Roche Holding (SIX:ROG) AG (OTC:RHHBY) announced that the FDA has accepted the company’s Biologics License Application (BLA) and granted Priority Review for hemophilia A candidate, emicizumab.

The FDA has granted emicizumab prophylaxis (preventative) priority review as a once-weekly subcutaneous treatment for adults, adolescents and children with hemophilia A with factor VIII inhibitors.

Priority Review designation from the FDA is generally granted to drugs that have the potential to provide significant improvements in the safety and effectiveness of the treatment, prevention or diagnosis of a serious disease.

The BLA for emicizumab was based on results from the phase III study, HAVEN 1, in adults and adolescents of 12 years or older, as well as interim results from the phase III study, HAVEN 2 study in children younger than 12 years of age.

We note that results from HAVEN 1 were published in The New England Journal of Medicine (NEJM) and results from both studies were presented at the 26th International Society on Thrombosis and Haemostasis (ISTH) Congress in July 2017.

The FDA is expected to give a decision by Feb 23, 2018. We remind investors that the FDA granted Breakthrough Therapy Designation for emicizumab in adults and adolescents with haemophilia A with inhibitors in September 2015.

Meanwhile, Roche is evaluating emicizumab in patients with hemophilia A both with and without inhibitors and evaluating less frequent dosing regimens as well.

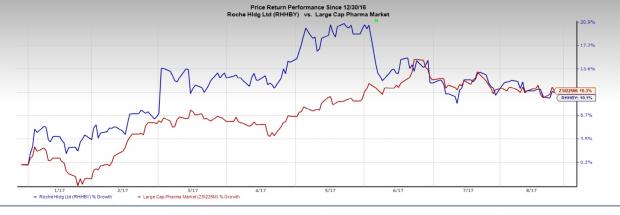

Roche’s stock has lost 10.1% so far in 2017 against the industry’s 10.3% gain.

Along with emicizumab, Roche’s hematology portfolio at present consists of MabThera/Rituxan, Gazyva/Gazyvaro and VenclextaTM/VenclyxtoTM in collaboration with AbbVie, Inc (NYSE:ABBV) along with a pipeline which has a small molecule antagonist of MDM2 (idasanutlin/RG7388) and polatuzumab vedotin.

A few other companies are also developing treatments for hemophilia A. Shire plc (NASDAQ:SHPG) also filed an investigational new drug (IND) application with the FDA, seeking approval for recombinant factor VIII (FVIII) gene therapy candidate, SHP654. The drug will be used for the treatment of patients with hemophilia A.

Zacks Rank and Stock to Consider

Roche currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the health care sector is Gilead Sciences, Inc. (NASDAQ:GILD) , which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Gilead’s earnings per share estimates increased from $7.98 to $8.53 for 2017, over the last 30 days. The company delivered positive earnings surprises in three of the trailing four quarters, with an average beat of 8.18%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Roche Holding AG (RHHBY): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Shire PLC (SHPG): Free Stock Analysis Report

Original post