I think if I see another story attributing market moves to trade war worries I might gouge my eyes out. Yes there are ongoing negotiations. Negotiations that for the first time are not only out in the open, but using the levers of social media to work their positions. This agonizing cycle is stirring up sentiment for sure. And the media is lapping it up. With their proclivity to promote panic I would expect they are hoping it will never end.

But if you step away from the trade wars and shut out the news what do you see? Strong earnings, a strong economy, inflation growing but slowly, strong jobs market and low interest rates. Hmm, maybe there is some other reason for the equity markets to be stagnating. Maybe it has to do with the numbers. The first is the date. The last trading day of the week, the month and the quarter is Friday. This aligns three timeframes of traders and their views and positions.

The next numbers to consider are 2700 and 2800. These big round numbers are very close to the current S&P 500 level. Round numbers have a way of drawing and holding prices to them. This choppy price action could very well be a battle between the round numbers of 2700 and 2800 and nothing more. And with a payout date for 3 timeframes Friday, there may be nothing constructive that can happen until the 3rd quarter begins.

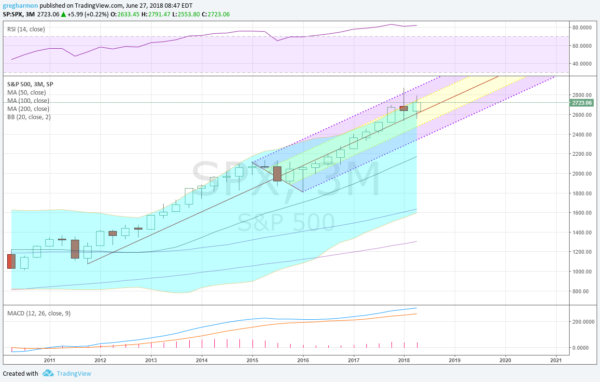

The chart above is certainly giving you every reason to want to own stocks. Strong momentum, steady volatility with a rising Bollinger Bands® channel, rising moving averages and price moving higher along the Median Line of the Andrews Pitchfork. Step away from the noise for a minute or a day or week, even a month.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI