by Clement Thibault

This is Part III of our four-part series about how specific groups of stocks repaid investors in 2016.

Part I, Best Comeback Stocks Of 2016, was published right before the Christmas holiday. Part II, SPX MVPs: The 5 Best Performing Stocks of 2016 was published earlier this week. We borrowed our designations from the world of sports. Early next week we'll publish our final installment in the series, a look at the stocks that most disappointed investors, the 'draft picks' that turned out to be a bust.

The 2016 Initial Public Offering (IPO) market was not an exciting one by any measure. Following on the heels of 2013, which gave investors the chance to own shares of Twitter (NYSE:TWTR), and 2014 when Alibaba (NYSE:BABA) made its debut in the markets, and 2015 when high-end automotive enthusiasts were finally able to take a stake in Ferrari (NYSE:RACE) even if they couldn't afford the car itself, expectations of a splashy IPO during 2016 never materialized. Indeed, our hopes were focused on Snapchat, which it turns out, at least as of this writing, is slated to go public in March.

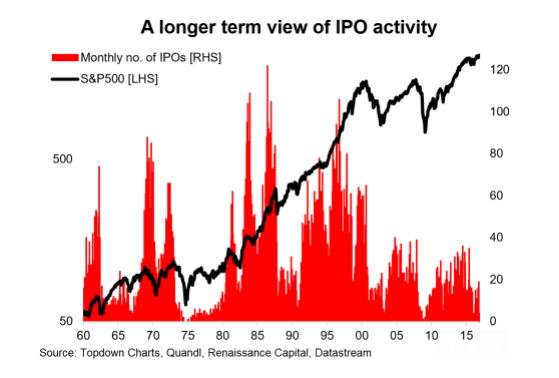

Unfortunately, we're equally disappointed with the quantity of IPOs that occurred in 2016. The average number of IPOs over the past three years is 284, but this year gave us only 124 IPOs, less than half of the three year average, and the smallest number of IPOs since 2009.

Courtesy Callum Thomas

There are a few plausible explanations for the slowdown in IPOs. First, the market's abysmal performance at the beginning of this year had a deleterious effect on many companies considering an IPO, as understandably, it's never smart to issue shares when markets are depressed.

Venture capital funds also appear to have a hand in the current situation. It looks like they may be keeping some of their companies private for longer. There are now more "unicorns" doing business than ever before—private startups valued at one billion dollars or more. Right now, it is estimated that there are upward of 180 such companies, including Uber and Chinese manufacturer Xiaomi at the top of the list, worth $68 and $46 billion dollars, respectively.

Still, even in a year as dull as this one, there were a few very successful IPOs with returns of over or close to 100% from their first day of trading.

Note that while most publications focus solely on IPO price, we find that metric to be irrelevant for individual investors since the IPO price is reserved for institutional investors who get in on the action earlier than the common investor, who doesn’t have access to shares at that early price.

Though we mention the IPO price, we've calculated returns based on the opening price on each stock's first day of public trading on its respective exchange.

#4. Impinj, Inc.

- IPO price: $14

- Began trading at: $18 (July 21st)

- Current price: $35.64

- Gain: +$17.64, +98%

Impinj (NASDAQ:PI) manufactures referral and information network (RAIN) radio frequency identification (RFID) solutions that provide item intelligence in retail, pharmaceutical, healthcare, food and beverage, and manufacturing and supply chain logistics. The company's platform uses RAIN RFID to wirelessly connect and network everyday items, such as inventory and assets, to software applications, such as enterprise resource planning systems and management systems.

According to its IPO filing, Impinj estimates its market share of the passive RFID tag customer base is about 65%. While the world hasn't yet adopted the technology at the rate the company anticipated, if and when the RFID boom occurs, Impinj is set to reap the rewards. Until then, a 30% revenue growth from year-to-year is a fine accomplishment too.

#3. Merus BV

- IPO price: $10

- Began trading at: $9.75 (May 19th)

- Current price: $20.97

- Gain: +$10.97, +109%

Merus BV (NASDAQ:MRUS) is a biotechnology company focusing on oncological treatments. The company has three drugs—for breast, colon and ovarian cancer—all in clinical trials.

Shares jumped 53% on December 21st, when it was announced that Incyte (NASDAQ:INCY) will pay approximately $200 million total to gain access to Merus' research. It has also been agreed that Incyte will fund the development and commercialization of Merus' drugs, in a deal that could potentially be worth $2.8 billion to Merus.

#2. Acacia Communications

- IPO price: $23

- Began trading at: $29 (May 13th)

- Current price: $65.90

- Gain: +$36.9, +127%

Acacia Communications' (NASDAQ:ACIA) innovation: optical-interconnect products that use special silicon photonic integrated circuits that convert light coming off of fiber-optic cable into usable data. While fiber optic technology has been around for a while, Acacia's silicon circuits are more efficient taking up less space and generating more power, thus giving them a technological advantage over older circuits.

Such circuits are used largely by big data center that require ultra-fast data transfer. Cisco (NASDAQ:CSCO) and Huawei, the Chinese networking and telecommunications company, are customers. ACIA's quarterly revenue has grown by 100% year-over-year for the second quarter in a row, which helps explain the phenomenal growth in share price since the IPO.

#1. AveXis, Inc.

- IPO price: $20

- Began trading at: $18.02 (February 11th)

- Current price: $48.59

- Gain: +$30.57, +169%

AveXis (NASDAQ:AVXS) is a biotech specializing in gene therapy, specifically the company is looking to find genetic treatments for orphan neurological diseases. AVXS is developing a treatment for spinal muscular therapy (SMA) type 1, a disease caused by a genetic defect that leads to the loss of motor neurons, resulting in progressive muscle weakness and paralysis.

The treatment candidate, AVXS-101, is currently in Phase 1 human clinical trials. This past July, the treatment received the FDA's Breakthrough Therapy designation, based on positive clinical trials. This enables the company to fast-track the drug's development and testing via the FDA.

Medical research companies are often some of the market's most volatile stocks because there is often little data available on their work coupled with hefty expectations, and thus hit or miss for investors. Shares shoot up on good news and crash on hiccups in the research. It's a similar situation for Merus, mentioned above.

Nonetheless, as long as the probability of AveXis' treatment reaching approval and distribution seems likely, its share price will continue to rise.

Author's Note: A shout out is due as well to ZTO Express (Cayman) Inc (NYSE:ZTO), a Chinese delivery firm that raised 1.4 billion dollars and was the biggest IPO of the year. Unfortunately, the biggest IPO was also one of the year's biggest flops. In three short months the company lost a third of its value, falling from $18.40 to $12.31.

An additional honorable mention goes to Twilio (NYSE:TWLO), a cloud based communication platform that started trading on June 23rd at $23.99, shot up 195% to $70.96 during late September, only to fall back to earth during Q4 to trade at $30.21.