Markets retreated yet again with the key US indexes trading down about -3% on average, led by the NASDAQ 100 and the Russell 2000. The rotation out of growth stocks into commodity plays continued this week as well as stronger performance by foreign equities. One huge divergence in the commodity arena was the -10% drop in oil and Oil Services while alternative energy, gold and soft commodities gained. Coal plays, used in the production of steel, rallied with strong demand from China.

This week’s highlights are:

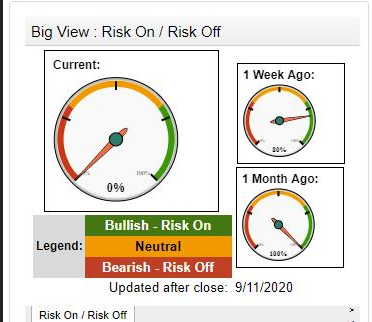

- Risk Gauges turned negative

- IWM and QQQ both closed under their 50 DMA’s and 10 week moving averages

- Volume shows a shift to distribution, led by the NASDAQ 100

- Market Internals continue to weaken with the New High /Low ratio rolling over

- Sentiment ended on a positive note in the short term as Volatility (VXX) dropped sharply this week defying the market sell off and the % of stocks below their 10 DMA hit oversold readings

- Value Stocks confirmed leadership over growth stocks short term, a clear sign of rotation to safety

- XLB and DBA two etf ‘s that focuses on commodities were the top performing sectors whose holdings include Gold, Soft Commodities, alternative clean energy (Hydrogen) and Coal.

- Oil and Oil services companies led the decline

- Value stocks (VTV) along with Big Caps (DIA) have good relative strength to both Growth and Small Caps

- Foreign Equities are outperforming US stocks

On a final note, the dollar looks vulnerable especially against the Yuan which is not a great sign for who is winning the trade war.