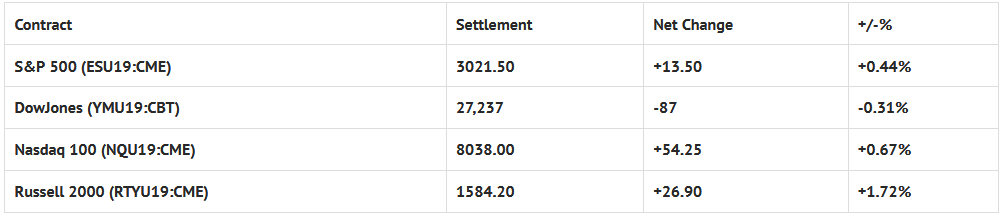

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.48%, Hang Seng +0.25%, Nikkei +0.22%

- In Europe 10 out of 13 markets are trading higher: CAC +0.46%, DAX -0.21%, FTSE +0.31%

- Fair Value: S&P +1.42, NASDAQ +14.32, Dow -25.01

- Total Volume: 1.04 million ESU & 73 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Durable Goods Orders 8:30 AM ET, International Trade in Goods 8:30 AM ET, Jobless Claims 8:30 AM ET, Retail Inventories 8:30 AM ET, Wholesale Inventories 8:30 AM ET, EIA Natural Gas Report 10:30 AM ET, Kansas City Fed Manufacturing Index 11:00 AM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

S&P 500 Futures: All Good Now… For Now!

Chart courtesy of Scott Redler @RedDogT3 – $spx that’s what u call a trend mostly above the 8/21day with patterns to navigate along the way.

During Tuesday nights Globex session, the S&P 500 futures (ESU19:CME) printed a high at 3008.25, a low at 2996.00, and opened Wednesday’s regular trading hours (RTH) at 2999.50.

The futures were strong right out of the gate, and by 10:00 CT had traded through the Globex high to print a new high at 3008.25.

After a little back-and-fill down the 3008.00, the ES traded sideways in a 4 handle range until 11:30, before starting to slowly creep higher.

Thin-to-win was the name of the game for the rest of the day. By the time the MiM reveal came out showing $435 million to sell MOC, the ES had traded up to another new high at 3021.00. It would then go on to print 3021.75 on the 3:00 cash close, and 3021.50 on the 3:15 futures close, up +13.50 handles on the day.