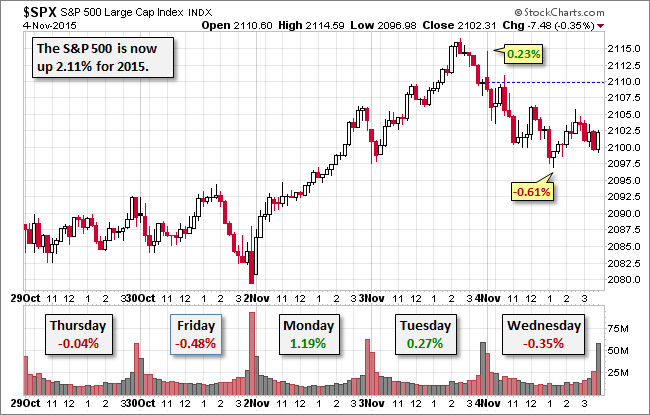

The S&P 500 ended the session with a modest -0.35% decline. The pre-market economic news was a tepid estimate of 182K new nonfarm private employment jobs from ADP countered by the September trade balance, which was the lowest since February. The S&P 500 hit its 0.23% intraday high moments after the open and then sold off to its -0.61% intraday low in the early afternoon. The 10AM release of better-than-expected ISM Non-Manufacturing (aka Services) hit the news as Fed Chair Yellen's congressional testimony began. That testimony included her assertion that a December rate hike is "a live possibility." The index ended at a trimmed loss of -0.35%, snapping a two-day rally.

The yield on the 10-year note closed October at 2.25%, up 2 bps from yesterday's close.

Here is a snapshot of past five sessions.

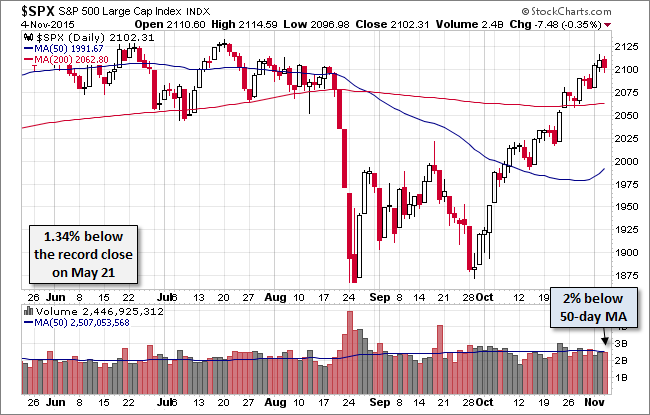

Here is a daily chart of the index. Trading volume today was unremarkable.

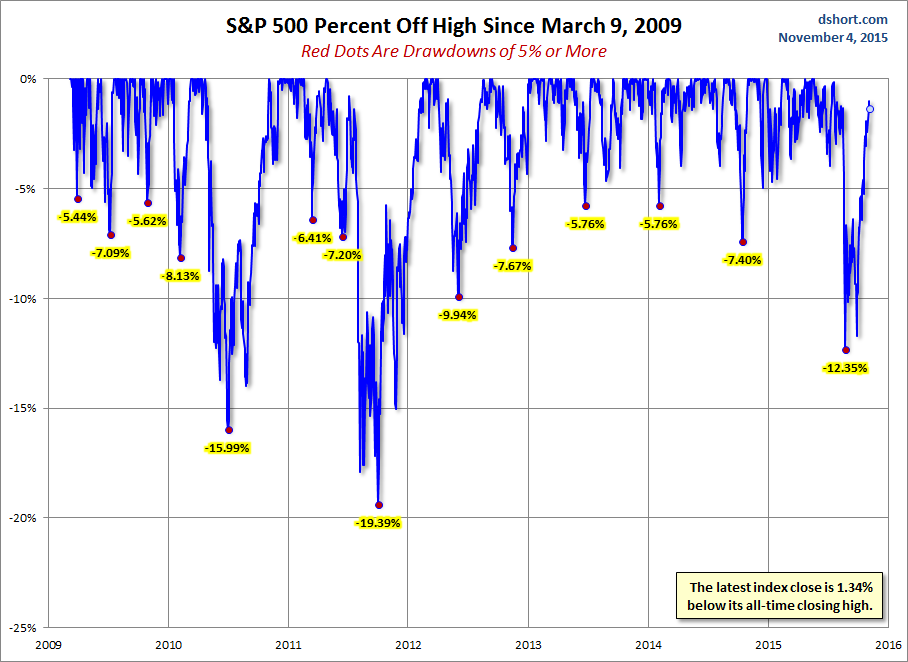

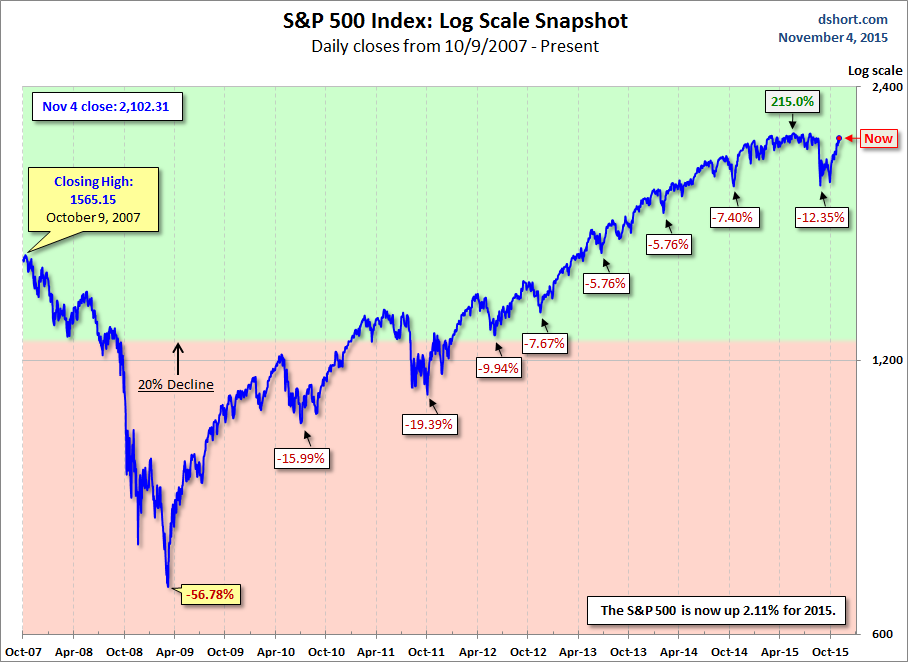

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

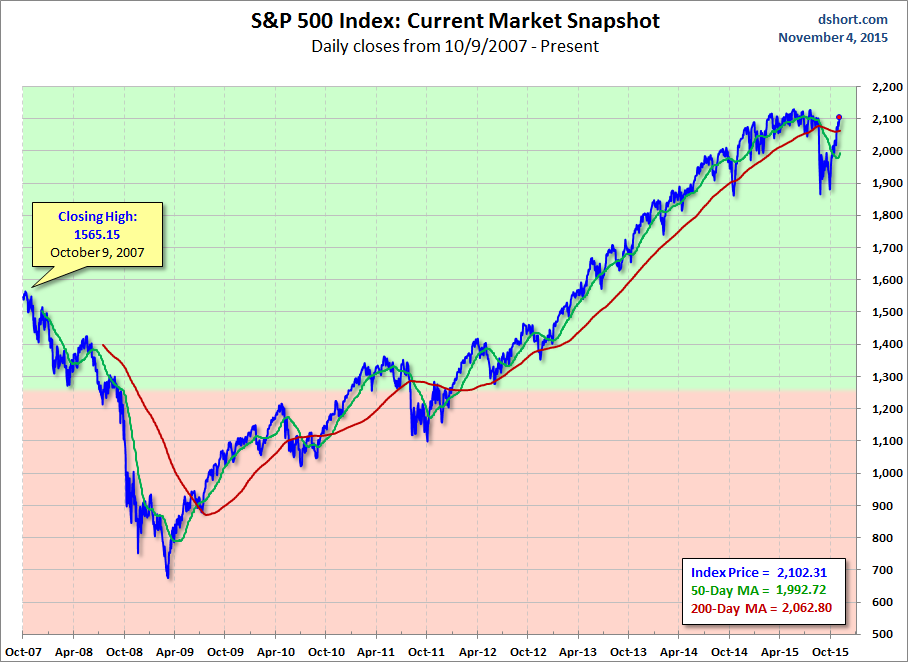

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.