Wynn Resorts, Limited (NASDAQ:WYNN) just released its first quarter 2017 financial results, posting earnings of $1.24 per share and revenues of $1.48 billion. Currently, Wynn is a Zacks Rank #3 (Hold), and is up 3.03% to $121.80 per share in after-hours trading shortly after its earnings report was released.

Wynn:

Beat earnings estimates. The company posted earnings of $1.24 per share (excluding $0.25 from non-recurring items), topping the Zacks Consensus Estimate of $0.74 per share.

Beat revenue estimates. The company saw revenue figures of $1.48 billion, beating our consensus estimate of $1.34 billion.

Wynn reported first quarter 2017 profit of $100.8 million. The company posted net revenues of $1.48 billion, which marks a massive 47.9% increase year-over-year.

Wynn’s Las Vegas operations were up 6% year-over-year to $412.9 million. The new Wynn Palace, which opened in the third quarter of 2016, added $475.8 million in net revenues. Wynn reported adjusted property EBITDA of $427.5 million, an increase of 42.4% from the first quarter of 2016.

However, Wynn Macau saw a small overall drop-off. Net revenues from the company’s Macau operations fell by 3.5% year-over-year to $587.0 million. Wynn Macau’s adjusted property EBITDA was down 5.3% to $181.1 million.

Wynn also announced that it approved a cash dividend of $0.50 per share, which will be payable on May 23 to any stockholders on record as of May 11.

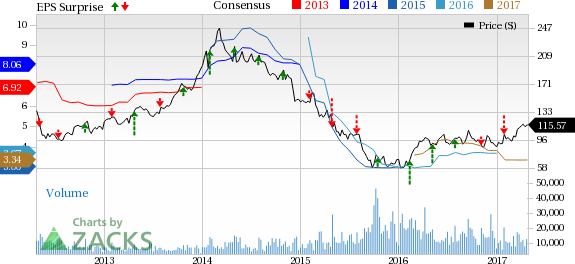

Here’s a graph that looks at Wynn’s Price, Consensus and EPS Surprise history:

Wynn Resorts Limited and its wholly-owned subsidiaries Wynn Las Vegas and Wynn Capital will own and operate Le Reve, which they've designed to be the preeminent luxury hotel and destination casino resort in Las Vegas. Le Reve will be situated at the site of the former Desert Inn & Casino on the Las Vegas Strip in Las Vegas, Nevada.

Check back later for our full analysis on Wynn’s earnings report!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Wynn Resorts, Limited (WYNN): Free Stock Analysis Report

Original post

Zacks Investment Research