Roche Holding (SIX:ROG) AG (OTC:RHHBY) announced that the FDA has accepted the company’s supplemental Biologics License Application (sBLA) and granted Priority Review to Gazyva in combination with chemotherapy followed by Gazyva alone for patients suffering from previously untreated follicular lymphoma.

The FDA is expected announce its final decision by Dec 23. We remind investors that priority review is given to those drugs which the FDA believes have the potential to provide significant improvements in the safety and effectiveness of the treatment, prevention or diagnosis of a serious disease.

We note that Gazyva in combination with chlorambucil is approved for patients suffering from previously untreated chronic lymphocytic leukaemia (CLL).

A potential approval in follicular lymphoma is expected to boost sales further.

The drug is also being evaluated with other approved or investigational medicines, including cancer immunotherapies and small molecule inhibitors.

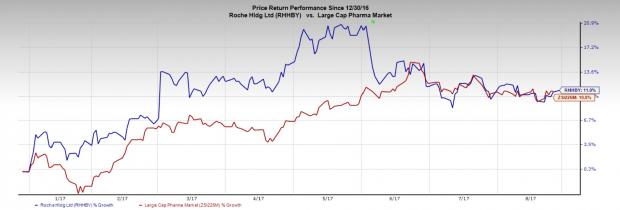

Roche’s stock has gained 11.0% against the industry’s 10.8% gain.

Roche’s hematology portfolio at present consists of MabThera/Rituxan, Gazyva/Gazyvaro and VenclextaTM/VenclyxtoTM in collaboration with AbbVie Inc. (NYSE:ABBV) along with a pipeline which has a small molecule antagonist of MDM2 (idasanutlin/RG7388) and polatuzumab vedotin.

The company also has a hemophilia A candidate, emicizumab, in its pipeline. Last week, the FDA granted emicizumab prophylaxis (preventative) priority review as a once-weekly subcutaneous treatment for adults, adolescents and children with hemophilia A with factor VIII inhibitors. The FDA is expected to announce its final decision by Feb 23, 2018. We remind investors that the FDA granted Breakthrough Therapy Designation for emicizumab in adults and adolescents with haemophilia A with inhibitors in September 2015.

Approval of new drugs will further boost Roche’s hematology portfolio.

Zacks Rank and Stocks to Consider

Roche currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Gilead Sciences, Inc. (NASDAQ:GILD) and Aduro Biotech, Inc. (NASDAQ:ADRO) . Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Gilead’s earnings per share estimates increased from $8.69 to $8.75 for 2017, over the last 30 days. The company delivered positive earnings surprises in three of the trailing four quarters, with an average beat of 6.38%.

Aduro Biotech’s loss per share estimates have narrowed from $1.46 to $1.32 for 2017 and from $1.41 to $1.24 over the last 30 days. The company delivered positive surprises in two of the trailing four quarters with an average beat of 2.53%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Roche Holding AG (RHHBY): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research