What’s Going On Here?

The markets have been crazy lately. Limit down, and literally, limit up. Brexit and Donald Trump have been the drivers, and both will have lasting ramifications that will be felt around the world for many years. Like the title of today’s Opening Print, we are in ‘uncharted waters.’

There was a lot of hype in the days leading up to Wednesday’s rate hike. After being up 6 out of the previous 7 trading days, the rate hike did cause a pause. The ESH17 made a high at 2272.50, just after the rate hike, and made an afternoon low of 2243.00. After that, the futures rallied all the way up to 2260.00, before settling at 2252.00.

Yesterday, the ESH17 traded on both sides of unchanged, settling 6.5 handles higher. On the 8:30 ct open they sold off down to 2249.25, and then in came the buyers pushing the ES all the way up to 2267.75. There was a sell off down to 2252.75 when I put this out:

01:56:53 TRADINGDATA2: (driley) buyers off the 2253s (MrTopStep 10 handle rule).

After that the ES started moving higher, and around 1:30 CT they had traded up to an afternoon high at 2260, before settling at 2258.50.

There has been a lot of talk about how crazy the markets have been, and I have to agree. It seems to be there there has been a sharp increase in algorithmic and high frequency trading. What would normally be a headline that would move the S&P 5 or 6 handles is pushing the ES 10 or even 15 handles. Tight stops up or down are constantly being run.

While You Were Sleeping

Overnight the equity rally resumed overseas as Asia traded modestly higher followed by a higher open in Europe. The S&P 500 futures opened globex at 2259.50 and made an early high at 2261.25 before trading down to 2256.50 early in the European session. The futures bounced back up to a session high of 2263.75 at 5:45 am cst, and has last printed 2262.75, up 4.25 handles, with volume at 112k as of 6:30 am cst.

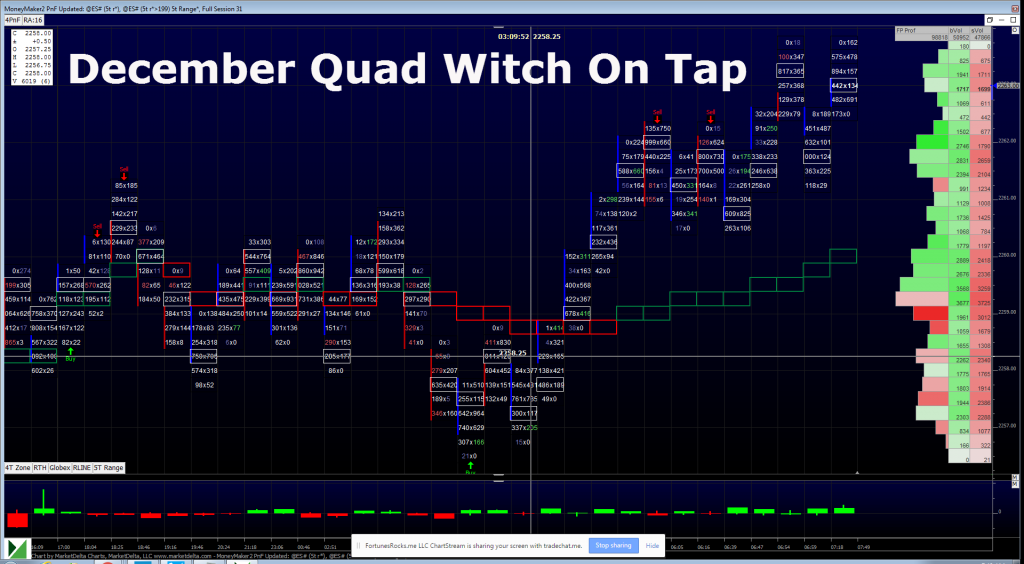

Heading into today’s session will be the December quad witch. Yesterday, the S&P did what we said that bulls needed to do, which was to resume building a floor above 2250. The overnight low was a higher low, which should lead to a higher high today. Bulls need to take advantage of expiration Friday and push to new highs, or at least settle as close to 2270 as possible, setting up for an easy early week break out of the highs next week. For bears, their task is more difficult, they have to sell this rally today and try to push back below 2250, and settle there. The path of least resistance seems to be to the upside, but it’s likely to return to a quiet trade.

Asia and Europe

In Asia, 6 out of 11 markets closed higher (Nikkei +0.66%), and in Europe 9 out of 11 markets are trading higher this morning (DAX +0.62%). Today’s economic calendar includes the Quadruple Witching, Housing Starts, Atlanta Fed Business Inflation Expectations, Jeffrey Lacker Speaks, and the Baker-Hughes Rig Count.

Our View

The stats show expiration Friday being higher for the S&P in 20 of the last 32 years. The overnight session has been quiet with a fairly steady bid since Europe came online. It looks like now with the roll over, and FOMC out of the way, the index futures may be poised for some further thin-to-win type price action. Our call is to buy early weakness and try to hold into new all time highs. In this environment it’s easier to aim for 10 handles when you can hold overnight. Selling the early rally has worked this week, but if today is trending hard, we don’t want to jump in front of the thin-to-win.