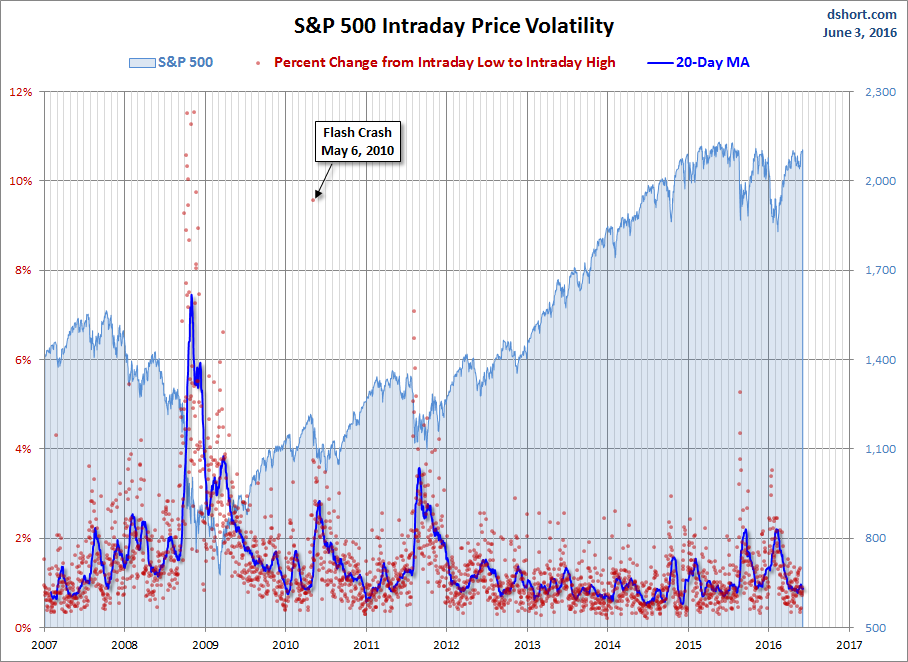

US equity markets took a hit today following the big miss on May new jobs (more here). The S&P 500 plunged at the open to its -0.95% intraday low in the first hour of trading. The index then recovered in a couple of waves to its -0.06% afternoon high. Some selling in the final minutes led to a -0.29% closing loss. The weak jobs report was likely the result of some isolated circumstances, most notably the Verizon (NYSE:VZ) strike. Trading volume on today's mini-drama was unremarkable. Week-over-week the index price was unchanged.

Treasurys were more impacted by this morning's jobs report than equities. 10-year note closed at 1.71%, down ten basis points from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

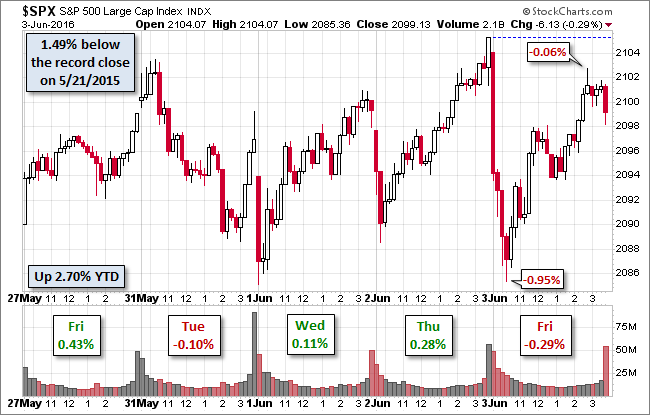

Volume was light on today's decline.

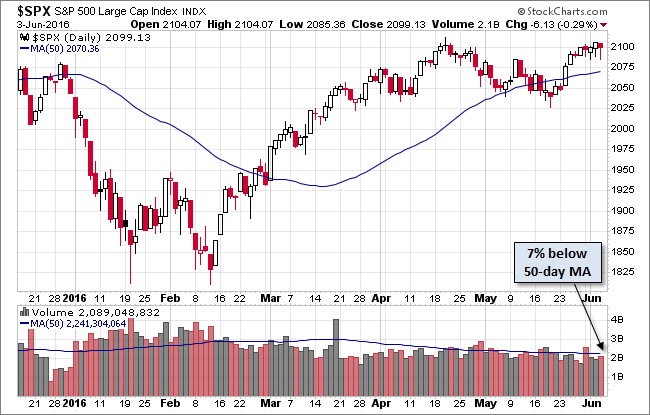

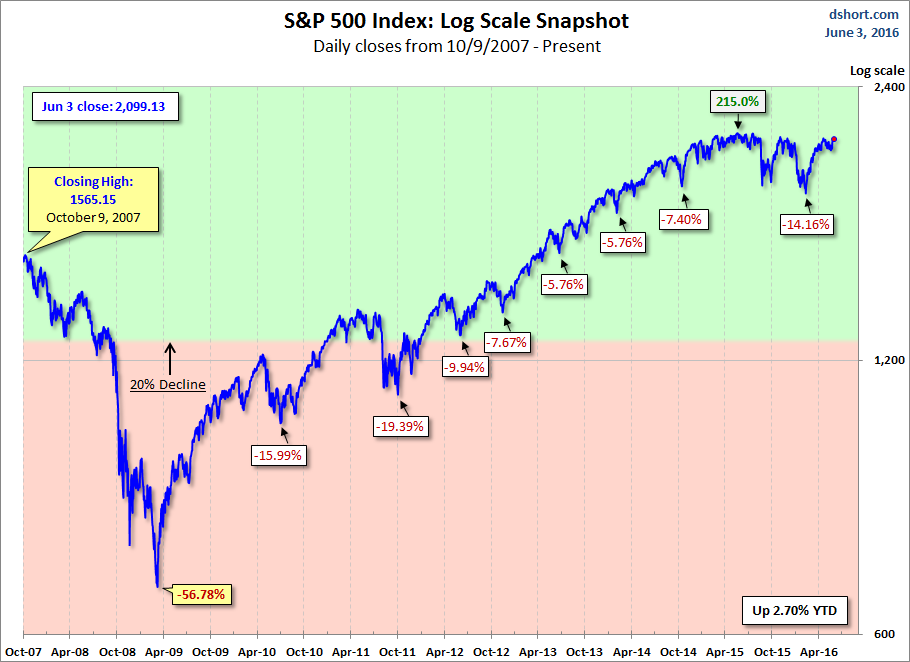

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

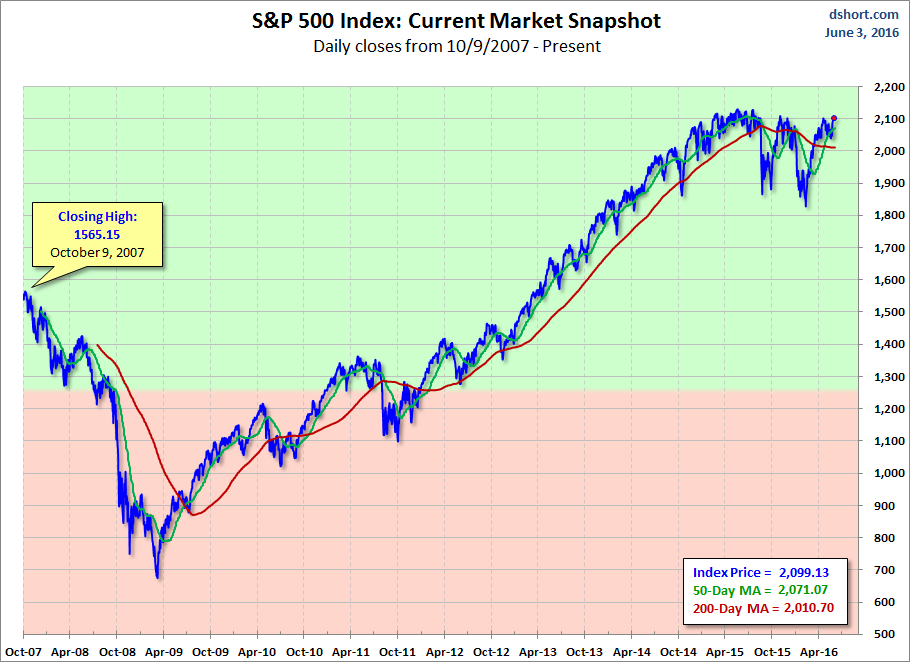

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

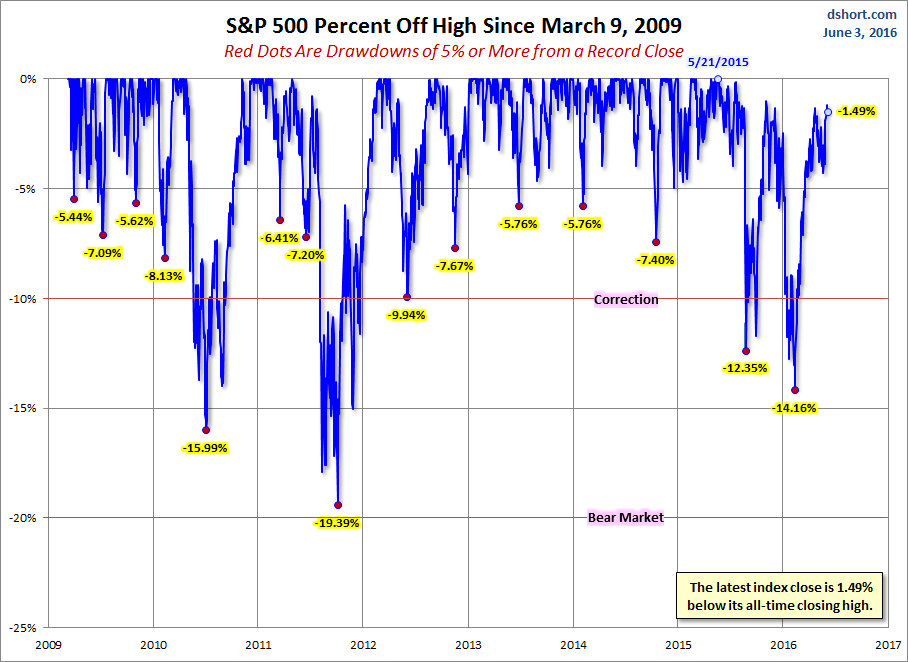

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.