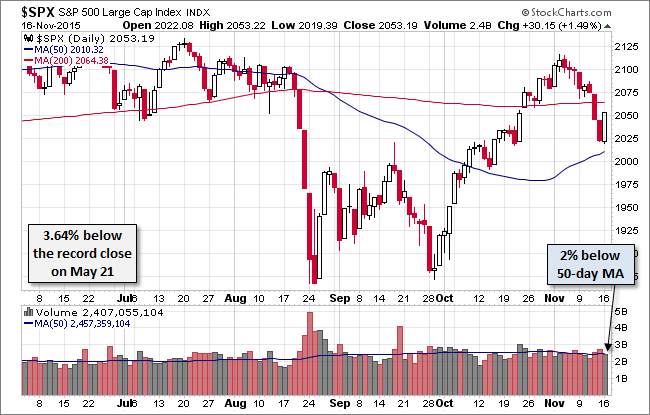

Here is a daily chart of the index. Trading volume was unremarkable.

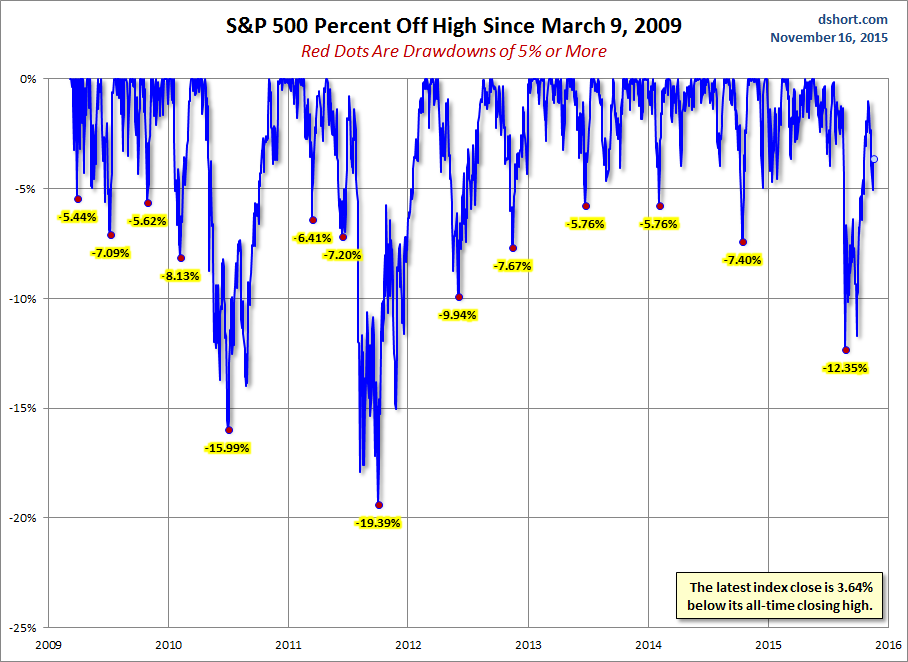

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

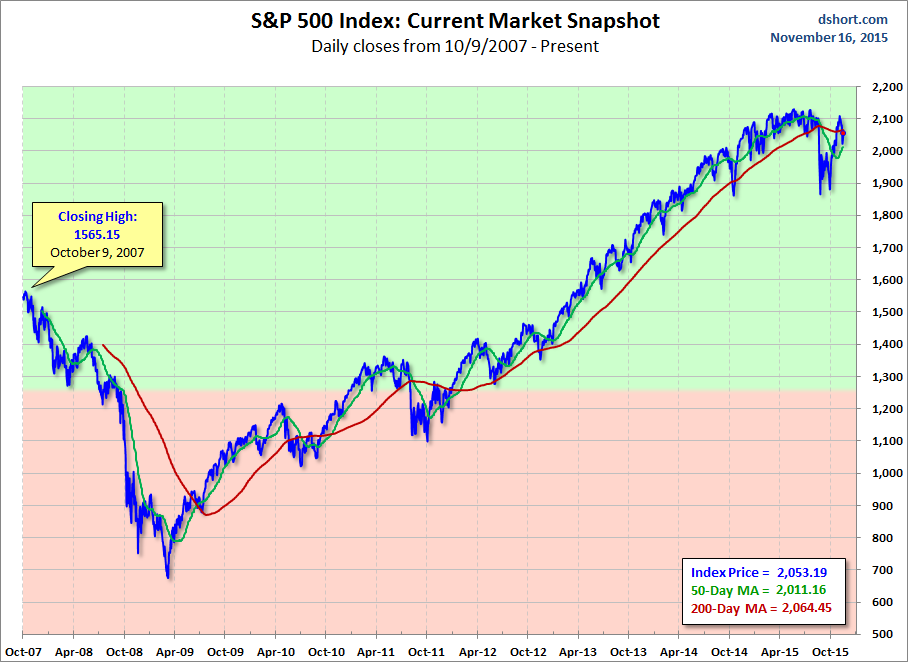

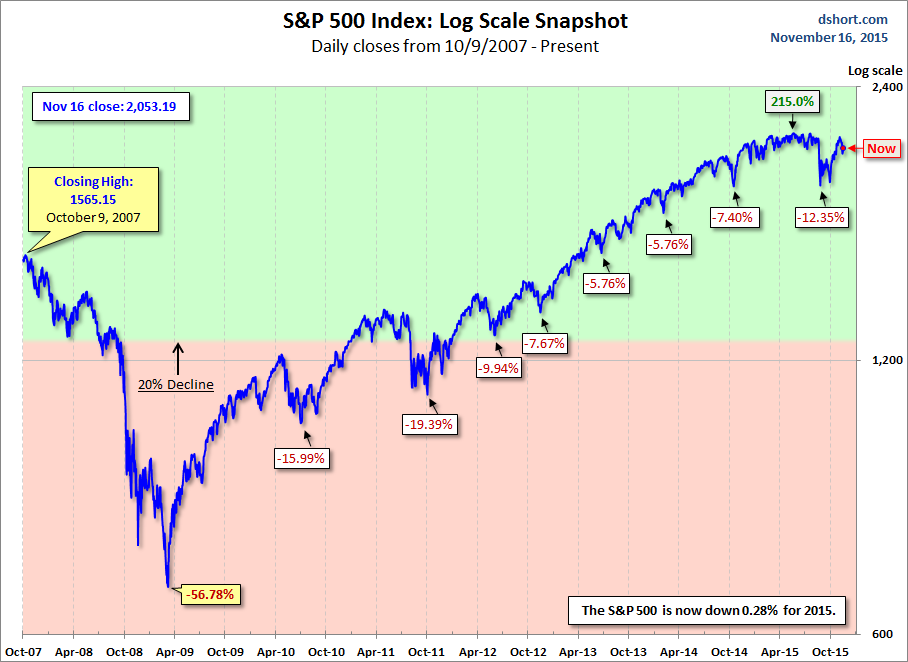

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.