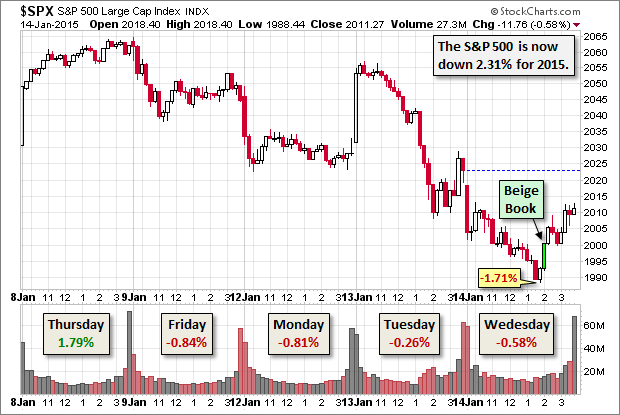

Pre-market futures were already pointing to weak open when the Advance Estimate for December Retail Sales came in much worse than economists' already low expectations. The S&P 500 nose-dived at the open and sold off to its -1.71% intraday low just before the 2 PM release of the Fed's Beige Book. The pervasive Fed theme of a "modest" or "moderate" pace of economic growth was perhaps the catalyst for the afternoon rally that trimmed the selloff to a psychologically more manageable -0.58%. This was the forth consecutive loss and the ninth of the eleven sessions since the S&P 500 posted its record close on December 29th.

The Treasury Department recorded a close of 1.86% for 10 Year T-Note, down 5 bps from yesterday. The 30 Year T-bond closed at 2.47%, one bp off its all-time closing low in July of 2012.

Here is a 15-minute chart of the past five sessions.

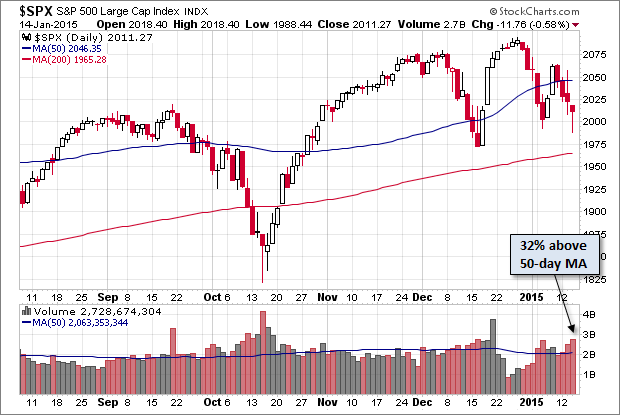

Red bars continue to accumulate on the daily chart, accounting for eight of the past ten sessions. Dispite the intraday volatility, today's volume was only 32% above its 50-day moving average.

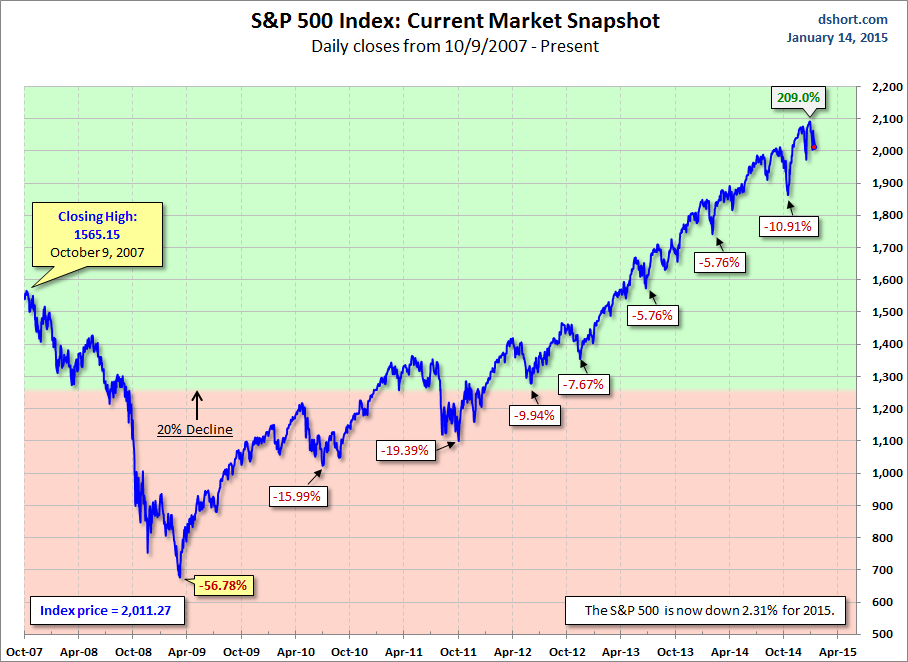

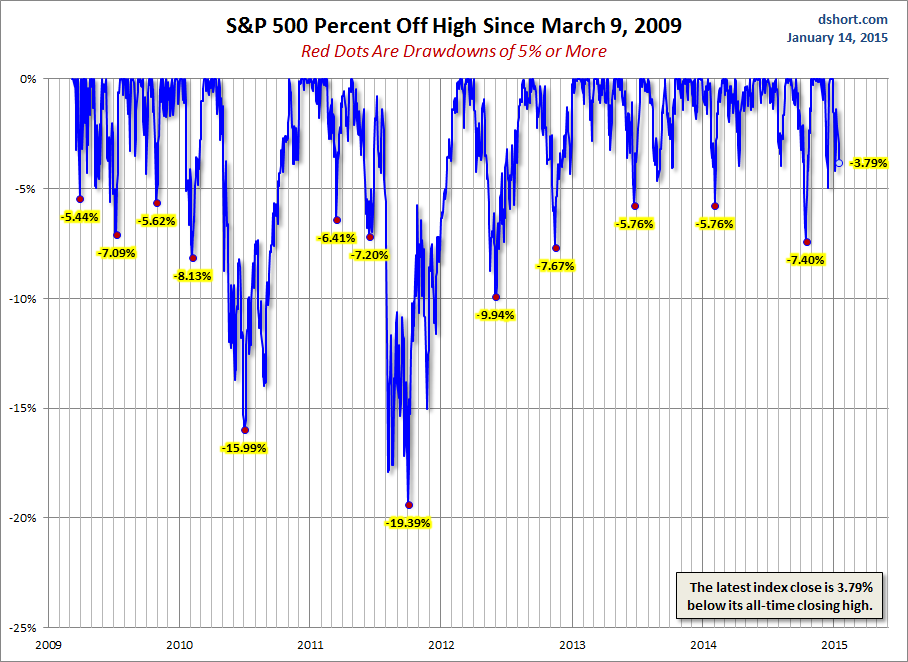

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough. The S&P 500 is 3.79% off its record close on December 29th.

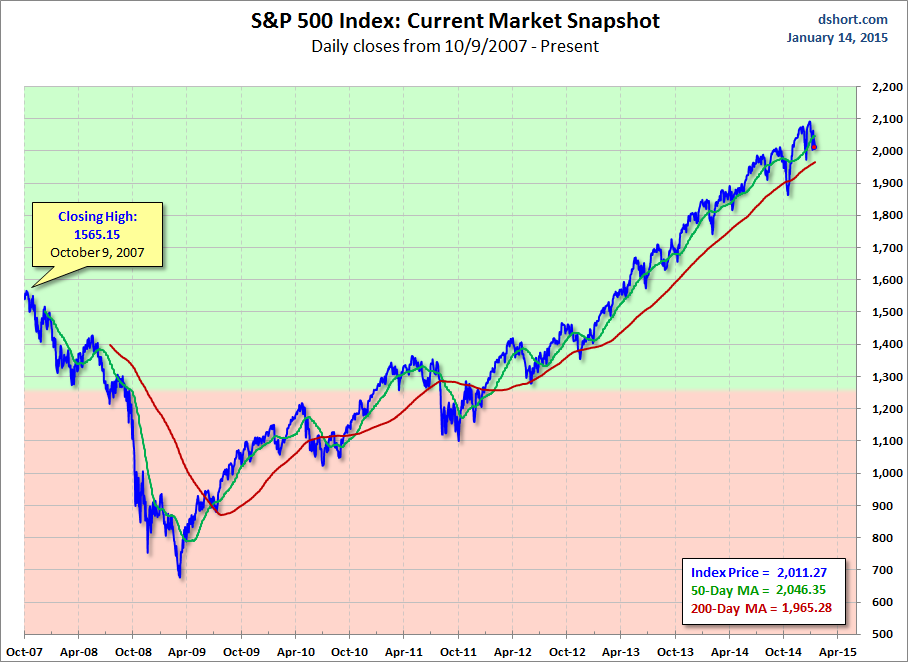

For a longer-term perspective, here is a pair of charts based on daily closes starting with the all-time high prior to the Great Recession.