Investing.com’s stocks of the week

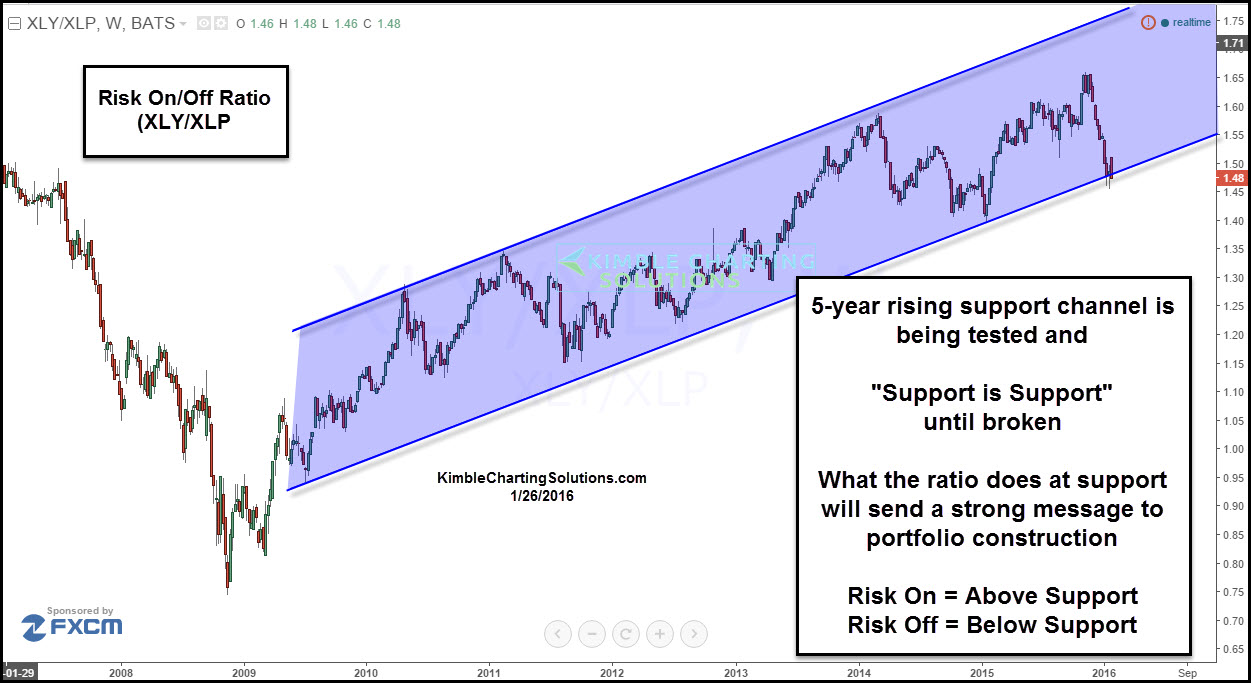

One of the more popular indicators for the “Risk-On-and-Off” trade is the Discretionary/Staples Ratio (N:XLY):(N:XLP).

When the ratio moves higher, Discretionary stocks act stronger, which means that investors should lean toward the “Risk-On” trade.

The opposite is true too when the ratio moves lower, as Staples act stronger than Discretionary Stocks, which means that investors should lean to toward the Risk-Off trade.

The Risk On/Off ratio has declined sharply of late, no doubt about it, which is concerning for the Risk-On crowd.

The decline has taken the ratio to 5-year rising support. The pattern looks just like global markets, which are testing 5-year rising support.

Note that the 90-Day trend is down, 5-year trend is up.

Keep a close eye on this Risk On/Off ratio as it's testing key rising support.

- Above Support = Risk-On Trade from a long-term perspective.

- Below 5-Year Support = Negative message for the Risk-On Trade.

I humbly feel that what the Ratio does at support will have a large impact on portfolios come summer.