The volume was light on Friday, but gains were enough to negate Thursday's selling. Markets have already recovered from the break of the loss of June's swing low, and are now looking at a challenge of 50-day MAs.

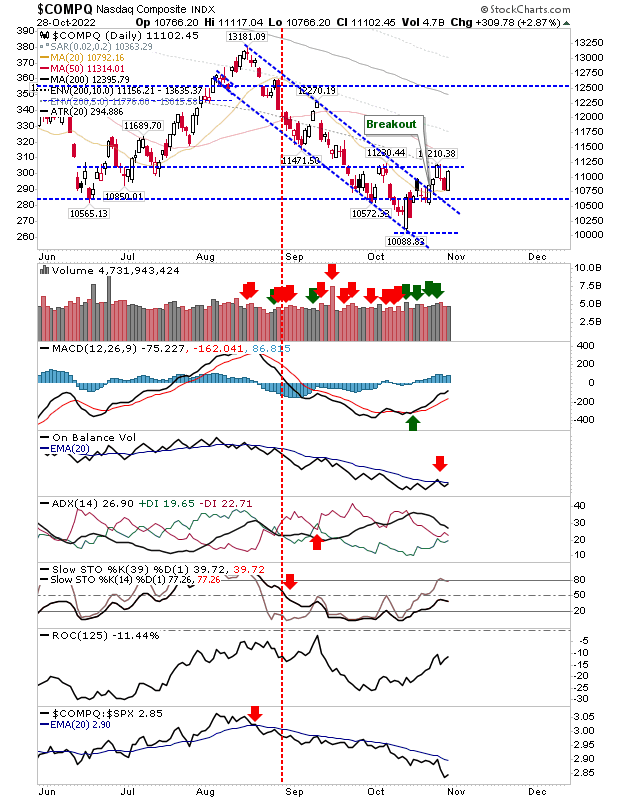

The Nasdaq is on a 'buy' trigger, but all other technicals are bearish. Relative performance losses have accelerated, but the broader picture is more bullish, and On-Balance-Volume is close to a new 'buy' trigger. The double October swing high is still there as resistance, but a close above 11,210 would confirm a sequence of higher highs and higher lows.

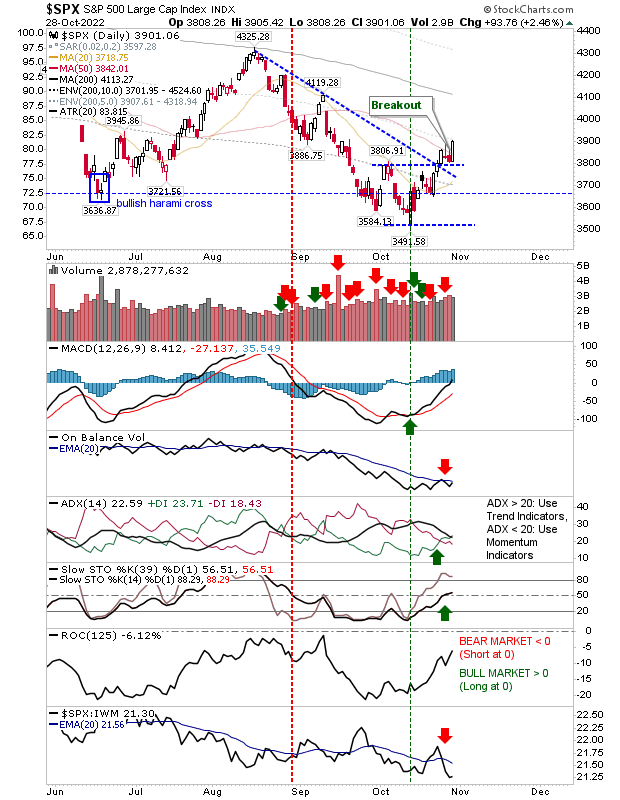

While the Nasdaq works towards a development of a new rally, the S&P is already a step ahead having cleared the early October swing high and a close above the 50-day MA. The next upside target is its 200-day MA - which is also close to the September swing high. Technicals are in better shape than the Nasdaq with 'buy' signals for Stochatics, MACD and ADX.

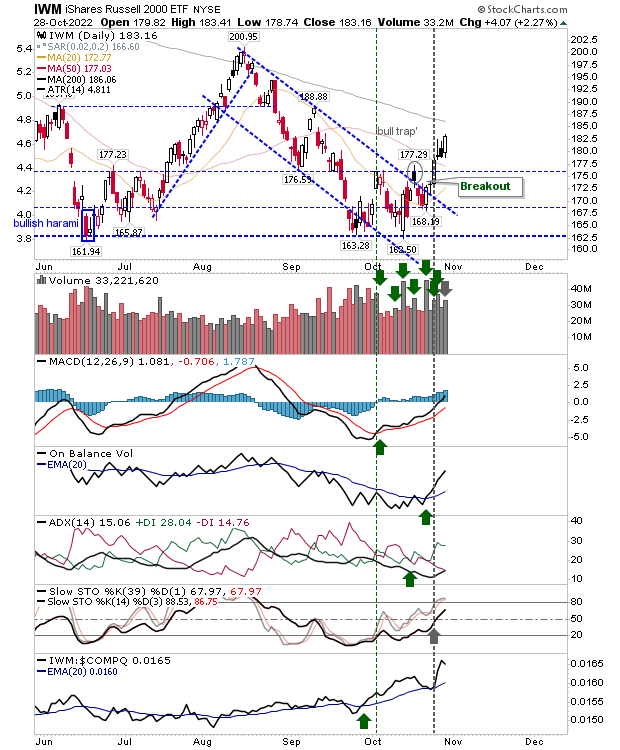

The Russell 2000 did well to negate not just the 'gravestone' doji from Wednesday but also the 'black' candlestick from Thursday; in doing so, it's probably just a day's gain away from a test of its 200-day MA. Technicals are net bullish and Friday even ranked as an accumulation day.

Into Friday it was looking like we had reached a natural topping point for the mini-rally and we were looking at some form of retracement - but Friday's trading blew this out of the water. This was important for what it means for the rally, but also for confirming October's overall trading as a swing low. The groundwork has been set for a positive end-of-year finish - it's now up to the indices to deliver.