Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

With little in the way of economic news, the S&P 500 spent the day in a relatively narrow intraday range between its 0.35% morning high and -0.52% low during the lunch hour. Actually that's fairly normal price volatility over the long haul -- the 47% percentile of the 183 market days so far this year, but its noticeably lower than we've seen over the past few weeks. The index closed the day with a modest -0.20% decline. Volume will likely increase with tomorrow's major economic updates, including weekly jobless claims, durable goods, new home sales and a speech by Fed Chair Yellen.

The yield on the 10 Year note closed the day at 2.16%, up 2 bps from the previous close.

Here is a snapshot of past five sessions.

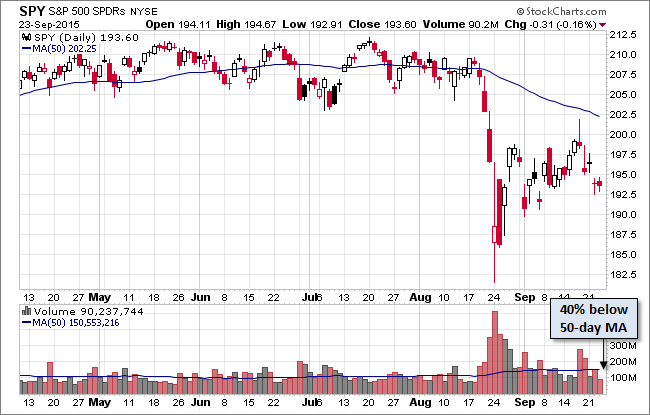

Here is a daily chart of the SPDR S&P 500 (NYSE:SPY) ETF, which gives a better sense of investor particiaption than index itself. Volume was conspicuously light on today's Yom Kippur session.

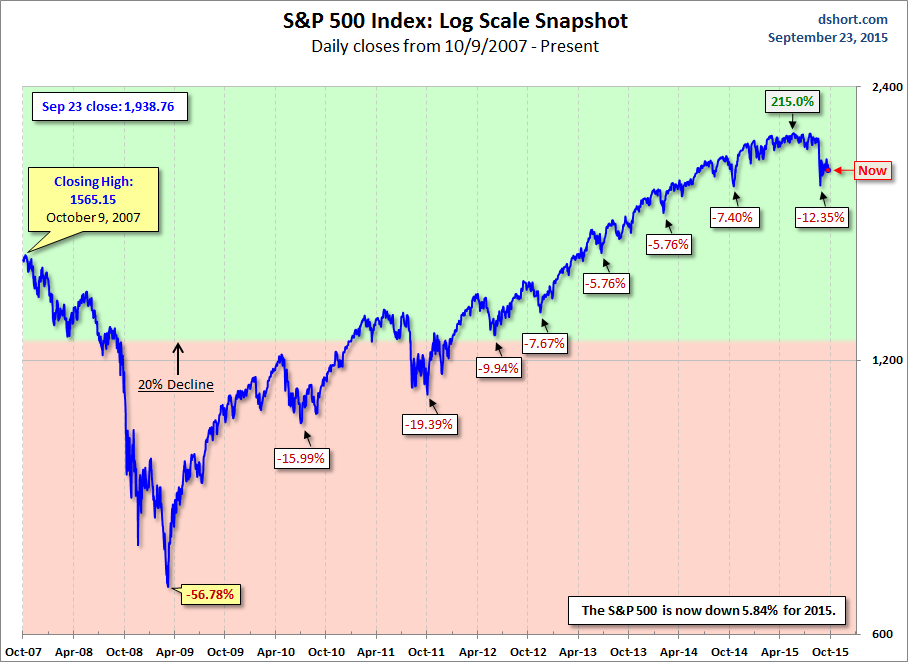

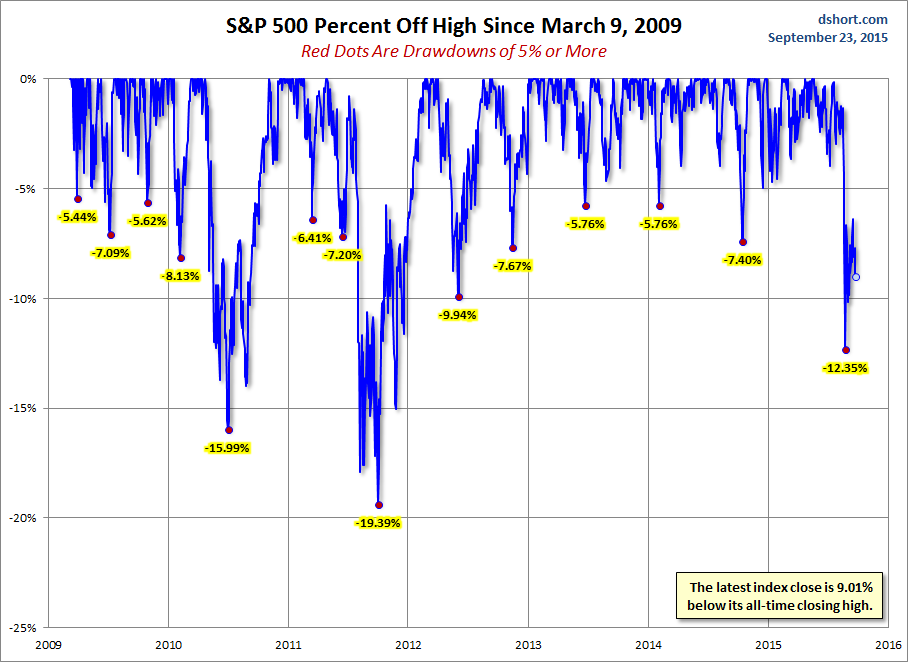

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.