The last dip in the market caused some damage to the psyche of market participants. So much so that they are exhibiting signs of reducing risk in a variety of ways. Here are three examples.

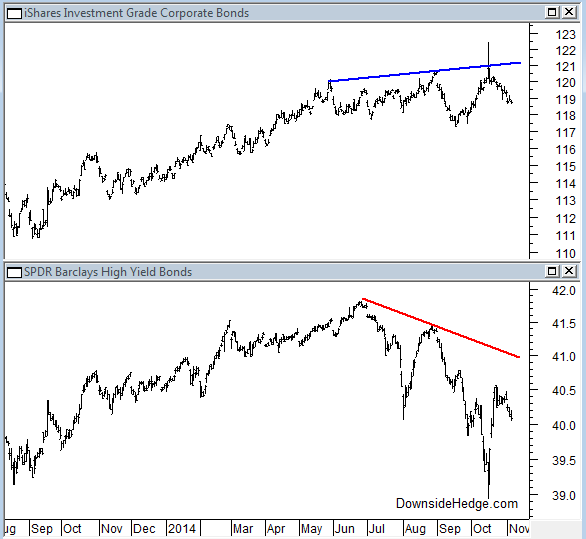

First is high quality bonds (via iShares Investible Grade Corporate Bonds (ARCA:LQD)) against junk bonds (via SPDR Barclays High Yield Bond (ARCA:JNK)). The damage done to junk bonds in July and October isn’t being repaired. People are shying away from junk. Which means they’re starting to get worried about cash flow and the ability to repay debt by middling companies. I’d like to see JNK start to mirror LQD again to give an all clear signal.

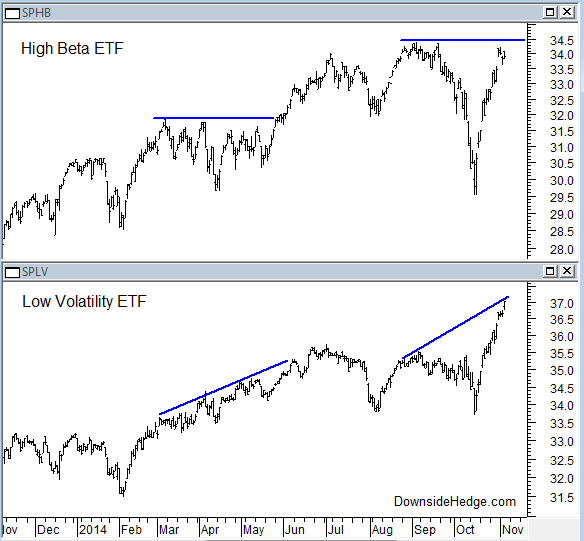

Next are high beta stocks (via PowerShares S&P 500 High Beta ETF (NYSE:SPHB)) against low volatility stocks (via PowerShares S&P 500 Low Volatility ETF (NYSE:SPLV)). The October selloff did a lot of damage to high beta stocks which was largely recovered, but low volatility stocks held up and have sped to higher highs. This indicates some rotation to safety during the last rally. A move to higher highs by SPHB will be the first step in repairing this relationship.

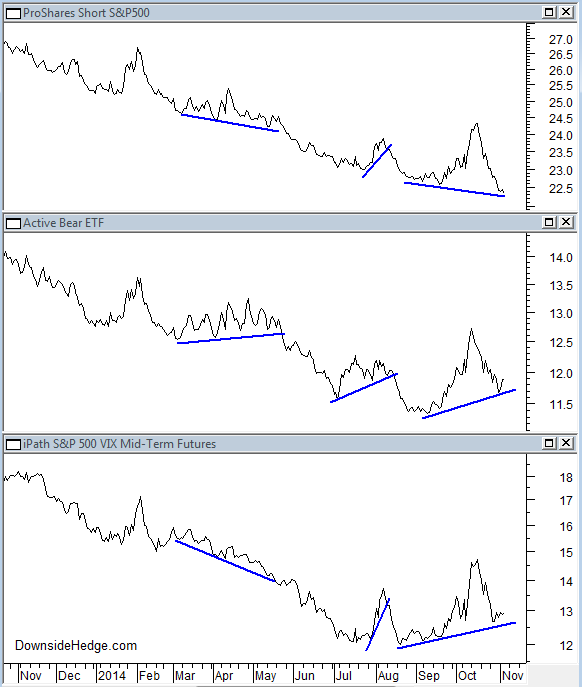

Another indication of the reduction of risk exposure comes from three short instruments (OK, two shorts and one volatility…which generally moves opposite the market). While the S&P 500 index (SPX) is making new highs (as indicated by ProShares Short S&P500 (NYSE:SH) falling) an actively managed bear fund (AdvisorShares Active Bear (NYSE:HDGE)) isn’t falling below previous lows. Mid term volatility (S&P 500 Dynamic VIX ETN (NYSE:XVZ)) isn’t falling below previous lows either. This indicates that investors are still worried about the end of the year (holding shorts and mid term volatility). Both HDGE and XVZ have pretty good trend lines we can watch. If they’re broken to the downside it will be an indication that the worst is probably behind us.