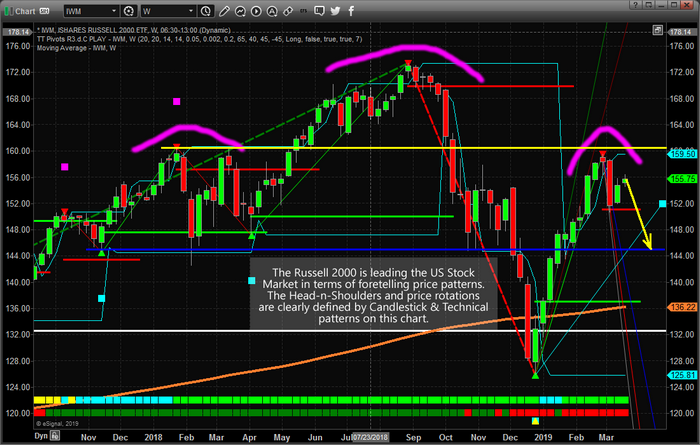

The Russell 2000 ETF continues to deliver critical technical and longer-term price patterns for skilled technicians. Combining the iShares Russell 2000 (NYSE:IWM) chart with the Transportation Index, oil, gold and others provide a very clear picture of what to expect in the immediate future.

Recently, we posted a research article about the head-and-shoulders pattern setting up in the Dow Jones Industrial Average. Again, the IWM is showing a clear head-and-shoulders pattern with critical resistance near $159.50 and support near $144.25. Our researchers believe this right shoulder will prompt a downside market move toward support near $144.25 before a downward sloping wedge pattern sets up. This first downward price leg will setup and a congesting wedge formation will, eventually, break to the upside and drive market prices higher.

We authored a research article about this pattern setup on February 17, 2019.

Skilled traders watch all the charts to assist them in identifying characteristics that can assist them in understanding price moves, key support/resistance levels and price patterns. This IWM chart should be on everyone's radar at the moment. Where the IWM finds support, so too will other US stock market indexes.

The IWM setup indicates we may only see a 5-7% downside price swing before support is found. We'll have to watch how this plays out over the next few weeks/months to determine if the $144.25 level is true support or if the lower $137.00 level will become support. Either way, the downside price swing appears poised to unfold over the next few days/weeks – so be prepared.