On Jul 11, Rockwell Automation Inc. (NYSE:ROK) was upgraded by a notch to a Zacks Rank #2 (Buy). Going by the Zacks model, companies carrying a Zacks Rank #2 have better chances of performing above the broader market over the upcoming quarters.

Why the Upgrade?

Market sentiments has been favourable to Rockwell Automation for quite some time now, especially after the company reported better-than-expected results in the first half of fiscal 2017. Earnings surprise was a positive 20.69% in the first quarter while in the recently reported second-quarter fiscal 2017, earnings surpassed the Zacks Consensus Estimate by 10.71%. The company reported adjusted earnings per share of $1.55 in second-quarter fiscal 2017, up 13% from $1.37 earned in the prior-year quarter.

Year to date, Rockwell Automation’s shares yielded a return of 23.7%, outperforming the 22.8% gain recorded by the Zacks categorized Industrial Automation and Robotics sub industry.

Backed by strong performance in first-half fiscal 2017, the company had increased fiscal 2017 sales growth guidance to the range of 4.5–7.5%. Further, it now anticipates adjusted earnings per share in the range of $6.45–$6.75. Compared with earnings per share of $5.93 in fiscal 2016, the mid-point of the range depicts a year-over-year climb of 11%. As the macro environment continues to improve, the consumer and transportation verticals are expected to deliver consistent growth. Heavy industries are anticipated to grow in 2017 despite the prevailing softness in oil and gas and mining.

Rockwell Automation’s new Connected Enterprise (CE) integrated supply chain management system will be a catalyst. The company is increasing the number of industries, applications and geographies, as well as improving investments to expand the value of CE. With average profitability well above the corporate average, CE sales will be an integral part of Rockwell Automation’s incremental growth and provide boost to margins over the next few years. Further, it remains active on the acquisition front. The company made three acquisitions during fiscal 2016 – Automation Control Products, MagneMotion and MAVERICK Technologies which further strengthened its technology differentiation, increased domain expertise and expanded presence in the markets.

Rockwell Automation continues to target long-term revenue growth of 6–8%, delivering double-digit EPS growth, return on invested capital (ROIC) of more than 20% over the long term and cash flow of around 100% of adjusted income. These long-term goals will be supported by the company’s strategy of diversifying sales streams by way of expanding products portfolio, solutions and services as well as global presence. The company also aims to achieve growth rates in excess of the automation market by expanding its served market, strengthening competitive differentiation, and serving a wider range of industries and applications.

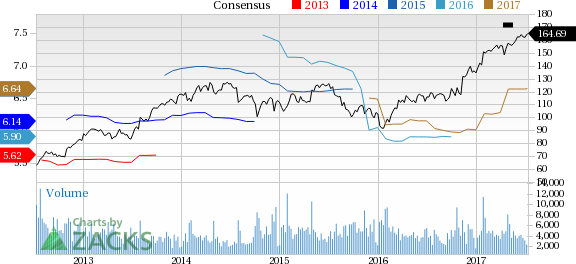

Rockwell Automation, Inc. Price and Consensus

Apogee Enterprises, Inc. (APOG): Free Stock Analysis Report

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE): Free Stock Analysis Report

Original post

Zacks Investment Research