I know, I know, there is a long list of prominent investors that are telling you the stock market is gonna crash. Paul Singer of Elliot Management added his name to the list that includes Gundlach, Gross, Faber and that guy with the beard thingy from last year. So why should I listen to a swimmer that busted up a bathroom and claimed he was robbed when it comes to the S&P 500? Evidence.

For those that have not noticed, the S&P 500 has been going up. There will be plenty of time to worry about it going down and how far it might go when that happens. So for now lets hear Ryan out. I have translated his two-word stoner broken English responses to make it readable.

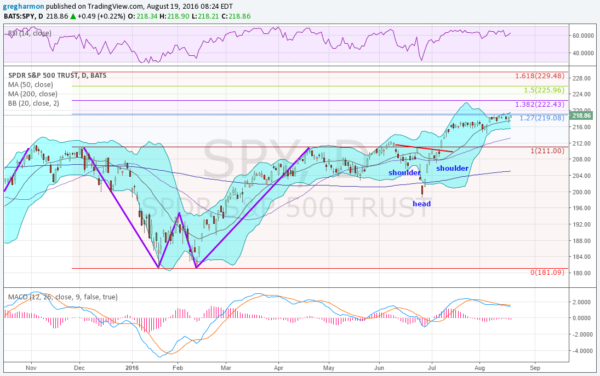

The chart above shows the SPDR S&P 500 (NYSE:SPY) since the start of December. It dropped to start the year and then made a “W” bottom and has been moving up. By April it had retraced the move lower from the December high. And after some consolidation and a digestive pullback it has now raced to new all-time high levels. This is great but it leaves no prior price history to look to for guidance on where it might go.

Fortunately a gentleman by the name of Leonardo de Pisa, better known and Fibonacci has stepped in to fill the gap. Anyway, Fibonacci extensions can be used to give some upside targets for the S&P 500 now. The ETF currently sits at a 127% extension of a retracement of the leg from December to the February low. Above that the next target would be 222.43, the 138.2% extension. This is also near the price objective of the small inverse head and shoulders pattern that worked out in June. The two targets above that are the 150% retracement to 225.96 and then the 161.8% retracement to 229.48.

None of these are hard price levels that have to happen and just because Ryan says they are targets does not mean they will be achieved. I mean, the guy lies to his mom, right?