While the eighth year of a Presidential term calls for a rally from mid-May to early/mid-June, it doesn’t promise to be straight up. This week looks set to see a correction downward against the bigger trend. The McClellan Oscillator’s dip below -150 and the lower Bollinger Band on 5/19/16 (the one-year anniversary of the top of the bull market in the Dow) marked the low of the recent sell-off. It closed above zero last week but the bears have the benefit of the doubt given the ‘complex’ structure below zero.

The CBOE Volatility index (VIX) fell 2.08 points last week to close on the 2014 trendline at 13.12 - its lowest level since early April. Since March, the VIX has been turned back by resistance at 16.40 several times highlighting its importance. A breakout from 16.40 will be very bearish for equities. The weekly Coppock is very oversold and turning upward warning of a tradable rally in the VIX (bearish equities).

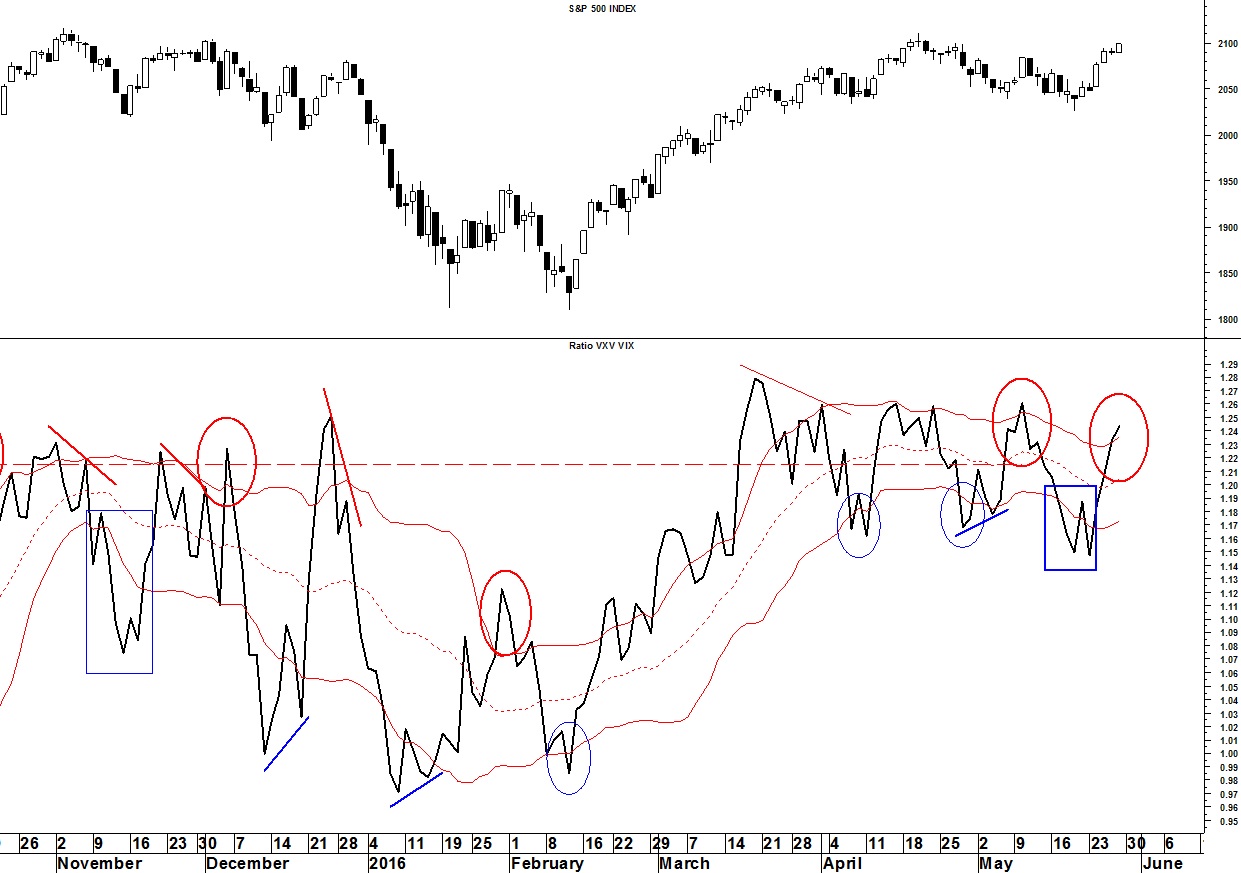

The VXV/VIX Ratio (chart) is back over its upper Bollinger Band which has often served as a reliable sell-signal for equities.