Everything is timing in trading. If you sold the S&P over the last 8 trading sessions, you more than likely lost. If you sold it on Tuesday after the ESH17 traded 2273.00, or after Wednesday’s mid day rally, you more than likely were paid. Up to that point though, it was one of the larges, short term short squeezes I have ever seen.

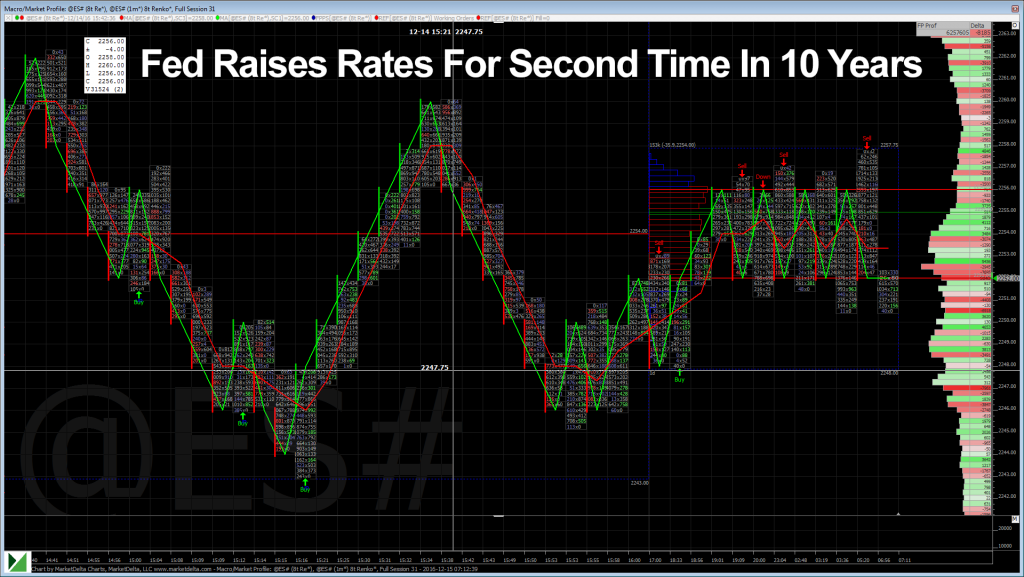

After a full year of waffling about the timing of an interest rate hike, Janet Yellen and Company finally pulled the trigger once again. The response was a quick push up, then an even larger push down. At 2:00 the ESH17 traded down to 2251.50, and then down to 2246.75.

The day started off quiet with a very light and relaxed 10 handle range globex session. Then, on the 8:30am cst bell, the S&P futures opened the regular session at 2263.50, down four handles on the session. A low was made at 2260.75 just after the European close before rallying midday up to 2269.00 going into the FOMC announcement.

After the 1:00pm cst Fed release, the ESH rallied up to 2272.50, coming two ticks from Tuesday’s high, and then went offered down to 2243.00, two ticks shy of a 30 handle drop, before finding a bottom going into 2:30 pm cst. The S&P’s did rally back up to the morning 2260.00 low, a 17 handle bounce, but then sold off into the close back down to 2245.25 before settling the cash session at 2252.00, down 15.50 handles.

At the end of the day, the S&P’s reaction to the Fed meeting was somewhat orderly and predictable. We stated that there were more sell stops to trigger than buy stops, but the algos are always going to give a head fake just to suck more weak money in. One of MrTopStep’s rule is that the first move is the wrong one. That being said, they took out the few buy stops, and then they turned their sights on the sell stops in the form of a 30 handle decline. Now the key for the S&P’s is pivoting on the 2250 area. Bulls need to rebuild that floor, while bears need to take out yesterday’s low.

While You Were Sleeping

Overnight, equity markets in Asia were weaker, with only the Nikkei closing higher by .10%. Europe opened up with some life, as most of the major markets are trading modestly higher. The S&P’s opened the overnight session at 2251.75 and found an early low at 2248.00 before rallying up to 2257.00 early in the Tokyo session. The ESH has been offered since the Euro open and has retraced back down to 2250.00 at 7:00 am cst, down 2 handles on the session, with volume at 235k.

Asia and Europe

In Asia, 10 out of 11 markets closed lower (Shanghai -1.77%), and in Europe 8 out of 11 markets are trading higher this morning (DAX +0.67%). Today’s economic calendar includes the Weekly Bill Settlement, 3-Yr Note Settlement, 10-Yr Note Settlement, 30-Yr Bond Settlement, Consumer Price Index, Jobless Claims, Philadelphia Fed Business Outlook Survey, Empire State Mfg Survey, Current Account, PMI Manufacturing Index Flash, Bloomberg Consumer Comfort Index, Housing Market Index, EIA Natural Gas Report, a 3-Month Bill Announcement, a 6-Month Bill Announcement, a 5-Yr TIPS Announcement, Treasury International Capital, Fed Balance Sheet, and Money Supply.

Our View:

I was a day early, and a dollar short, on my ESH16 position. I thought the ES could pull back 20 to 30 handles off the 2273’s and got shook out at 2268.00. Everything is timing, and if you’re off on that, you are OUT. We have a busy eco calendar this morning. Our view; I do not think the sell off that started yesterday is over. There are just too many sell stops below. Sell the rallies and look to buy the late weakness.

As always, please use protective buy and sell stops when trading futures and options.

- In Asia 10 out of 11 markets closed lower: Shanghai Comp -0.73%, Hang Seng -1.77%, Nikkei +0.10%

- In Europe 8 out of 11 markets are trading higher: CAC +0.89%, DAX +0.67%, FTSE +0.23% at 6:00am ET

- Fair Value: S&P -4.80, NASDAQ +1.75, Dow -57.97

- Total Volume: 750k ESZ, 2.2m ESH and 17.6k SPZ, 14.2k SPH traded