Roche (OTC:RHHBY) announced that the European Commission (EC) has approved a label expansion of hemophilia drug, Hemlibra (emicizumab).

The drug is now approved for routine prophylaxis of bleeding episodes in patients with severe hemophilia A (congenital factor VIII deficiency, FVIII

The approval was based on encouraging results from the HAVEN 3 and HAVEN 4 studies.

An approval was on the cards as the EU Committee for Medicinal Products for Human Use (“CHMP”) had given a positive opinion on the same.

We remind investors that the FDA has also approved Hemlibra to prevent or reduce the frequency of bleeding episodes in adults and children (newborn or older) without hemophilia A without factor VIII inhibitors in October 2018.

The drug is already approved for routine prophylaxis to prevent or reduce the frequency of bleeding episodes in people with hemophilia A with factor VIII inhibitors in more than 60 countries worldwide.

Hence, the drug can be used for all indicated people with hemophilia A, including those with factor VIII inhibitors with multiple dosing options (once weekly, every two weeks, or every four weeks).

A label expansion of the drug should further boost sales.

Roche’s hematology portfolio comprises approved drugs like MabThera/Rituxan, Tecentriq, Gazyva and Venclexta in collaboration with AbbVie (NYSE:ABBV) .

The pipeline includes polatuzumab vedotin and a small molecule that inhibits the interaction of MDM2 with p53 (idasanutlin/RG7388).

In February 2019, the FDA accepted the company’s Biologics License Application (BLA) for anti-CD79b antibody drug conjugate (ADC) polatuzumab vedotin in combination with bendamustine plus Rituxan (BR), for the treatment of patients suffering from relapsed or refractory (R/R) diffuse large B-cell lymphoma (DLBCL). The FDA also granted Priority Review status to the candidate. A decision from the FDA is expected by Aug 19, 2019.

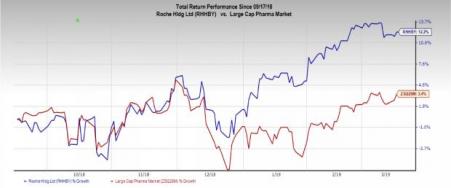

Roche’s stock has gained 12.2% in the past six months compared with the industry's growth of 3.4%.

Approval of new drugs and a potential label expansion of existing drugs bode well for Roche, as its legacy drugs like Herceptin and MabThera are facing competition from biosimilars.

Novartis (NYSE:NVS) has already launched its biosimilar version of Rituxan/MabThera in Europe. Amgen (NASDAQ:AMGN) also obtained FDA approval for a biosimilar version of Avastin for the treatment of five types of cancers, including lung, colorectal, glioblastoma, renal cell carcinoma and cervix. Entry of biosimilars of these key drugs adversely impacted sales in Europe in 2018.

Zacks Rank

Roche currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post

Zacks Investment Research