Europe’s largest oil company Royal Dutch Shell (LON:RDSa) plc RDS.A is set to release its second-quarter 2017 results before the opening bell on Thursday, Jul 27.

In the preceding three-month period, The Hague-based supermajor reported in-line earnings as its upstream business swung to a profit on rebounding oil prices.

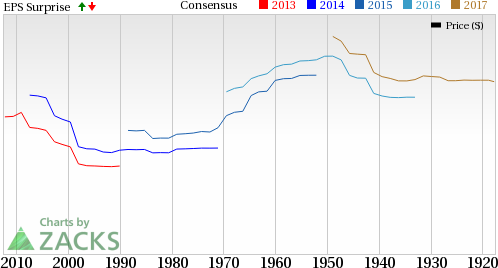

Coming to earnings surprise history, Shell has a bad record: its beaten estimates in just one of the last four quarters.

Let’s see how things are shaping up for this announcement.

Factors to Consider This Quarter

Oil prices have been on a freefall over the past few weeks, erasing all the gains associated with the OPEC-led output cut. The continued rise in domestic production thanks to soaring shale output have dragged down the commodity well below the psychologically-critical $50 threshold. This will hamper earnings and cash flows for Royal Dutch Shell and its upstream unit in particular.

Moreover, weak realizations limit the companies' internally-generated cash flow amid high capital spending and dividend payments. Worse, refining margins – that have saved the blushes for the supermajors over the last few quarters – have shrunk considerably and will further hamper profits.

However, Shell’s successful cost reduction initiatives and efficiency gains are expected to cushion the results. In particular, production gains too present a bright spot for the group. In the previous quarter, Shell’s upstream volumes averaged 3,011 thousand oil-equivalent barrels per day (MBOE/d), 6% higher than the year-ago period. While crude oil production increased 9%, natural gas output was up 3% - thanks to the contribution from BG Group that was acquired in early 2016.

Earnings Whispers

Our proven model does not conclusively show that Royal Dutch Shell will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat consensus estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is 0.00%. This is because the Most Accurate estimate and the Zacks Consensus Estimate both stand at 74 cents.

Zacks Rank: Royal Dutch Shell’s Zacks Rank #5 (Strong Sell) further decreases the predictive power of ESP, making us less confident of an earnings surprise call.

As it is, we caution against Sell-rated stocks (Zacks Ranks #4 and 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Share Performance: Royal Dutch Shell has gained 0.9% of its value during the second quarter versus the 3.1% decline of its industry.

Stocks to Consider

While earnings beat looks uncertain for Royal Dutch Shell, here are some energy firms you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this quarter:

TransCanada Corp. (TO:TRP) has an Earnings ESP of +7.84% and a Zacks Rank #1. The energy infrastructure developer is expected to release earnings results on Jul 28. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Patterson-UTI Energy Inc. (NASDAQ:PTEN) has an Earnings ESP of +3.57% and a Zacks Rank #3. The onshore contract driller is anticipated to release earnings on Jul 27.

QEP Resources Inc. (NYSE:QEP) has an Earnings ESP of +5.26% and a Zacks Rank #3. The oil and gas company is likely to release earnings on Jul 26.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

Patterson-UTI Energy, Inc. (PTEN): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

QEP Resources, Inc. (QEP): Free Stock Analysis Report

Original post

Zacks Investment Research