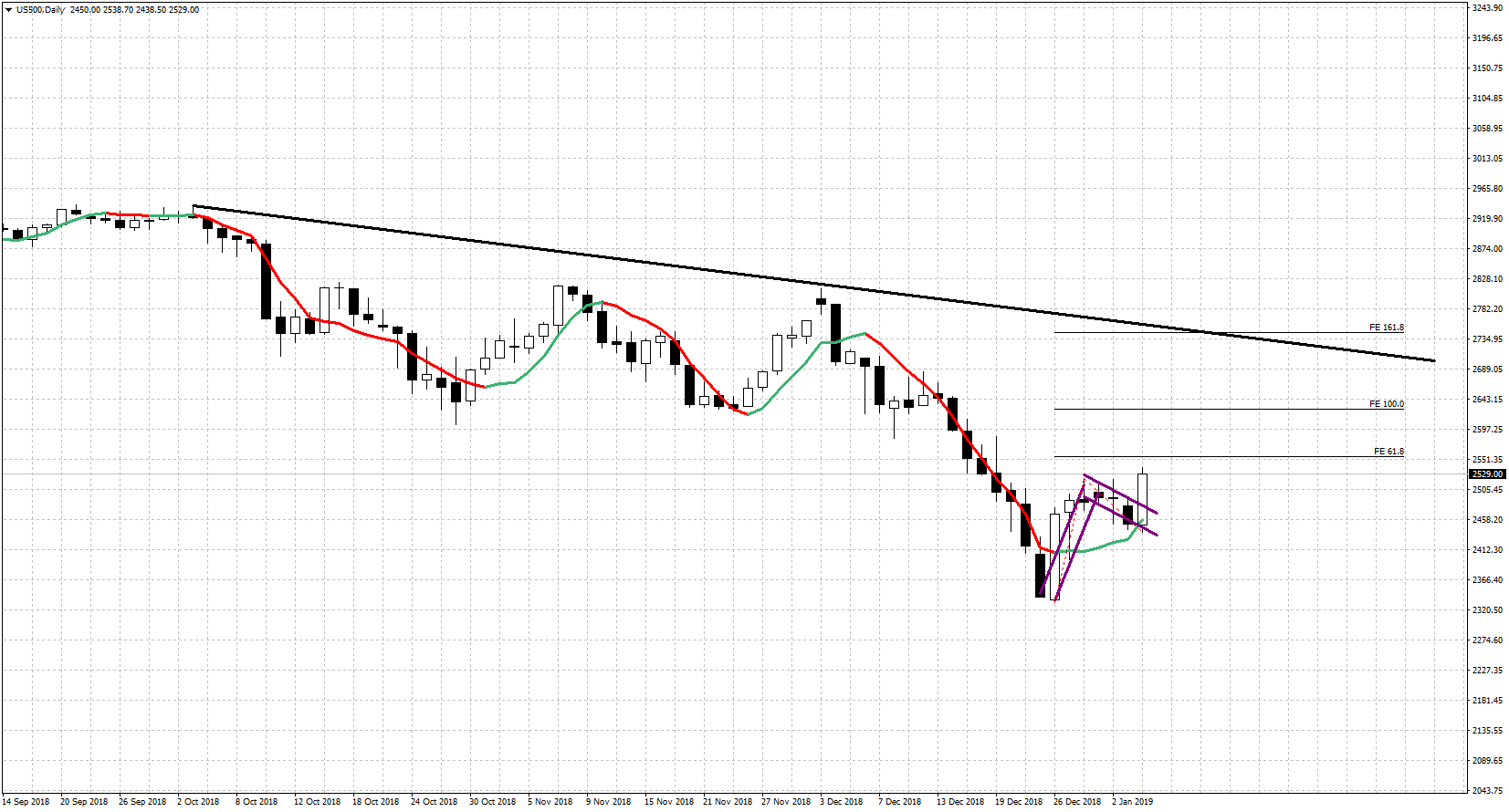

We do not often see declines in equity markets like the ones we witnessed for the last few months in the U.S. and for almost the last year in Europe. The bears are back and looking for a repeat of the 2007-2009 crisis or worse, a repeat of the 1929 crash. Is this wave count out of reality?

The S&P 500 regaining 2500 last week was the first step towards a bigger bounce if not the start of a new uptrend.

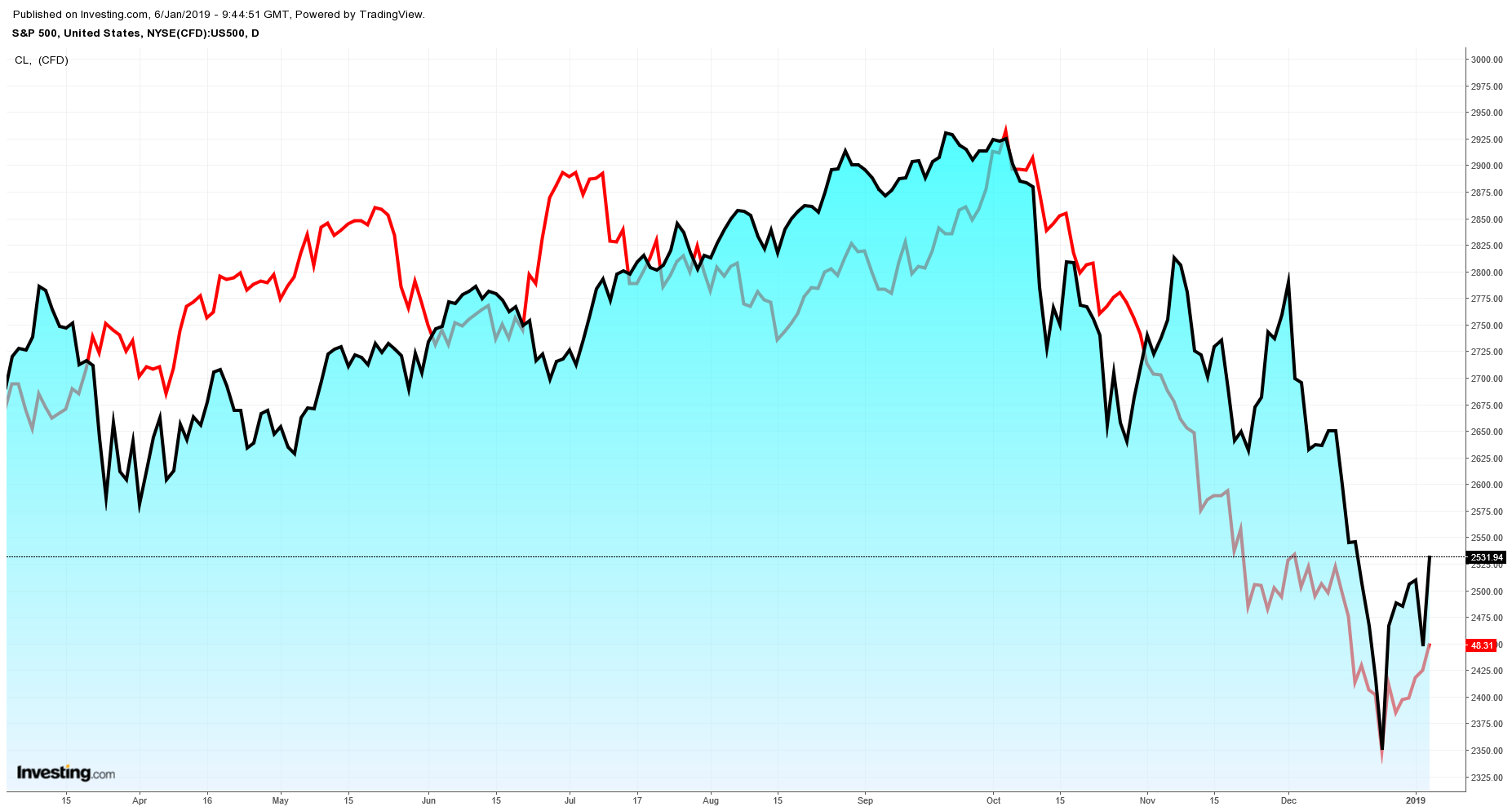

If the recent lows only marked the end of a corrective wave, we should see a strong bounce as SPX has recaptured 2520. The next few sessions will be crucial. Why? Because the bullish flag pattern will be confirmed or canceled. 2620 or even 2720 are viable targets for a B wave correction or the third wave of a new impulse. Whichever wave count we choose, short-term I’m biased to the upside as long as we hold above 2490-2520. Oil which was leading SPX also shows reversal signs.

Oil has already broken out of its bearish channel and despite the new low, I consider this setup to be very bullish as it was a backtest on the upper channel boundary.

Oil has declined towards its support (consolidation) area that was once resistance.

A move back towards $60 is very possible for me at least as a backtest of the broken trend line or a test of the Ichimoku cloud.

There are signs implying that Risk-on is coming back.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.