Investing.com’s stocks of the week

With the three-day Memorial Day weekend in the immediate offing, the S&P 500 spent the day in semi-vacation mode. The intraday high-low trading range of 0.29% was the smallest of the year. The peak coincided, not surprisingly, with Janet Yellen's "Outlook for the Economy" speech at 1 PM. In her speech, Ms. Yellen discounted economic projections with a rather stunning self-abnegation, especially so in coming from a Fed Chair.

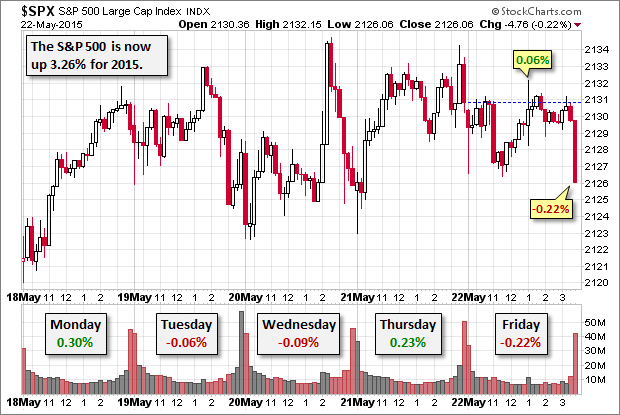

The official yield on the US 10 Year T-Note closed at 2.21%, up two bps from the previous close and seven bps from last Friday's close.The microscopic size of that intraday high, 0.06%, suggests that the fast-trade was essentially paralyzed by the remarkable Fed candor. The S&P 500 then traded sideways near the flatline, falling in the final minutes to its -0.22% close at its intraday low.

Here is a 15-minute chart of the week.

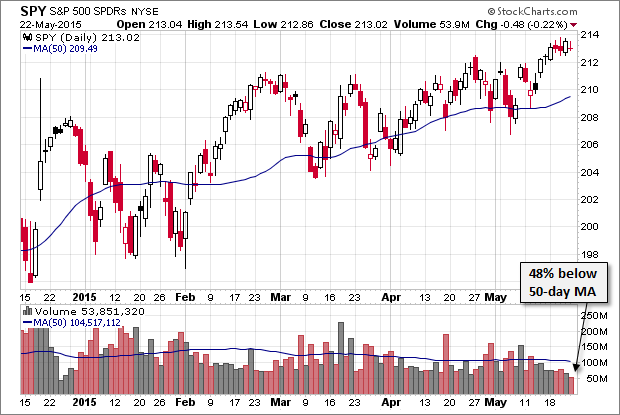

Here is a daily chart of the SPDR S&P 500 (ARCA:SPY) ETF, which gives a better sense of investor participation. Today's volume was the lowest of 2015. The same was true for the index itself.

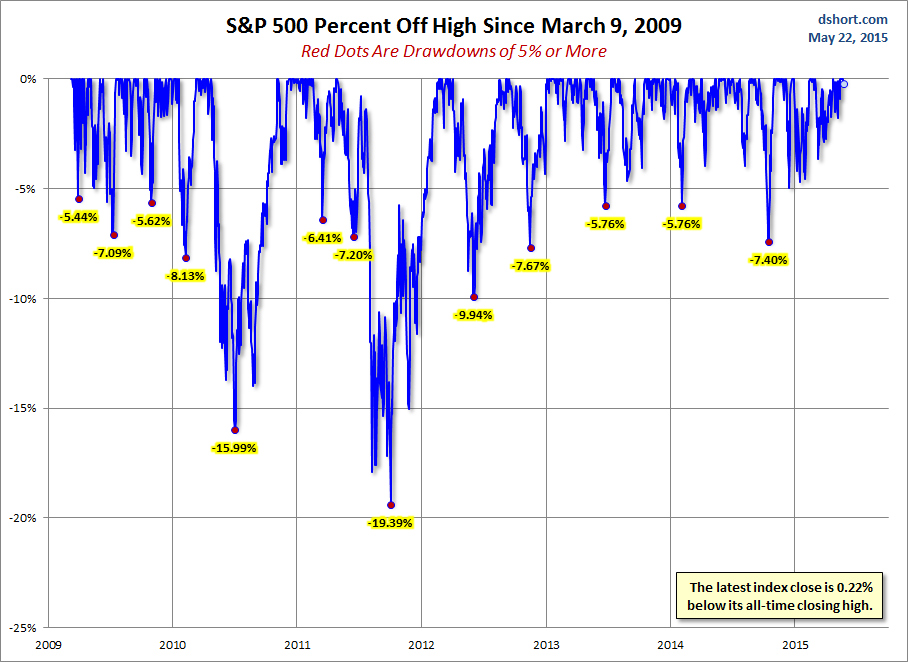

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

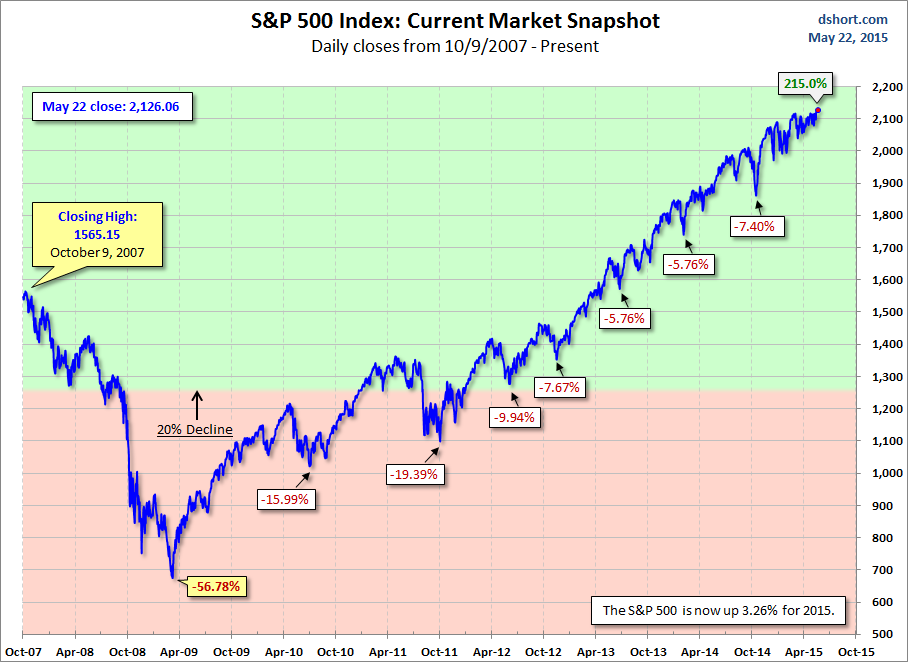

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.