The day started with new all time contract highs, but that’s not how the day ended.

Fridays trade started with the ES selling off on Globex when the British election showed the conservatives losing ground. The ESU had a quick drop down to 2423.00 overnight, and then a push back up to the 2436.00 area. On the 8:30 open, the ESU17 traded 2434.50, and immediately started moving higher. During Friday’s early trade, I posted that I thought there could be an ‘upside stop run,’ and I posted exactly where the stops began, and where I thought they initially went to…

09:28:46 TRADINGDATA2: upside buy stops 2436.70 up to 2443-2346.

At 10:00am cst, the futures (ESU17:CME) traded 2443.50 and started pulling back. Just as the (ESU17:CME) was making its high I posted this:

Dboy:(10:51:58 AM):close to early high.

I put this out next…

Dboy:(10:52:39 AM): PitBull always says that if your long and still think higher you get out of some and replace lower

…and the PitBull responded by saying:

11:01:44 PITBULL: correct lesson well learned.

At 11:25 cst the (ESU17:CME) sold off down to 2435.00. The Nasdaq 100 futures (NQU17:CME), which has been weak all day, was down 53 points at 5840.00. From 11:25 to 1:25 the ESU sold off all the way down to 2426.00. The Nasdaq futures ended up selling off all the way down to the 5760.00 area, down 2.34%, and had its worst day in 2017.

At 1:50 cst, another flush pushed the the NQU all the way down to 5669.00, and the ESU all the way down to 2412.25. It’s been one tech sell program after another. The next move was back up. At 3:00 the ESU traded all the way up to 2429, a 17 handle pop, and the NQU traded up to 5762.25, up 93 points off its low.

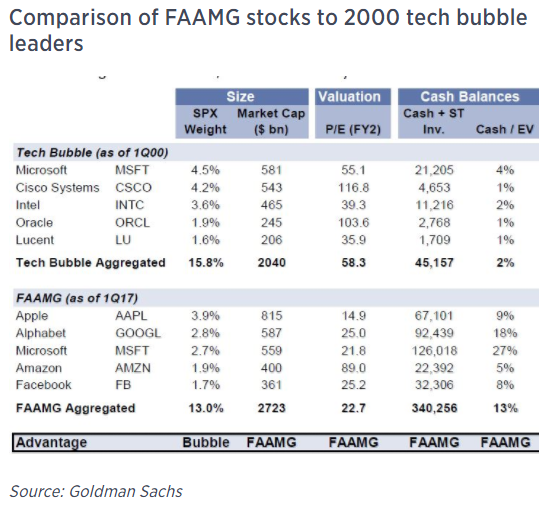

In the end, I don’t care what anyone says, but this sell off was a great example of several different ‘flash crashes’ going all at once. The big trade this year has been in tech and internet stocks. Most participants have known that it’s a very over crowded space. As APPLE continued to fall, many of the major tech names went for the ride.

While You Were Sleeping

Overnight, equity markets in Asia traded mostly lower, fueled by the HSI, which closed 1.24% lower. Meanwhile, in Europe, most majors are also trading lower, with the exception of the OMXC 20, which is currently up 0.01%. In the U.S., the S&P 500 futures opened the globex session at 2428.00 and immediately found a high at 2428.75. Since the open, the ESU has been drifting lower, down to 2419.75, extending the overnight range to 9 handles. As of 6:20 am cst, the last print in the ESU is 2422.00, down 6 handles, with 172k contracts traded.

In Asia, 8 out of 11 markets closed lower (Shanghai -0.57%), and in Europe 11 out of 12 markets are trading lower this morning (FTSE -0.09%). This week’s economic calendar includes 21 reports, 2 Fed speakers and 15 U.S. Treasury auctions and announcements, and a 2-day Fed meeting.Today’s economic calendar includes a 4-Week Bill Announcement, a 6-Month Bill Auction, a 3-Yr Note Auction, a 3-Month Bill Auction, a 10-Yr Note Auction, and Treasury Budget.

Our View

There is a 98% probability that the fed will raise rates during this week’s two day meeting. Some people think that after last friday Nasdaq beating, it can’t be just a one day event, and that there is more to come. On the other hand, some people are pointing back to 2450 – 2460. I am not sure whats going to happen. Monday’s are usually the slowest day of the week, but who knows. If the techs take another dive, the ES will go for the ride. Our view is to keep an eye on the Nasdaq #FANG and friends. There could be some early weakness and then a bounce.