Roche Holdings AG (OTC:RHHBY) announced results from a six-month study combining idiopathic pulmonary fibrosis (IPF) drug Esbriet (pirfenidone) and Ofev. The data was presented at the European Respiratory Society (ERS) congress in Italy.

The results revealed a similar safety profile for the combination treatment to that expected for each treatment alone. A majority of the 89 patients included in the study tolerated the combination treatment.

Patients were given a stable dose of Esbriet for at least 16 weeks before initiation of Ofev for the combination study. 16.9% of patients experienced at least one treatment-emergent adverse event (TEAE) related to Esbriet only, compared to 74.2% of patients who experienced at least one TEAE that investigators attributed as related to Ofev only.

In addition, a second, retrospective, post-hoc, analysis suggests that treatment with Esbriet may be associated with a reduction of multiple progression events as well as reduction of deaths after one or more progression events.

Moreover, a third study, involving real-world post-authorisation safety data from over 1,000 European patients receiving treatment with Esbriet and followed for up to 2 years, was also presented at ERS. Data from the study showed that occurrence of adverse drug reactions (ADRs) was consistent with the known safety profile of Esbriet, with no new safety signals observed.

Esbriet was approved in Europe in 2011 for adults with mild-to-moderate IPF. The drug was also approved in the United Stated for patients with IPF in October 2014. In 2017, the FDA and the European Commission approved the Esbriet 801 mg and 267 mg tablets as new options for administering the drug for the treatment of IPF. The new formulation offers patients a maintenance option for taking Esbriet with fewer pills per day.

The drug was added to Roche’s portfolio with the 2014 InterMune acquisition. Roche’s respiratory portfolio includes Xolair, Pulmozyme for cystic fibrosis, and Esbriet while drugs like Alecensa, Avastin, Tarceva and Tecentriq are approved for the treatment of specific types of lung cancer.

However, sales of Avastin and Tarceva continue to decline.

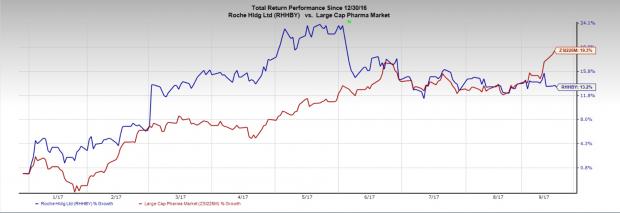

Roche’s stock has lost 13.2% compared with the industry’s gain of 19.3% in the year so far.

Roche has a strong presence in the oncology market. The company dominates the breast cancer space with strong demand for its HER2 franchise drugs like Herceptin, Perjeta and Kadcyla.

Competition from biosimilars looms large on Roche's key drugs like Herceptin, Avastin and Rituxan. The FDA has accepted Novartis AG’s (NYSE:NVS) Biologics License Application (BLA) for a proposed biosimilar version of Rituxan.

Zacks Rank and Key Picks

Roche currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) and Aduro Biotech (NASDAQ:ADRO) . While Alexion sports a Zacks Rank #1 (Strong Buy), Aduro carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion Pharmaceuticals’ earnings per share estimates have moved up from $5.32 to $5.61 for 2017 and from $6.53 to $6.92 for 2018 over the last 60 days. The company delivered positive earnings surprises in the trailing four quarters, with an average beat of 11.12%.

Aduro Biotech’s loss per share estimates narrowed from $1.46 to $1.32 for 2017 and from $1.55 to $1.24 over the last 60 days. The company delivered positive surprises in two of the trailing four quarters with an average beat of 2.53%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research