Since Super Tuesdays limit down move, the S&P futures (ESZ16:CME) have rallied 175 handles, or 7.75%, in 10 trading days. Below are the net changes from a week before the election to yesterday’s close and the double top at 2203.00.

| Monday Oct 24 | +9.50 |

| Tuesday Oct 25 | -8.75 |

| Wednesday Oct 26 | -2.75 |

| Thursday Oct 27 | -6.00 |

| Friday Oct 28 | -4.25 |

| Monday Oct 31 | -0.25 |

| Tuesday Nov 1 | -22.50 |

| Wednesday Nov 2 | -12.25 |

| Thursday Nov 3 | -7.00 |

| Friday Nov 4 | -1.75 |

| Monday Nov 7 | +48.75 |

| Tuesday Nov 8 | +5.25 |

| Wednesday Nov 9 | +25.75 |

| Thursday Nov 10 | +4.00 |

| Friday Nov 11 | -4.00 |

| Monday Nov 14 | +0.50 |

| Tuesday Nov 15 | +18.00 |

| Wednesday Nov 16 | -6.25 |

| Thursday Nov 17 | +12.75 |

| Friday Nov 18 | -4.75 |

| Monday Nov 21 | +13.50 |

| Tuesday Nov 22 | +7.75 |

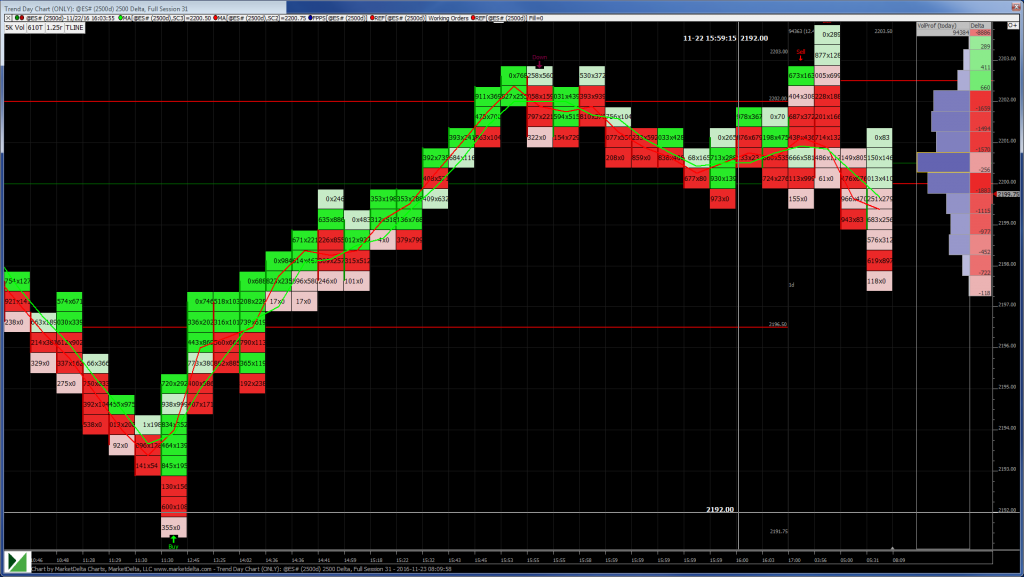

Yesterday the S&P did exactly what we thought it would do. Below is a copy of yesterday’s view. While I am not bragging, the view did fit the day’s trade.

“Today’s economic calendar is a bit light, but tomorrow there is a full schedule. The S&P has now taken out buy stops all the way up to 2203. The futures have now traded above the ‘big figure.’ What we don’t want to do is get caught buying into an all-time high after a 174.50 handle rally. While the markets look great, and more than likely want to go higher, there will be pull back. Our view is to sell the early rallies and buy weakness, keeping in mind two variables; 1) the ESZ, YMZ, and NQZ are all overbought short term, and 2) with the Thanksgiving holiday upon us, volumes are sure to drop, which means ‘thin to win.’ You can take it from there.”

The ES opened at 2200.00 on yesterday’s 8:30 am bell, up 7.25 handles. Buyers were only able to push the index up to 2101.00 before drying up and falling down to 2191.75, just three ticks shy of the ten handle retracement. That was good enough to give buyers an opportunity to take advantage of the positive stats and ‘thin to win’ chop. The S&P futures pushed higher throughout the rest of the afternoon to make a high of 2102.75 just before settling the day at 2200.75, up 7.75 handles, or .35%.

Overnight the Nikkei was closed, and the Shanghai and Hang Seng moved slightly lower, while the rest of Asia was higher. Europe came online with a lean toward lower prices. The S&P’s traded sideways until making a new all time high of 2203.50 early in the Euro session, and then went on to trade the low at 2197.75, giving a quiet 5.75 handle range. The ESZ last printed 2200.00, down a single tick on the session, with volume at 89k as of 6:45 am cst.

Barclays (LON:BARC) on Today’s FOMC Minutes

“The only important development aside from politics is the publication of the minutes of the FOMC meeting. As was widely expected, the November FOMC meeting was uneventful. Heading into the meeting, we felt the Fed had two main goals: to keep expectations centered on a December rate hike, while maintaining flexibility to delay action, should events in the next two months not materialize as expected. We believe that the Fed achieved these goals. Although a few members likely called for a November rate hike, we think most members were likely comfortable waiting for the December meeting, given the proximity of the US election. We look to the minutes for the change in forecast that underpinned the FOMC’s modest upgrading of the inflation outlook.”

While You Were Asleep

In Asia, 8 out of 10 open markets closed higher (Shanghai -0.22%), and in Europe 7 out of 11 markets are trading lower this morning (DAX -0.46%). Today’s economic calendar includes Bank Reserve Settlement, MBA Mortgage Applications, Durable Goods Orders, Jobless Claims, FHFA House Price Index, PMI Manufacturing Index Flash, Bloomberg Consumer Comfort Index, New Home Sales, Consumer Sentiment, EIA Petroleum Status Report, a 3-Month Bill Announcement, a 6-Month Bill Announcement, EIA Natural Gas Report, a 7-Yr Note Auction, and the FOMC Minutes.

Our call follows the rest of the week. We lean toward finding an early low to buy, and holding late into the session. The old 2191.50 high area held as support yesterday and there will be a lot of chop between there and yesterday’s 2102.75 high. The key for bears will be to break below that 2191.50 price, while bulls need to start to build a floor above 2200.

As always, please use protective buy and sell stops when trading futures and options.