- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

S&P 500 Looks To Consolidate

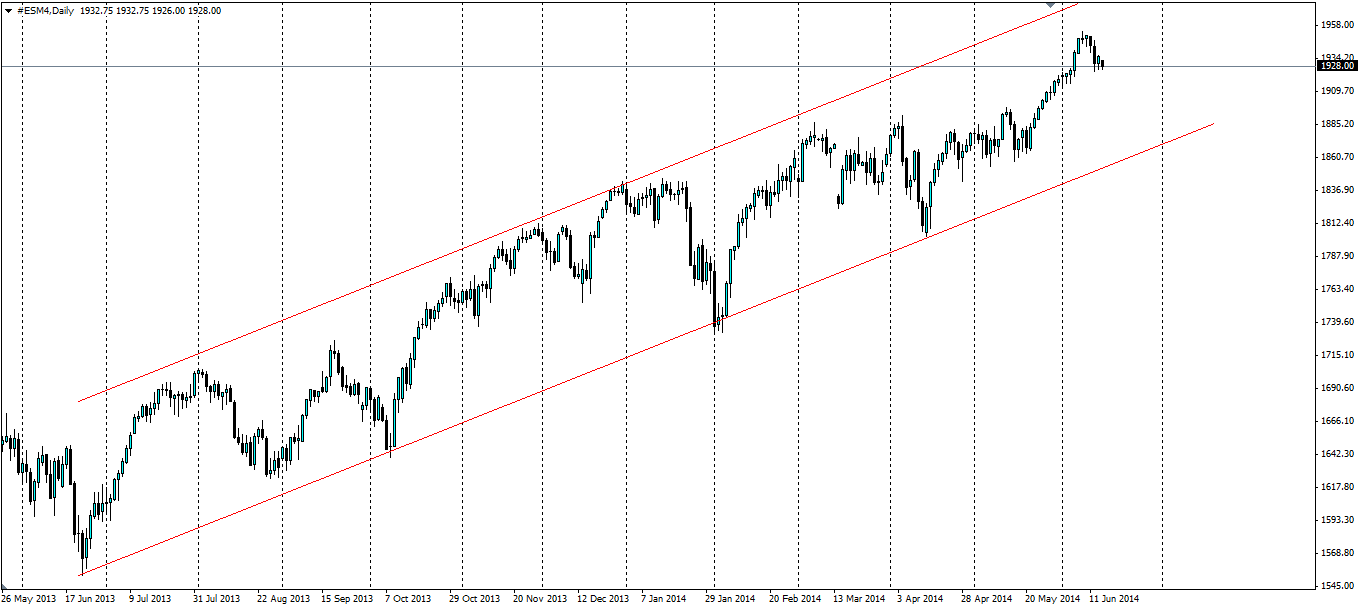

The S&P 500 index has recently hit an all-time high, but is looking to pull back slightly. It has been following a very solid looking bullish channel for the past year, which looks set to hold, but a short term pullback could be on the cards as fear looks to take hold of the market for now.

Equities have been on a bull run since early 2009, with the odd correction, and the S&P 500 is no exception. The current state of the index is a bullish channel that has seen the lower line of the channel tested on 4 occasions, with it holding every time. Another test of it should be no different and traders should be aware of the potential buy trade here. But we have a while to go before we touch the trend line again.

The current state in Iraq is weighing on the markets, creating a bit of fear selling as the militant group known as ISIS (or ISIL) have taken control of large parts of northern Iraq. A civil war will impact heavily on oil markets, which will in turn be a drag on equities. Traders do not like shocks to the global oil markets and the current pullback in the S&P 500 is a result of this. This situation is not going away any time soon, so traders could look to take advantage of a short term pull back in the equity markets.

The Stochastic Oscillator in its current state shows that this pullback could have further to fall. The momentum is certainly with the bears and if the current support does not hold, we could see a fall all the way down to the trend line.

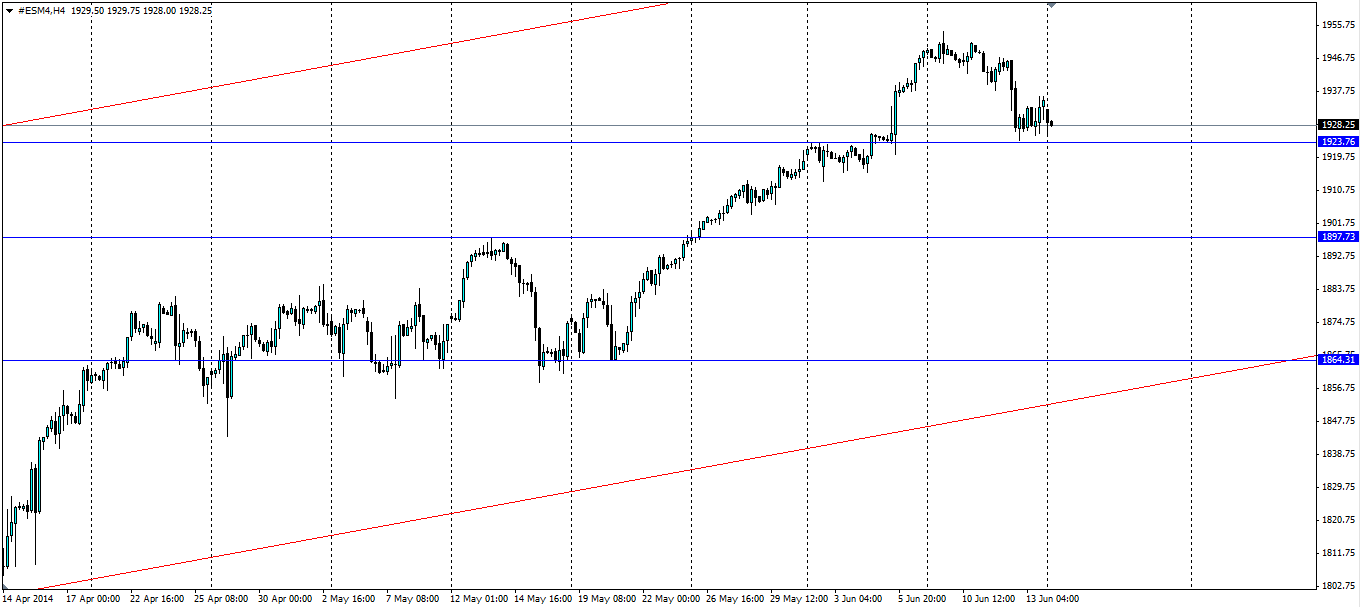

The current H4 chart gives us a good indication of where to enter a trade if we were to take the S&P 500 as a short. The current support at 1923.76 looks to be holding for now, but if the bearish momentum continues, we should see this breached in no time. Look to enter once this support does break down.

A target for this play could be either of the next two support levels at 1897.73 or 1864.31, or, dependent on your risk profile. The bullish trend line will act as solid support so this will be the last target. A stop loss should be set back above the support at 1923.76 in case the breakout is a false one.

There is a bit of fear in the global equity markets at the moment and bit of price consolidation looks to take effect in the S&P 500. The long term outlook for equities is bullish as the channel looks likely to hold firm, but a pull back towards this line could present an opportunity for anyone willing to take it.

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.