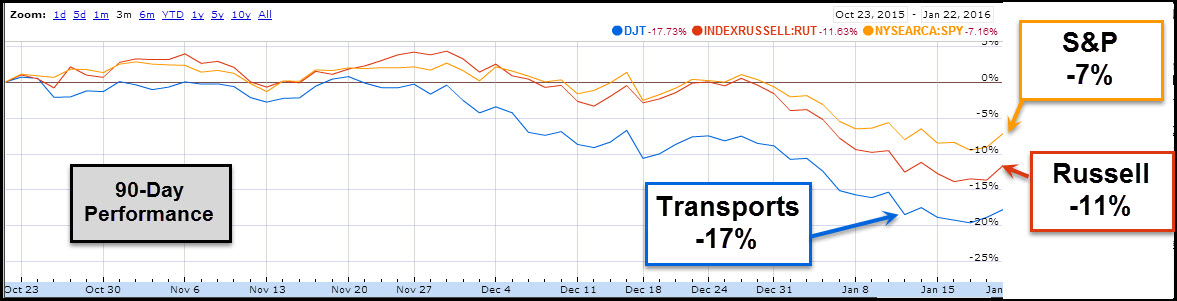

One trend is clear: over the past 90-days, stocks have been soft. Below looks at which markets have been the weakest during the past 90-days.

The two “downside leaders” are Transports and Small Caps (Russell 2000). So let's take a peak at what these two look like, from a Power of the Pattern perspective.

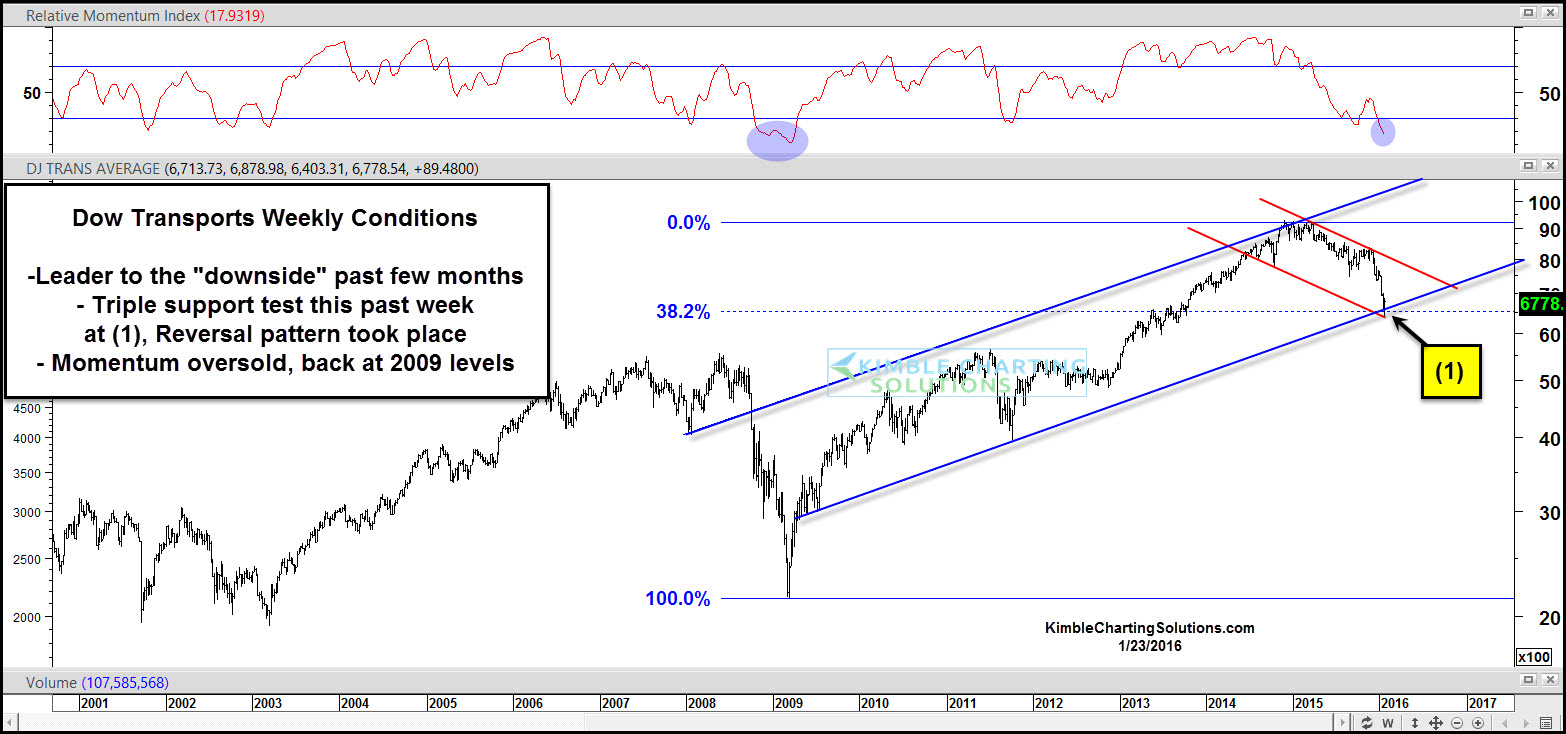

The Transports' 17% decline in the last 90-days found it testing 5-year rising support this past week and its Fibonacci 38% retracement level (based upon Financial crisis lows in 2009 and 2015 highs). At the same time, weekly momentum is back at levels hit at the 2009 lows. This past week, Transports created a reversal pattern (bullish wick) at dual support at (1) above.

The Russell’s swift decline of late has put it testing 5-year rising support and it is just above two key Fibonacci retracement levels. This past week, while hitting dual support, the Russell index created a reversal pattern (bullish wick). In fact, this past week, global stock markets created the same reversal patterns as these two downside leaders did.

Bottom line…The 90-day trend is down.

If you were to create a wish list to buy any asset, what would be on that list? Would you want support to be in play? Would you want momentum to be oversold? Would you want sentiment to be hitting extremes? Would you want to see reversal patterns at support take place? Would you want bullish falling wedges to be in play? I would want EVERY one of these on my wish list!

One week's bullish reversal pattern, at 5-year support, DOES NOT change the 90-day trend! Impressive “weekly reversal” patterns did take place last week, at long-term support, where you would want to see them from a wish list perspective. What took place and where last week, really has my attention.