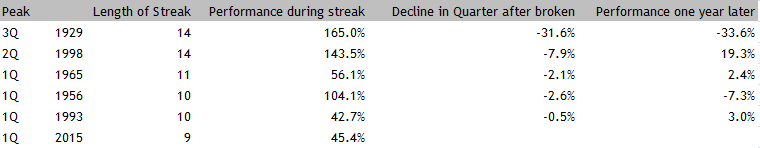

I’ve heard a lot of people mention that the S&P 500 has now risen for nine straight quarters, but I hadn’t seen a comparison yet of how that relates to other streaks, so I figured that I would put the data together. Below is a list of the longest quarterly win streaks in S&P Composite history (the S&P 500 starts in 1957) going back to 1900.

There are five other times that quarterly win streaks have lasted longer than this one. The median decline in the quarter that the streak is broken is just 2.6%. The median change over the next twelve months is actually positive 2.4%. The end of the streak signaled the end of a bull market in two of the five instances (1929 and 1956), although the 1956 bear market just barely qualifies as a bear.

As far as the streak goes, this one has ranked near the bottom in terms of performance (but if it goes on for another 5 quarters that may change). We’ve only risen 45% in the last 9 quarters compared to triple digit percentage gains in three of the five other streaks.

This nine quarter run is pretty rare. In 1946 and 1951 there were two 7 quarter streaks, but there aren’t any streaks that ended at eight quarters.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.