Roche Holdings AG (OTC:RHHBY) announced positive results from the phase III IMmotion151 study on immunoncology drug Tecentriq in combination with oncology drug Avastin. (bevacizumab). The drug will serve as a first-line treatment option for advanced or metastatic renal cell carcinoma (mRCC).

IMmotion151, a multicenter, randomized, open-label study is being conducted to evaluate the efficacy and safety of Tecentriq and Avastin versus sunitinib in people with inoperable, locally advanced or metastatic renal cell carcinoma (“RCC”) who have not received prior systemic active or experimental therapy.

The study met its co-primary endpoint of investigator-assessed progression-free survival (PFS) in patients whose disease expressed the PD-L1 (programmed death-ligand 1: expression ≥ 1 percent) protein. Results showed that patients who received Tecentriq plus Avastin had a 26% reduced risk of disease worsening or death (PFS) compared to people treated with Sutent (median PFS [mPFS]: 11.2 vs. 7.7 months; HR=0.74; 95 percent CI 0.57, 0.96; p=0.02). Moreover, a pre-defined analysis of patient-reported outcomes revealed that the combination of Tecentriq and Avastin markedly delayed the time to a worsening of disease symptoms that interfere with day-to-day life compared to Sutent.

The study is the second phase III study on the combination regimen. A monoclonal antibody, Tecentriq is approved for various cancers like bladder and urinary tract cancers.

The company is evaluating this combination in a broad range of cancers, including advanced RCC.

Data for the co-primary endpoint of overall survival in the overall study population (intention-to-treat, ITT) were encouraging, but are still immature.

We note that Exelixis’ (NASDAQ:EXEL) Cabometyx is also approved for treating advanced RCC.

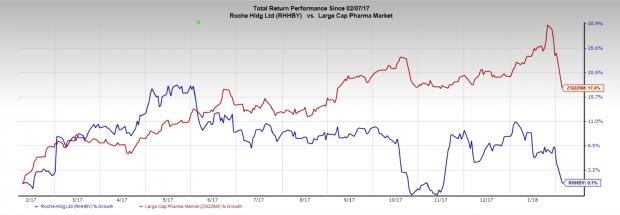

Roche’s stock has gained 0.1% in the past one year compared with industry's gain of 17.4%.

Roche performance in 2017 was strong driven by contribution from newly launched drugs. The label expansion of key drugs, Perjeta, Tecentriq and Alecensa will drive growth further. Ocrevus and Hemlibra have been successfully launched. However, sales of Avastin and Tarceva continue to decline.

Approval of new drugs and a potential label expansion of existing drugs bode well for Roche as its legacy drugs like Herceptin, MabThera are facing competition from biosimilars.

Novartis AG (NYSE:NVS) has already launched its biosimilar version of Rituxan/ MabThera in Europe. Amgen (NASDAQ:AMGN) also obtained FDA approval for a biosimilar version of Avastin for treatment of five types of cancers including lung cancer, colorectal cancer, glioblastoma, renal cell carcinoma and cervix cancer.

Zacks Rank

Roche carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Original post