Exit Strategies for covered call writing is the third required skill for successful implementation of this strategy (stock selection and option selection are the first two). This is also known as position management. One of the most common situations we face each month is when the strike price we initially sold is expiring in-the-money (stock price is higher than the strike price) and we are considering retaining the underlying security. On August 15, 2017, Jesse contacted me and shared a trade that required analysis for a possible rolling execution. Since the email was 4 days prior to contract expiration, Jesse and I agreed that final management decisions would be reserved for Thursday or Friday of expiration week. However, we also felt that it would be instructive to do an analysis using current stats if expiration was upon us.

Jesse’s trade with BioTelemetry Inc (NASDAQ:BEAT)

- Buy 100 BEAT at $33.63

- Sell August $34.00 call at $1.67

- Current share price is $36.65

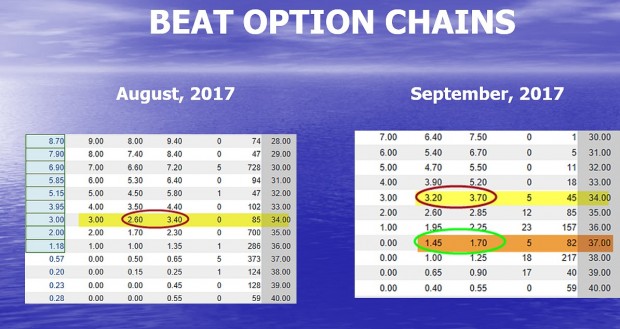

- Cost-to-close the August $34.00 call = $3.10

- Sell-to-open the September $34.00 call = $3.40 (rolling out)

- Sell-to-open the September $37.00 call = $1.50 (rolling out-and-up)

These statistics were gleaned from the option chains displayed below slightly favoring the market-maker:

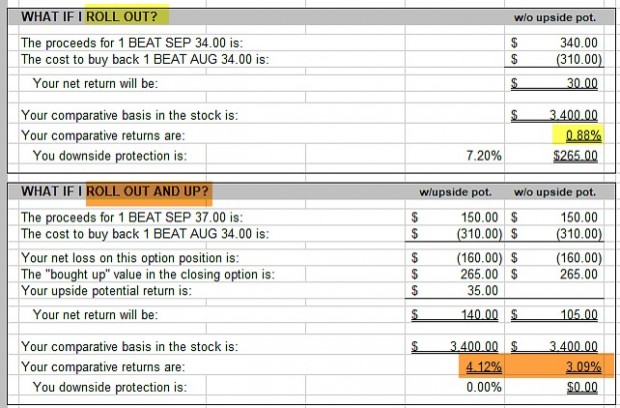

Calculations using the Ellman Calculator

Next we enter the option chain information into the “What Now” tab of the Ellman Calculator (blue cells on left side of spreadsheet) and the results will appear in the white cells on the right side as shown here:

The spreadsheet shows the following initial results:

- Rolling out to the September $34.00 call results in a 0.88%, 11% annualized (yellow field) 1-month return with 7.20% downside protection of that profit

- Rolling out-and-up to the September $37.00 call results in an initial return of 3.09% with a possible 4.12% final return if share value moves up to the $37.00 strike by expiration

Discussion

As expiration Friday approaches and our strikes are in-the-money, we are faced with 3 possible choices. We can allow assignment and sell our shares at the agreed upon strike price thereby maximizing our near-month covered call trade. The second path is to roll out to the forward month same strike, $34.00 in this case. The third path is to roll out-and-up to the forward month higher strike. Given the calculator results shown in this article, most covered call writers would opt for allowing assignment or rolling out-and-up as rolling out offers too low of a time value return.

Market Overview

- Personal income Dec 0.4% (above expectations)

- Consumer spending Dec 0.4% (below expectations)

- Core inflation Dec 0.2% (expected)

- Consumer confidence Jan 125.4 (above expectations)

- ADP employment Jan 234,000

- Pending home sales Dec 0.5%

- FOMC announcement 1.25% – 1.5%

- Weekly jobless claims 1/27 230,000 (below expectations)

- Produtivity Q4 (-) 0.1% (below expectations)

- ISM manufacturing index Jan 59.1 (above expectations)

- Construction spending Dec 0.7% (above expectations)

- Non-farm payrolls Jan 200,000 (above expectations)

- Unemployment rate Jan 4.1%

- Consumer sentiment Jan 95.7 (above expectations)

- Factory orders Dec 1.7% (above expectations)

THE WEEK AHEAD

Mon Feb 5th

- Markit services PMI Jan

- ISM manufacturing Jan

Tue Feb 6th

- Foreign trade deficit

- Job openings

Wed Feb 7th

Thu Feb 8th

- Weekly jobless claims for week ending 1/27/18

Fri Feb 9th

For the week, the S&P 500 declined by 3.85% for a year-to-date return of 3.31%

Summary

IBD: Uptrend under pressure

GMI: 6/6- Buy signal since market close of August 31, 2017 (as of Friday afternoon)

BCI: The increase in market volatility is moving my new positions to a neutral bias, selling an equal number of in-the-money and out-of-the-money strikes. I view this as a short-term bump-in-the-road as our economy as well as the global economy remain strong.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral-to-slightly bearish outlook. In the past six months, the S&P 500 was up 11% while the VIX (17.16) moved up by 70%.

Wishing you much success,