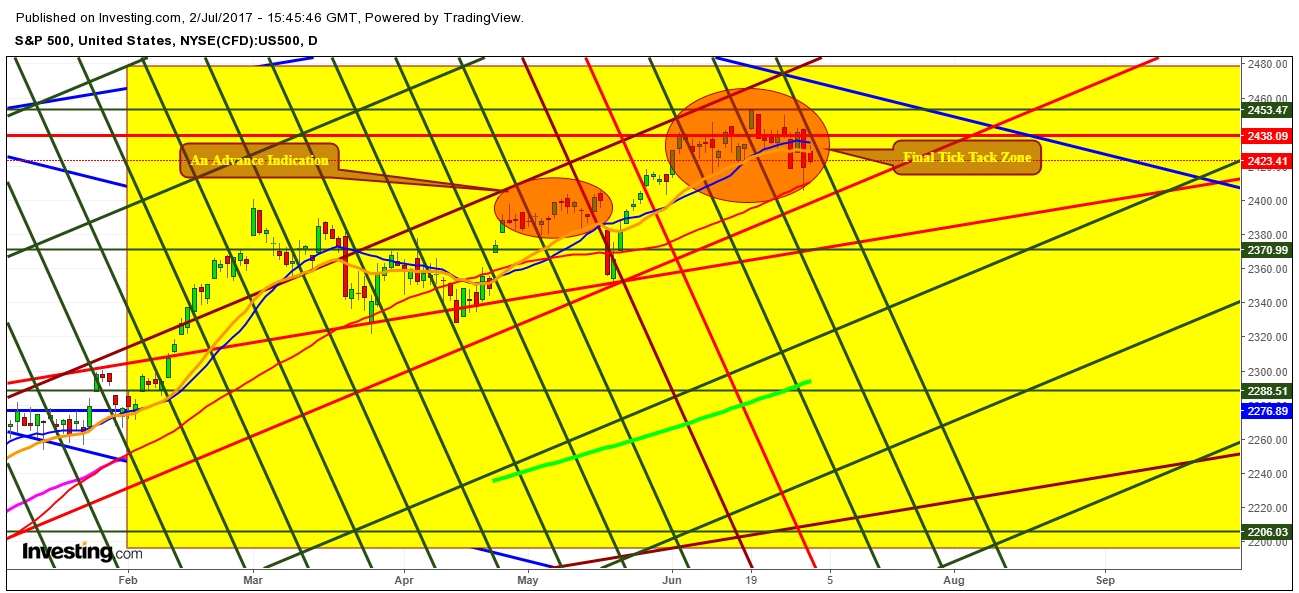

S&P 500 Futures price seems to be heading for a downward trend after a month long jolting moves inside “Tick Tack Zone” which I concluded in my last analysis “Is S&P 500 Entry Inside A Tick Tack Zone Waiting For An Excuse?”. On analysis of the movement of S&P 500 in different time zones, I conclude that the economic events during the Week of July 1st, 2017 may enhance the probabilities of the beginning of a downward trend on its exit from this “Tick Tack Zone” on the first trading session of the Week. I find this downward voyage may be up to the levels of 2310, a strong support level.

Having a relook at the same daily chart frame on July 1st, 2017 seems to be evident enough for concluding a downward trend ahead amid growing volatility.

Have a Nice Trading Week.