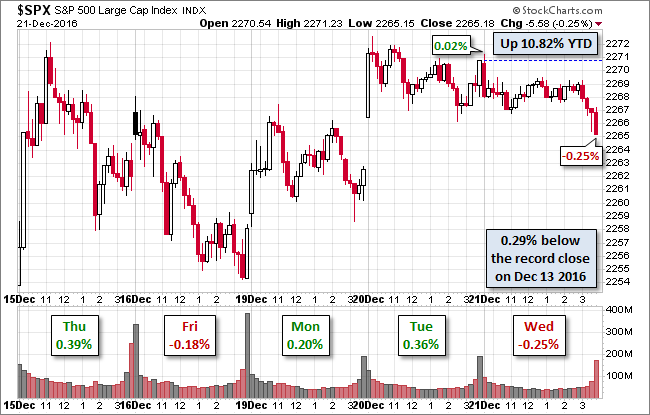

Wednesday's major US equities indexes spent the day in the shallow red. Our benchmark S&P 500 hit its 0.02% intraday high shortly after the open and sold off to a narrow intraday range. The selling accelerated in the final hour and the index closed with a 0.25% loss. The 0.27% intraday range was the second narrowest of the 246 market days so far in 2016.

Here is a snapshot of the past five sessions.

The yield on the 10-year note closing at 2.55%, down two BPs from the previous close.

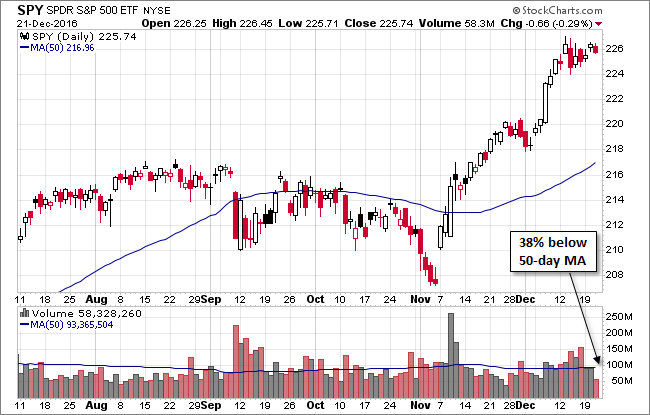

Here is daily chart of the SPY ETF, which gives a better sense of investor participation (or lack thereof) than the underlying index. Trading volume was well below its 50-day moving average.

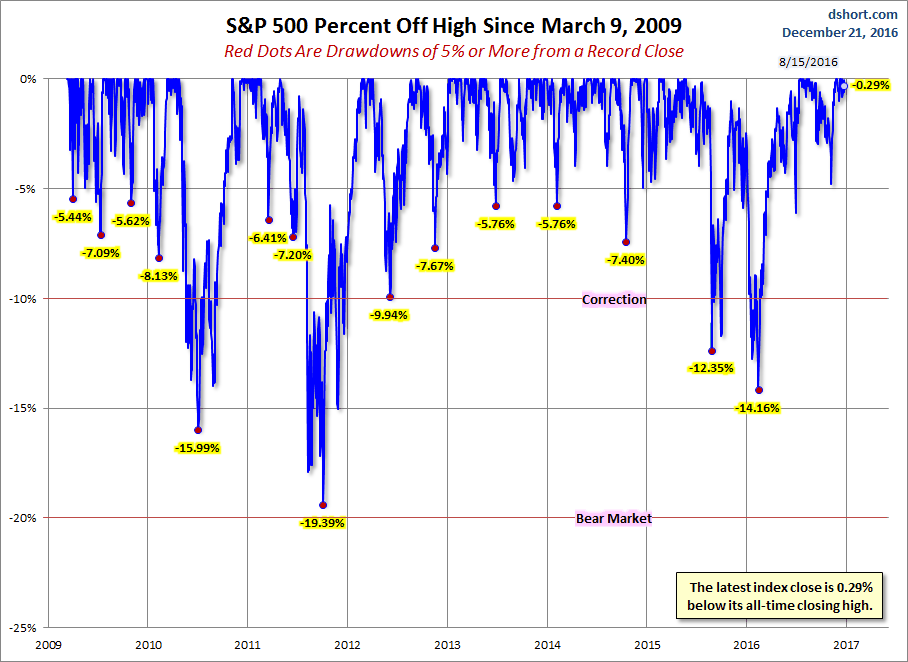

A Perspective On Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

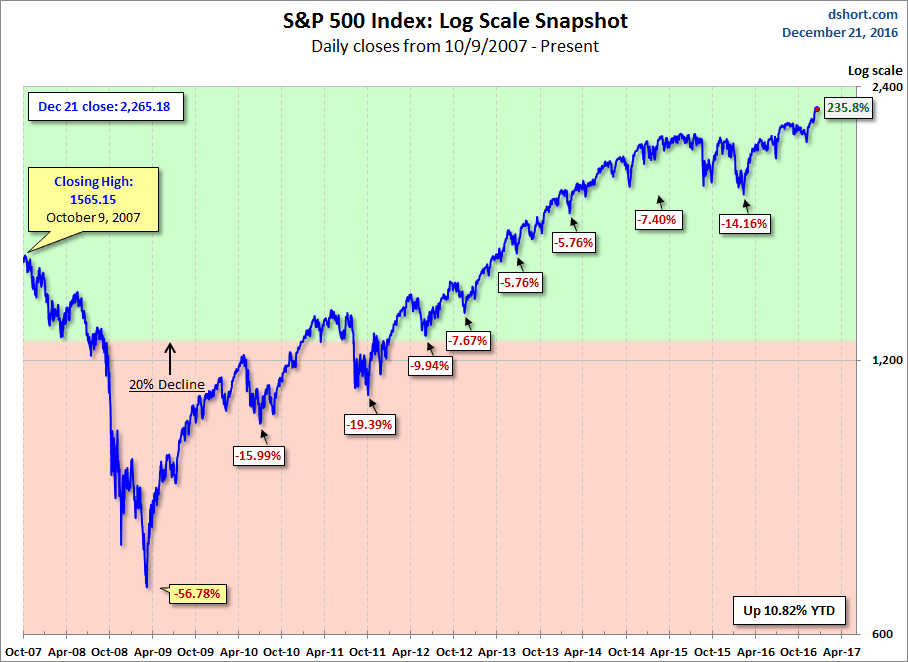

Here is a more conventional log-scale chart with drawdowns highlighted.

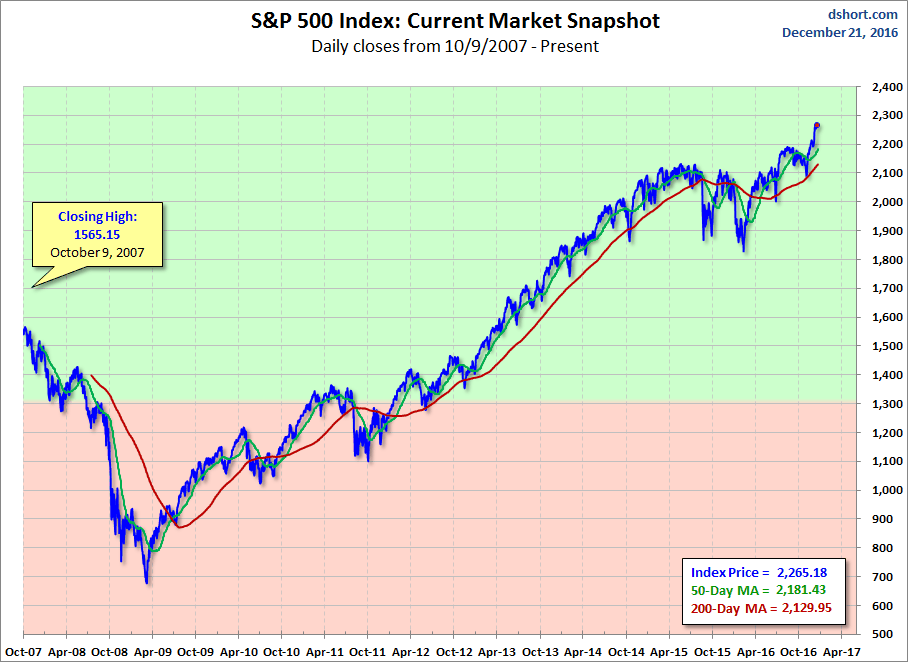

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

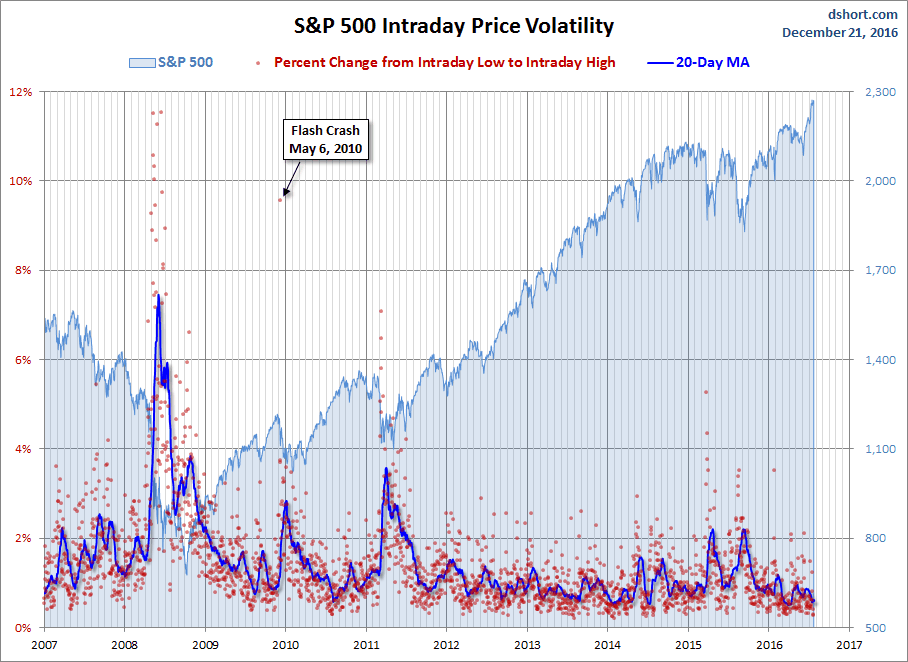

A Perspective On Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.