The bull market in US equities (via SPDR S&P 500 (NYSE:SPY)), which started in March 2009, has been anything but quiet and calm. For years, volatility has been one of the leading points of discussion and the main reason the majority of retail investors have stayed out of the market. The rally out of March 2009 lows was incredibly powerful.

Equally, corrections in May 2010 (Flash Crash) and August 2011 (Debt Ceiling) shook out the majority of investors, who were expecting a repeat of the ’08 Global Financial Crisis. Moreover, the lift-off in equity prices from November 2012 has been just as robust.

US equities have now rallied for almost 4 years without a 10% correction. Even more interesting is the fact that the tight range for the last half year is pretty much a historical anomaly.

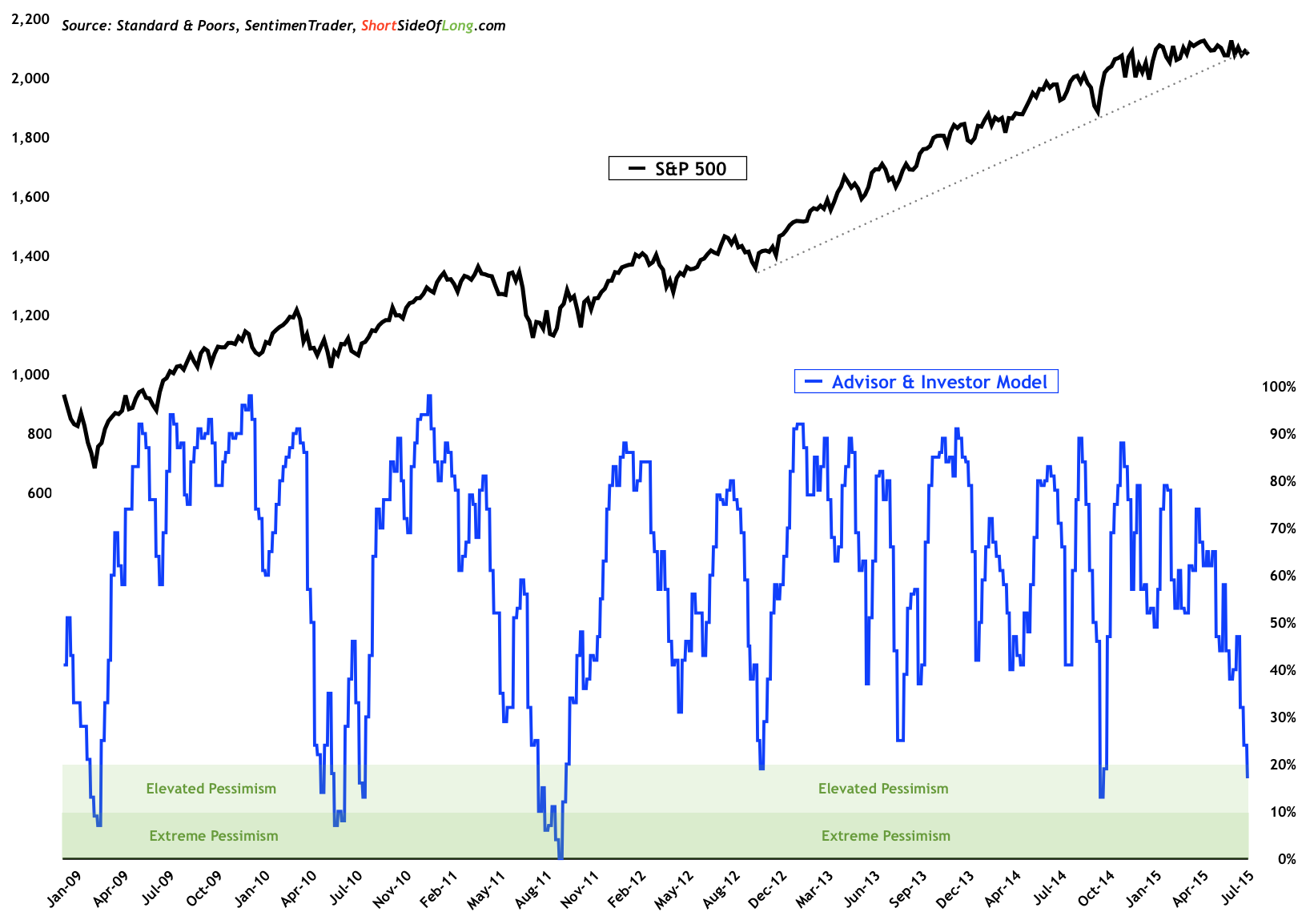

Cumulative readings of stock market sentiment surveys shows elevated pessimism

Source: Short Side of Long

Source: Short Side of Long

Despite the fact that the S&P 500 has only corrected by a minuscule 4% since the peak in May of this year, the bulk of stock market sentiment surveys have dropped to levels of pessimism usually associated with major corrections or even bear markets. At a reading of 17 percent bullish (thanks to SentimenTrader research), the mood of investors is now almost as negative as it was during the October 2014 correction.

Furthermore, it is clear that pessimism is also at its second lowest reading in over 3 years. Could the stock market decline, despite low sentiment readings? Of course it could. We have seen stocks constantly disappoint throughout the 2008 bear market, despite elevated pessimism.

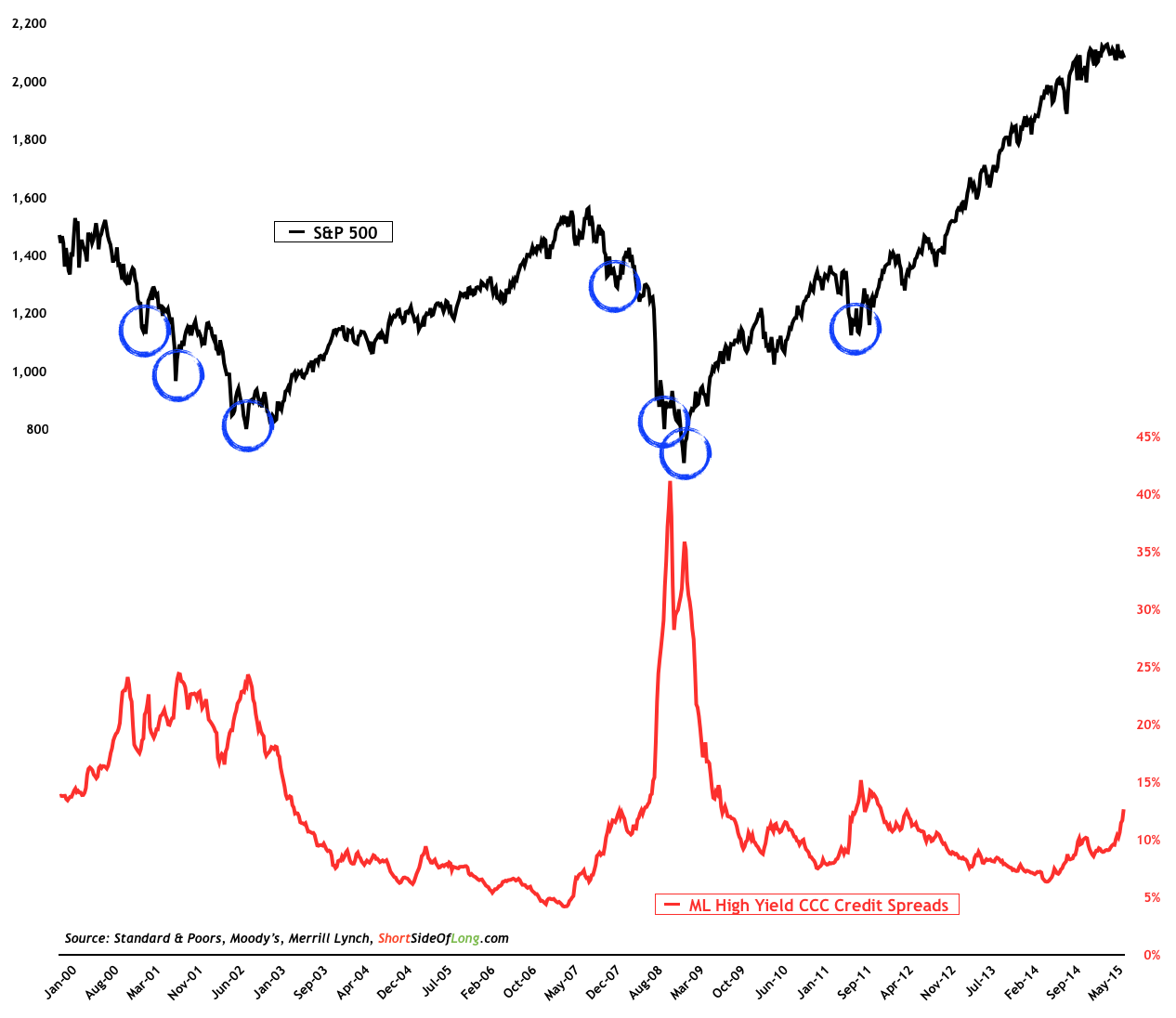

Lower grade investment and junk grade bond credit spreads have jumped recently

Source: Short Side of Long

Source: Short Side of Long

Sentiment isn’t the only indicator that signals short term oversold conditions for the stock market. Merrill Lynch’s High Yield Credit Spreads (via iShares iBoxx $ High Yield Corporate Bond fund (NYSE:HYG)) have recently spiked towards levels not seen since 2012.

Whenever junk bond yields spike relative to Treasury yields, it usually signals that market participants are running for the hills. In other words, this type of behaviour is classic risk aversion, where purchases of safe havens increase relative to lower grade asset quality.

Could credit spreads rise much further? Of course they could. We have seen CCC junk bond spreads rise above 20% during the 2000-03 and 2007-09 bear markets.

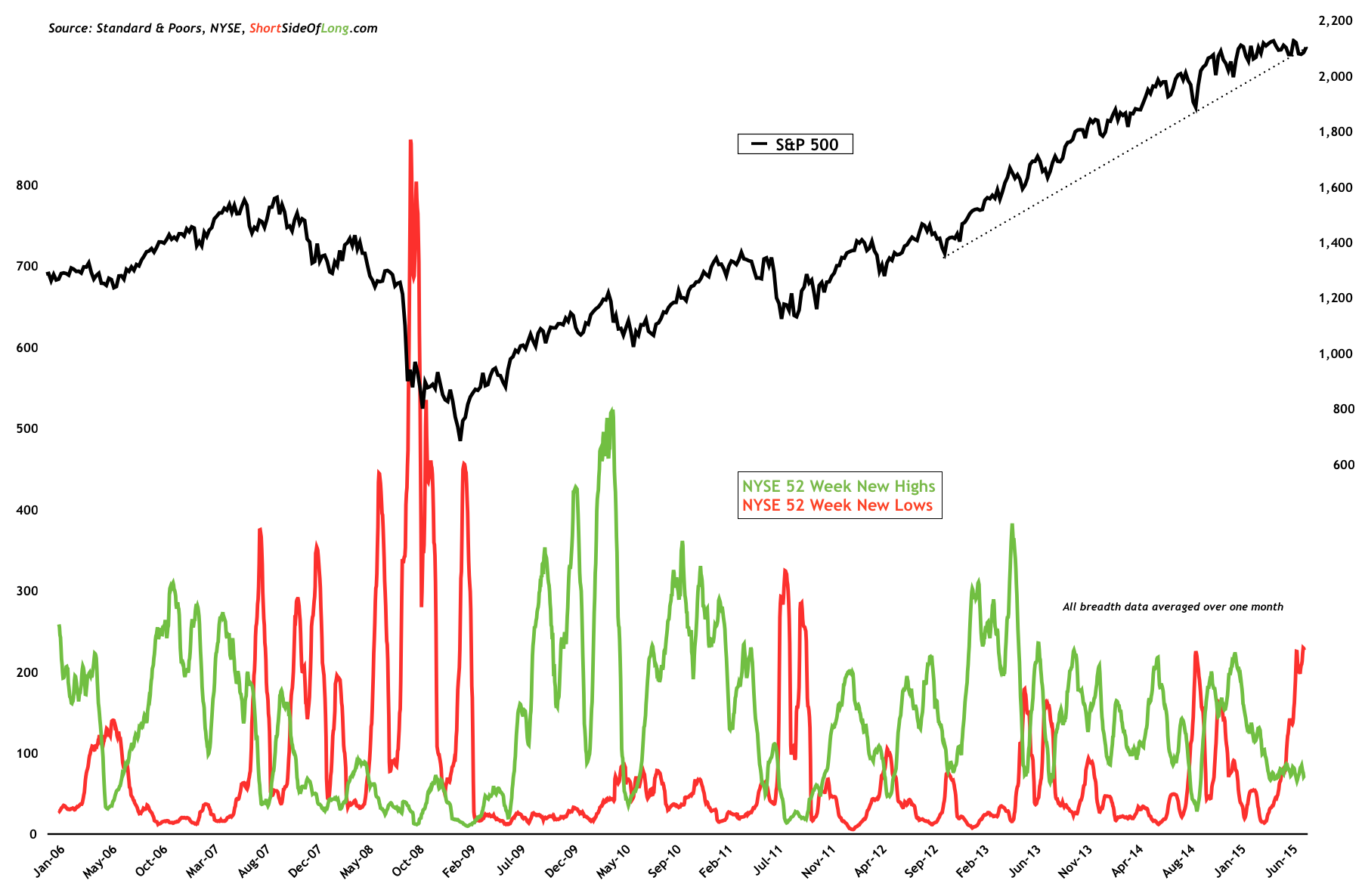

Such a high number of 52 week new lows is usually associated with intermediate bottoms

Source: Short Side of Long

Source: Short Side of Long

Finally, stock market breadth readings are confirming the risk aversion observed in both sentiment and credit. When averaged over a one trading month (or 21 business days), the number of NYSE 52 week new lows has risen to October 2014 levels, just as the market was finding a bottom.

Furthermore, once again there are now signs that selling is becoming exhausted. Since the beginning of June, 38 out of 55 trading days have had negative breadth readings, where the number of 52 week new lows exceeded 52 week highs. This type of selling pressure is usually associated with intermediate degree market bottoms. Readers should remember that historically, regardless of the trend, selling pressure can not persist forever. Even during the great bear market of 2008 selling pressure would rise and retreat.

In my opinion, elevated indicator readings (charts above) such as what we have today will eventually mean revert, at least for a while, and should push the stock market a little bit higher. On the other hand… if negative sentiment, elevated credit spreads and oversold breadth cannot help the equities rally, it will be a sign that trouble is directly ahead.