Introduction

John Sheehy of Konecko recently highlighted the writings of Ronnie Chan, Board Chairman of the Hang Lung Group (HNLGF). Hang Lung is one of Hong Kong’s largest real estate developers. Sheehy noted that Chan (like Buffett) has a reputation for writing insightful shareholder letters. I quote Sheehy:

“Chan has a reputation for thinking long-term. The company completed its Harbourside luxury apartment tower in Hong Kong in 2004 and held many units off the market until selling them in 2014 and realizing a 78% gross margin due to market appreciation. Chan was an early investor in mainland China. The company completed the Grand Gateway, its first shopping mall and multi-use commercial center in Shanghai in 1999.”

In what follows, I quote Chan (Chan) from the Hang Lung’s 2017 Interim Report. I also comment on what Chan says and suggest possible investment implications (Elliott).

Chan: “The world has always been a troubling place, but today it is particularly so. The less developed parts have been usually more troublesome than others, and this condition persists. The Middle East situation deteriorates from bad to worse; North Korea keeps everyone alert about nuclear threats; and Venezuela reminds us that Latin America is in general still an unstable place.

Developed economies once boasted stability. Now they themselves are not so sure. Brexit may take a long time to resolve, and no one yet knows the eventual outcome. The refugee problem may not be as hot as it was last year, but the issue has certainly not gone away. In fact, European countries’ reactions to the issue today will affect the Continent for decades to come. Terrorist attacks, long associated with the less developed parts of the world, have now become a common occurrence in Europe.

The United States, which is the most self-righteous country in modern history, now has a president who regularly blurts out facts with alternative facts, and truths with untruths. The media, which has long been regarded as the bastion of the Western concept of liberty, is now daily inundated with fake news. The Internet certainly exacerbates the problem.

Elliott: Chan characterizes the US as “self-righteous.” I agree completely: the US tells all countries they should adopt democratic forms of government. US citizens, relatively uneducated on what is happening in the rest of the world, are watching the Burns/Novick documentary on the Vietnam War and the ill-informed/mistaken policies the US followed. Were lessons learned? No. The US followed that disaster by invading Iraq, an action that led to the complete destabilization of the Middle East.

Chan: Relatively speaking, Asia today appears to be the more peaceful part of the world. China, which endured tremendous turbulence in much of the 20th century, has in the past 20 to 30 years enjoyed stability and peace. While the United States is in the long run stable, it is steeped with short-term uncertainties and noises. China on the other hand appears to be more tranquil, at least in the near term, a condition that can last for decades and even longer. When economic growth rate is taken into consideration, the country looks even more attractive as a destination for investments. For the foreseeable future, it should be more or less double that of the West, if not more. It is far easier to make progress when swimming along with the current than against it.

Elliott: Good point: when the Chinese GDP growth rate falls from 8% to 6.7%, it is viewed as a real collapse. Keep in mind that the US is growing at just over 2%.

Looking Ahead

Chan: Even taking a longer-term view, China may remain one of the best places to do business. For example, the Belt and Road Initiative (BRI) enunciated by President Xi Jinping four years ago should help keep China’s economy growing for many years to come. This is exactly the old Silk Road, if you will. It may even alter the geo-economic map of the world to some extent. Throughout the process, many countries between East Asia and Eastern Europe should reap great economic benefits. Yet I am surprised by how the West, especially the United States, has been too proud to recognize its potential. When I recently addressed a group of mostly Americans in California, almost none of them had even heard of it.

Let me first put the BRI in its historical context. About 2,000 years ago, globalization, as we understand it, began. Those were the days of the Roman Empire in the West, and the prosperous Han Dynasty of China in the East. Both empires were strong but were too far apart to enter into conflict with each other. Instead, trade routes by land and by sea prospered.

Fast forward to the present time, the least globalized part of the world today is probably where globalization began — the area west of East Asia and east of Eastern Europe. There are obvious historical reasons, for many countries in this area were part of the former USSR. Interactions across the Atlantic since the 18th century and even those across the Pacific after World War II have received most of the attention.

Yet the landmass including Central Asia, the Caucasus and countries to their southern and western borders are rich in natural resources — oil and gas, minerals, fertile agricultural land, and forestry. After centuries of being in the backwaters, infrastructure is lacking, thus impeding their economic development. If the “One Belt” on land presents huge economic opportunities, so does the “One Road” by sea. (In Chinese, “sea road” is acceptable, hence “One Road”. In English, it is better rendered as “sea route” or “One Route”, for there cannot be “roads” at sea.) Being densely populated, these coastal countries are enormous markets for all. Besides China, consider just six of them: Japan, Indonesia, the Philippines, Bangladesh, India, and Pakistan, with a total population of almost 2.2 billion people. Each of them has a population of over 100 million, and in the case of India, over 1.3 billion.

While it is highly doubtful if Hang Lung will ever follow the Silk Road and build commercial properties along the way, the strengthening of China’s economy alone will mean a lot to us. To us, it means more business. This is yet another reason we are pleased to be investing in the mainland China market.

Elliott: Xi Jinping announced the BRI strategy with plenty of fanfare. My reaction (and I am not alone): China is a resource poor country – BRI is just another manifestation of its worldwide search for more resources. A number of BRI countries are far from enthusiastic about it. China has already negotiated deals for resources with a large number of Latin America and African countries.

Investment Implications

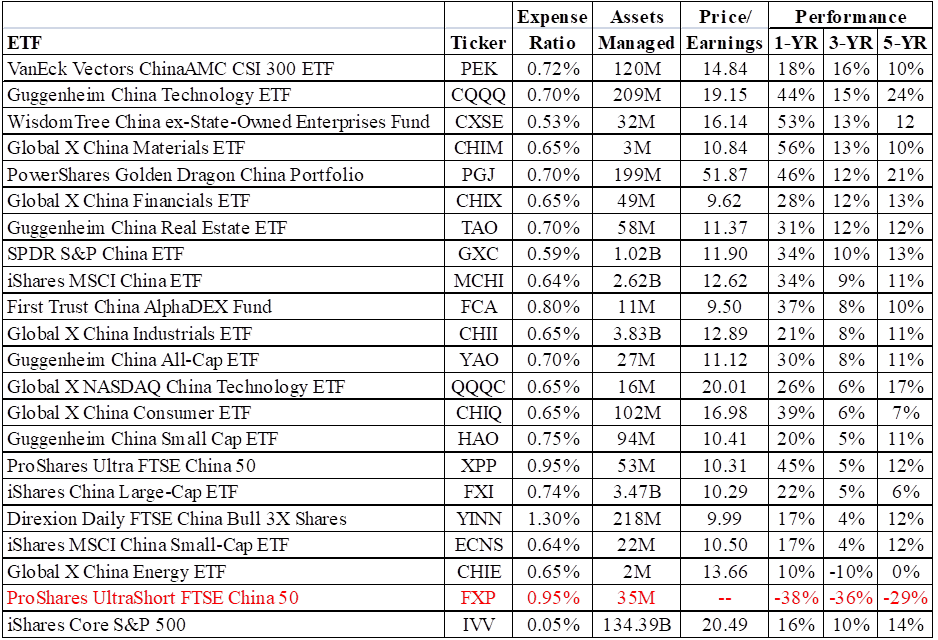

Elliott: Following on Chan’s points, I am convinced that well-balanced investment portfolios should include at least some Chinese holdings. Table 1 includes Chinese exchange traded funds (ETFs). I favor ETFs that have good 3-year track records and low price-earnings ratios. I include the Proshares UltraShort (FXP) to show it has not paid to bet against China. The iShares Core S&P 500 reflects US performance. Note the high P/E ratio and only moderate 3-year performance.

Table 1. – Chinese ETFs

Source: Yahoo (NASDAQ:AABA) Finance, ETFdb.com

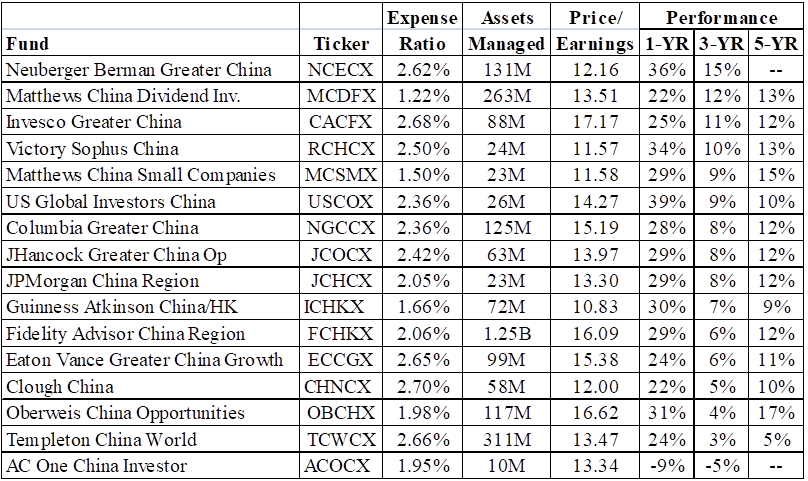

Table 2 provides a listing of Chinese mutual funds. The performance data are load-adjusted. As with the ETFs, I look for low P/E ratios and good 3 year performance. In terms of performance, I view a compounded rate of 10% and up for 3 years more than satisfactory. Of course, past performance is no guarantee….

Table 2. – Chinese Mutual Funds

Source: Yahoo Finance, Morningstar

Real Estate

Elliott: Since Chan has been successful in the real estate business, his views on this sector are worth considering.

Chan: Historically, at least since World War II, real estate prices in Asian cities, which are densely populated, have always been high by global standards. The situation in Hong Kong is particularly acute. Due to a long-held policy under the British, less than 25% of the landmass is developed, hence self-limiting the amount of buildable land. Country parks alone account for some 40% of the total area of Hong Kong.

Being predominantly ethnic Chinese, Hong Kong’s citizenry has a propensity to own bricks and mortar. In fact, they prefer new units. As a result, purchasing apartments for the purposes of investment is commonly practiced. History has proven that real estate is a great way to preserve value. No wonder that browsing new residential blocks for sale has become a popular weekend pastime, often for the entire family. Many have even become experts on design and construction! We the developers all know that the best way to improve our products is through walking around our flats with them and listening to their critiques.

I recall what our founder Mr. T.H. Chan said to me around 1980. He reminded me that many Hong Kong citizens did not need to work for a living, and yet could live rather comfortably. Owning an apartment or two for rental, and the high monthly income therefrom could feed a family. The appreciation in property value when they eventually sell might take care of their retirement needs. This was certainly not far from the truth.

Elliott: Chan is clearly bullish on Chinese real estate. Table 1 lists Guggenheim China Real Estate ETF (TAO) with some pretty reasonable numbers: P/E ratio at 11 and a 12% average 3-year return. And while I don’t believe in picking stocks, I have been following Xinyuan Real Estate (XIN) for some time. It started by investing in 2nd tier Chinese cities and now has several developments in the US. Its numbers are excellent: P/E ratio of 6.7 and a dividend rate of 6.9%.

Conclusion

US stock markets have appreciated significantly in the last few years. It is time to consider investing in Chinese equities.