- Stocks record strong weekly gains as the first Fed rate cut gets closer

- Markets are gradually preparing for the Jackson Hole gathering

- Euro/dollar trades within a critical resistance area

- Gold in demand as geopolitics generate headlines

Stocks Rally, Enjoy the Mixed US Data

Markets continue to recover after the recent rout, with US equities finishing last week with strong gains. More specifically, the Nasdaq 100 index led the rally with a 5.4% weekly rise as the three main US stock indices simultaneously recorded weekly gains of more than 2% for the first time since the December 11-15, 2023 period.

Last week's mixed US data has probably played a key role in the improved market mood. The US inflation report for July surprised somewhat to the downside, cementing expectations for a September Fed rate cut.

The exaggerated calls for emergency cuts or a 50bps rate cut next month have eased now that equities are performing better, although there are still some diehards advocating for a strong move if the early September non-farm payroll figure disappoints considerably.

Friday’s retail sales report managed to surprise to the upside, but the market continues to ignore the strong data and instead focuses on data prints pointing to an economic slowdown like last week's weak housing data and the key Michigan consumer sentiment survey remaining stuck at a low level.

Markets preparing for a dovish Jackson Hole gathering

The focus is gradually turning to the Jackson Hole Symposium held on August 22-24. While most Fed members stayed on the sidelines during the recent market rout, they made a comeback at the latter part of last week in an attempt to set the scene for Friday’s speech by Fed Chairman Powell.

The gist of their appearances was that the time is nigh for the first rate cut of the easing cycle. We are bound to hear more from Fed members leading up to the Symposium with Fed’s Waller, a known hawk and a 2024 voter, being on the wires later today.

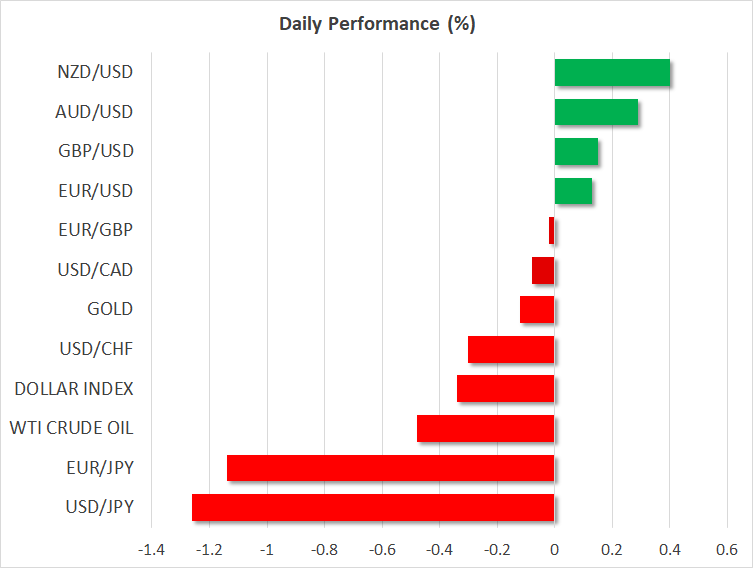

Until then, the August preliminary PMI surveys for both the manufacturing and services sectors could prove significant for market sentiment. The US dollar remains on the back foot, underperforming its key rivals in August, as euro/dollar continues to edge higher despite the eurozone data being mediocre at best.

Another set of weak euro area prints on Thursday could finally allow the dollar to recoup part of its recent losses, especially as euro/dollar is now trading inside the key 1.1032-1.1095 area. This region has clearly been a problem for euro bulls since 2023 as there have been four occasions in the past 18 months when a move above this area failed spectacularly.

Gold reaches new high, bitcoin rally falters

Demand for gold remains potent, pushing the precious metal to a new record high while Bitcoin has dropped below the $60k level again. The situation in the Israel-Iran-Hamas conflict remains fluid with Iran still expected to make a show of force in response to the recent assassination of Hamas’ political leader. Negotiations for a ceasefire have come to a standstill once again as the US Secretary of State Antony Blinken is visiting the region.

In the meantime, Ukraine's attempt to reverse the fate of the Russian-Ukraine conflict by mounting an offensive in Russian territories is gathering momentum. However, the possible direct involvement of Belarus and the increased chances of an asymmetric response from the Russian side could potentially scare investors going forward.